Acer 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

124

FINANCIAL STANDING

125

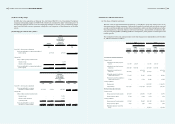

(d) Management service fee

The Consolidated Companies paid iDSoftCapital Inc. management service fees amounting to NT$49,333

and NT$31,542 for the years ended December 31, 2009 and 2010, respectively.

(e) Advances to/from related parties

The Consolidated Companies paid certain expenses on behalf of related parties. Additionally, related

parties paid non-recurring engineering and other operating expenses, and accounts payable on behalf

of the Consolidated Companies. As of December 31, 2009 and 2010, the Consolidated Companies had

aggregate receivables from related parties of NT$21,507 and NT$46,914, respectively, and payables to

related parties of NT$92,187 and NT$537,267, respectively, resulting from these transactions.

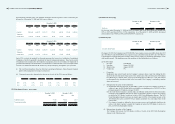

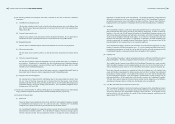

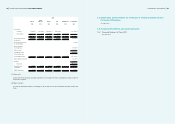

(3) Compensation to executive ofcers

For the years ended December 31, 2009 and 2010, compensation paid to the Consolidated Companies’

executive ofcers including directors, supervisors, president and vice-presidents was as follows:

2009 2010

Amount Amount

NT$ NT$ US$

Salaries 339,997 279,974 9,611

Cash awards and special allowances 175,655 356,201 12,228

Business service charges 1,080 1,080 37

Employee bonuses 443,855 690,920 23,719

960,587 1,328,175 45,595

The aforementioned compensation included the accruals for employee bonus and remuneration to directors

and supervisors as discussed in note 4(21).

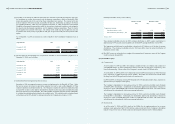

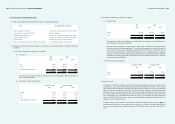

6. Pledged Assets

Carrying amount

at December 31,

Pledged assets Pledged to secure 2009 2010

NT$ NT$ US$

Cash in bank and time deposits

Contract bidding, project fulllment,

security for letter of credit, and others 61,939 61,937 2,126

As of December 31, 2009 and 2010, the above pledged cash in bank and time deposits were classied as “restricted

deposits” and “other nancial assets” in the accompanying consolidated balance sheets.

7. Commitments and Contingencies

(1) Royalties

(a) The Consolidated Companies have entered into a patent cross license agreement with International

Business Machines Corporation (“IBM”). According to the agreement, the Consolidated Companies

made xed payments periodically to IBM.

(b) The Consolidated Companies and Lucent Technologies Inc. (“Lucent”) entered into a Patent Cross

License agreement. This license agreement in essence authorizes both parties to use each other’s

worldwide computer-related patents for manufacturing and selling personal computer products. The

Consolidated Companies agree to make fixed payments periodically to Lucent, and the Consolidated

Companies will not have any additional obligation for the use of Lucent patents other than the agreed

upon xed amounts of payments.

(c) On June 6, 2008, the Consolidated Companies entered into a Patent Cross License agreement with

Hewlett Packard Development Company (“HP”). The previous patent infringement was settled out of

court, and the Consolidated Companies agreed to make xed amounts of payments periodically to HP.

The Consolidated Companies will not have any additional obligation for the use of HP patents other than

the agreed upon xed amounts of payments.

(d) The Consolidated Companies have entered into software and royalty license agreements with Microsoft,

MPEG-LA and other companies. The Consolidated Companies have fullled their obligations according

to the contracts.

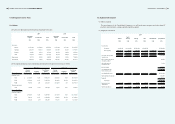

(2) As of December 31, 2009 and 2010, the Company’s outstanding stand-by letters of credit totaling

NT$269,987 and NT$195,563, respectively, for purposes of bids and contracts.

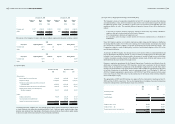

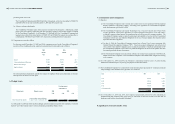

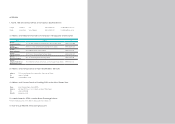

(3) The Consolidated Companies have entered into several operating lease agreements for warehouses, land and

ofce buildings. Future minimum lease payments were as follows:

Year NT$ US$

2011 457,182 15,694

2012 324,196 11,129

2013 264,341 9,075

2014 170,519 5,854

2015 and thereafter 516,388 17,727

1,732,626 59,479

(4) As of December 31, 2009 and 2010, the Company had provided promissory notes amounting to

NT$28,552,820 and NT$39,931,666, respectively, as collaterals for factored accounts receivable and for

obtaining credit facilities from nancial institutions.

8. Signicant Loss from Casualty: None