Advance Auto Parts 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

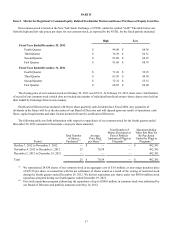

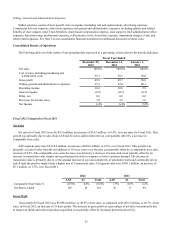

Fiscal 2012 Highlights

A high-level summary of our financial results and other highlights from our Fiscal 2012 include:

Financial

• Total sales during Fiscal 2012 increased 0.6% to $6,205.0 million as compared to Fiscal 2011, primarily driven by the

addition of 132 net new stores partially offset by a 0.8% decrease in comparable store sales.

• Our operating income for Fiscal 2012 was $657.3 million, a decrease of $7.3 million from the comparable period in

Fiscal 2011. As a percentage of total sales, operating income was 10.6%, a decrease of 18 basis points, due to the

deleverage of our SG&A rate partially offset by a slightly higher gross profit rate.

• Our inventory balance as of December 29, 2012 increased $265.5 million, or 13.0%, over the prior year driven

primarily by our inventory availability initiatives, including store upgrades, the opening of our new distribution center,

continued expansion of our HUB network and new store growth.

• We generated operating cash flow of $685.3 million during Fiscal 2012, a decrease of 17.3% compared to Fiscal 2011,

with the largest portion of the decrease consisting of an increase in accounts receivable resulting from the in-sourcing

of our Commercial credit program.

Other

• In January 2012 we issued $300 million of senior unsecured notes, due in 2022, with an interest rate of 4.50%.

• We opened our tenth distribution center in Remington, IN which will provide needed warehouse capacity and

upgraded supply chain technology.

• We in-sourced our Commercial credit function and rolled out our MotoLogic® diagnostic and repair resource to

support the continued investment in our Commercial business.

Subsequent to Fiscal 2012, we completed the acquisition of B.W.P. Distributors, Inc., a leading Commercial provider in the

Northeast.

Refer to the "Results of Operations" and "Liquidity" sections for further details of our income statement and cash flow results,

respectively.

Business Update

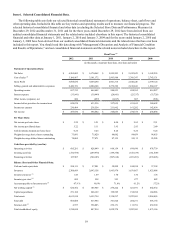

Our two key strategies, Superior Availability and Service Leadership, remained unchanged in Fiscal 2012 and continue to

serve as the foundation for all of the initiatives we undertake. Superior Availability is focused on consistently improving

product availability and maximizing the speed, reliability and efficiency of our local market availability. Service Leadership

relies on Superior Availability and a more consistent execution of serving our DIY and Commercial customers' needs whether

in our stores or online. Through these two key strategies, we believe we can continue to build on the initiatives discussed below

and produce favorable financial results over the long term. Sales to Commercial customers remain the biggest opportunity for

us to increase our overall market share in the automotive aftermarket industry. Our Commercial sales, as a percentage of total

sales, increased to 38% in Fiscal 2012 compared to 37% in Fiscal 2011.