Advance Auto Parts 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-16

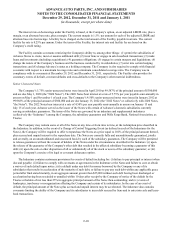

In June 2011, the FASB issued ASU No. 2011-05 “Comprehensive Income – Presentation of Comprehensive Income.”

ASU 2011-05 requires comprehensive income, the components of net income, and the components of other comprehensive

income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. In both

choices, an entity is required to present each component of net income along with total net income, each component of other

comprehensive income along with a total for other comprehensive income, and a total amount for comprehensive income. This

update eliminates the option to present the components of other comprehensive income as part of the statement of changes in

stockholders' equity. The amendments in this update do not change the items that must be reported in other comprehensive

income or when an item of other comprehensive income must be reclassified to net income. The amendments in this update

should be applied retrospectively and is effective for interim and annual reporting periods beginning after December 15, 2011.

The Company adopted this guidance in the first quarter of 2012. The adoption of ASU 2011-05 is for presentation purposes

only and had no material impact on the Company’s consolidated financial statements.

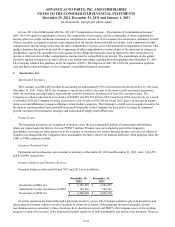

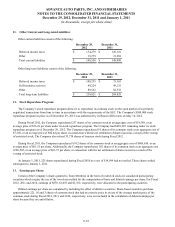

3. Inventories, net:

Merchandise Inventory

The Company used the LIFO method of accounting for approximately 95% of inventories at both December 29, 2012 and

December 31, 2011. Under LIFO, the Company’s cost of sales reflects the costs of the most recently purchased inventories,

while the inventory carrying balance represents the costs for inventories purchased in Fiscal 2012 and prior years. The

Company recorded a reduction to cost of sales of $24,087 and $29,554 in Fiscal 2012 and Fiscal 2010, respectively. As a result

of utilizing LIFO, the Company recorded an increase to cost of sales of $24,708 for Fiscal 2011, due to an increase in supply

chain costs and inflationary pressures affecting certain product categories. The Company’s overall costs to acquire inventory for

the same or similar products have generally decreased historically as the Company has been able to leverage its continued

growth, execution of merchandise strategies and realization of supply chain efficiencies.

Product Cores

The remaining inventories are comprised of product cores, the non-consumable portion of certain parts and batteries,

which are valued under the first-in, first-out ("FIFO") method. Product cores are included as part of the Company's

merchandise costs and are either passed on to the customer or returned to the vendor. Because product cores are not subject to

frequent cost changes like the Company's other merchandise inventory, there is no material difference when applying either the

LIFO or FIFO valuation method.

Inventory Overhead Costs

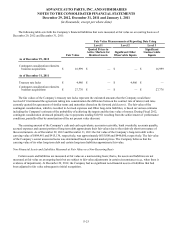

Purchasing and warehousing costs included in inventory at December 29, 2012 and December 31, 2011, were $134,258

and $126,840, respectively.

Inventory Balance and Inventory Reserves

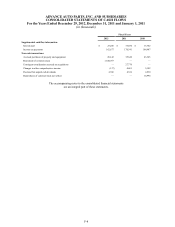

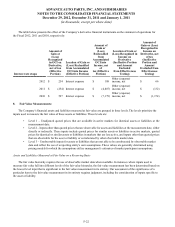

Inventory balances at the end of Fiscal 2012 and 2011 were as follows:

December 29,

2012

December 31,

2011

Inventories at FIFO, net $ 2,182,419 $ 1,941,055

Adjustments to state inventories at LIFO 126,190 102,103

Inventories at LIFO, net $ 2,308,609 $ 2,043,158

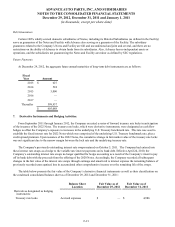

Inventory quantities are tracked through a perpetual inventory system. The Company completes physical inventories and

other targeted inventory counts in its store locations to ensure the accuracy of the perpetual inventory quantities of both

merchandise and core inventory in these locations. In its distribution centers and PDQ®s, the Company uses a cycle counting

program to ensure the accuracy of the perpetual inventory quantities of both merchandise and product core inventory. Reserves

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 29, 2012, December 31, 2011 and January 1, 2011

(in thousands, except per share data)