Acer 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

104

FINANCIAL STANDING

105

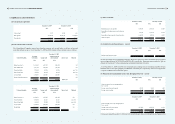

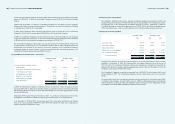

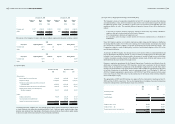

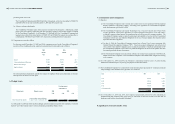

and trademarks and trade names with indenite useful lives and the respective CGUs to which they are

allocated as of December 31, 2009 and 2010, were as follows:

December 31, 2009

ITRO-EMEA ITRO-PA ITRO-AAP ITRO-China ITRO-TWN E-Ten SHBG

NT$ NT$ NT$ NT$ NT$ NT$ NT$

Goodwill 12,061,458 4,698,297 2,511,387 137,919 646,380 221,424 1,682,869

Trademarks

& trade names 3,328,857 2,308,646 1,149,623 45,180 62,867 450,900 -

December 31, 2010

ITRO-EMEA ITRO-PA ITRO-AAP ITRO-China ITRO-TWN E-Ten SHBG

NT$ NT$ NT$ NT$ NT$ NT$ NT$

Goodwill 9,956,021 3,855,027 2,062,580 2,121,561 560,268 221,424 1,682,869

Trademarks

& trade names 3,341,867 2,331,711 1,161,109 45,632 63,495 450,900 -

Each CGU to which the goodwill is allocated represents the lowest level within the Consolidated

Companies at which the goodwill is monitored for internal management purposes. Based on the results

of impairment tests conducted by the Company’s management, there was no evidence of impairment of

goodwill and trademarks and trade names as of December 31, 2009 and 2010. The recoverable amount

of a CGU was determined based on the value in use, and the related key assumptions were as follows:

(i) The cash flow projections based on historical operating performance, future financial budgets

approved by management covering a 5-year period.

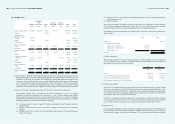

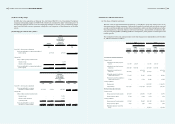

(ii) Discounted rates used to determine the value in use for each of the CGUs were as follows:

ITRO-EMEA ITRO-PA ITRO-AAP ITRO-China ITRO-TWN E-Ten SHBG

2009 12.9% 10.9% 16.9% 20.4% 15.7% 19.7% 16.0%

2010 15.2% 12.1% 19.1% 21.2% 17.6% 21.2% 17.6%

(15) Other nancial assets-non-current

December 31, 2009 December 31, 2010

NT$ NT$ US$

Refundable deposits 771,957 956,241 32,827

Non-current receivables 17,754 82,260 2,824

789,711 1,038,501 35,651

(16) Short-term borrowings

December 31, 2009 December 31, 2010

NT$ NT$ US$

Bank loans 548,059 1,651,630 56,699

For the years ended December 31, 2009 and 2010, the interest rate on the above bank loans ranged from

0.9% to 1.95% and from 0.69% to 15.5%, respectively. As of December 31, 2009 and 2010, the unused

credit facilities were NT$29,125,833 and NT$39,584,674, respectively.

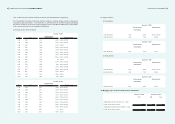

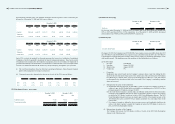

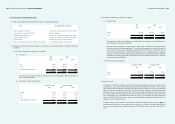

(17) Bonds Payable

December 31, 2009 December 31, 2010

NT$ NT$ US$

Convertible Bonds Payable - 13,103,887 449,842

On August 10, 2010, the Company issued US$300,000 of zero coupon overseas convertible bonds due 2015

(the “2015 Bond”) and US$200,000 of zero coupon overseas convertible bonds due 2017 (the “2017 Bond”)

at the Singapore Exchange Securities Trading Limited, for the purpose of purchasing merchandise in line

with business growth. The signicant terms and conditions of convertible bonds are as follows:

(a) The 2015 Bonds

i Par value US$300,000

ii Issue date August 10, 2010

iii Maturity date August 10, 2015

iv Coupon rate 0%

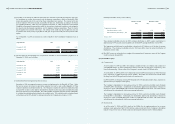

v Conversion

Bondholders may convert bonds into the Company’s common shares at any time starting the 41th

day from the issue date until 10 days prior to the maturity date. The conversion price will initially

be NT$110.76 per common share, with a fixed exchange rate of NT$31.83 = US$ 1.00, subject

to adjustment by the formula provided in the issue terms if the Company’s outstanding common

shares are increased.

vi Redemption at the option of the bondholders

A. Bondholders shall have the right, at such holder’s option, to require the Company to redeem, in

whole or in part, the 2015 Bonds held by such holder at a redemption price of 101.297% of their

principal amount in US dollars on August 10, 2013.

B. In the event that the Company’s common shares are ofcially delisted from the Taiwan Securities

Exchange, each bondholder shall have the right, at such holder’s option, to require the Company

to redeem the 2015 Bonds, in whole or in part, at 2015 Early Redemption Amount. The 2015

Early Redemption Amount represents an amount equal to 100% of the principal amount of the

2015 Bonds plus a gross yield of 0.43% per annum (calculated on a semi-annual basis) at the

relevant date.

C. If a change of control (as dened in the issue terms) occurs, each bondholder shall have the

right, at such holder’s option, to require the Company to redeem the 2015 Bonds, in whole or in

part, at 2015 Early Redemption Amount.

vii Redemption at the option of the Company

The Company shall redeem the 2015 Bonds, in whole or in part, at the 2015 Early Redemption

Amount, in the following cases: