Advance Auto Parts 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-15

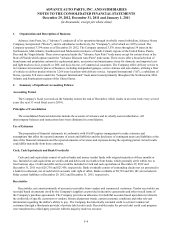

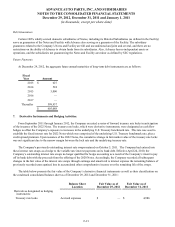

Cost of Sales and Selling, General and Administrative Expenses

The following table illustrates the primary costs classified in each major expense category:

Cost of Sales SG&A

Total cost of merchandise sold including: Payroll and benefit costs for retail and corporate

- Freight expenses associated with moving Team Members;

merchandise inventories from our vendors to Occupancy costs of retail and corporate facilities;

our distribution center, Depreciation related to retail and corporate assets;

- Vendors incentives, and Advertising;

- Cash discounts on payments to vendors; Costs associated with our commercial delivery

Inventory shrinkage; program, including payroll and benefit costs,

Defective merchandise and warranty costs; and transportation expenses associated with moving

Costs associated with operating our distribution merchandise inventories from our retail store to

network, including payroll and benefit costs, our customer locations;

occupancy costs and depreciation; and Self-insurance costs;

Freight and other handling costs associated with Professional services;

moving merchandise inventories through our Other administrative costs, such as credit card

supply chain service fees, supplies, travel and lodging;

- From our distribution centers to our retail Closed store expense; and

store locations, and Impairment charges, if any.

- From certain of our larger stores which stock a

wider variety and greater supply of inventory ("HUB

stores") and Parts Delivered Quickly warehouses

("PDQ®s") to our retail stores after the customer

has special-ordered the merchandise.

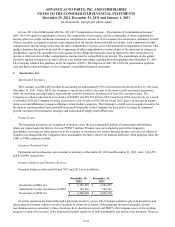

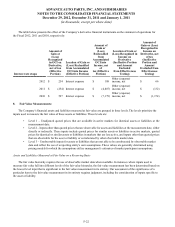

New Accounting Pronouncements

In July 2012, the Financial Accounting Standards Board, or FASB, issued ASU No. 2012-02 “Intangible-Goodwill and

Other – Testing Indefinite-Lived Intangible Assets for Impairment.” ASU 2012-02 modifies the requirement to test intangible

assets that are not subject to amortization based on events or changes in circumstances that might indicate that the asset is

impaired now requiring the test only if it is more likely than not that the asset is impaired. Furthermore, ASU 2012-02 provides

entities the option of performing a qualitative assessment to determine if it is more likely than not that the fair value of an

intangible asset is less than the carrying amount as a basis for determining whether it is necessary to perform a quantitative

impairment test. ASU 2012-02 is effective for fiscal years beginning after September 15, 2012 and early adoption is permitted.

The adoption of ASU 2012-02 is not expected to have a material impact on the Company’s consolidated financial condition,

results of operations or cash flows.

In September 2011, the FASB, issued ASU No. 2011-08 “Intangible-Goodwill and Other – Testing Goodwill for

Impairment.” ASU 2011-08 provides entities the option of performing a qualitative assessment to determine if it is more likely

than not that the fair value of a reporting unit is less than the carrying amount as a basis for determining whether it is necessary

to perform a two-step quantitative goodwill impairment test. ASU 2011-08 is effective for fiscal years beginning after

December 15, 2011. The adoption of ASU 2011-08 had no impact on the Company’s consolidated financial condition, results of

operations or cash flows.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 29, 2012, December 31, 2011 and January 1, 2011

(in thousands, except per share data)