Acer 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

102

FINANCIAL STANDING

103

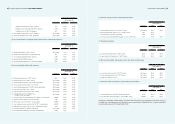

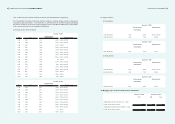

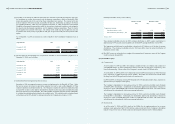

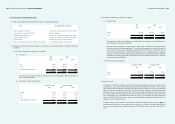

(14) Intangible assets

Goodwill

Trademarks

and

trade names Patents

Customer

Relationships

Channel

Resources Others Total

NT$ NT$ NT$ NT$ NT$ NT$ NT$

Balance at January 1, 2009 22,574,040 8,067,556 692,838 1,517,349 - 1,894,982 34,746,765

Additions - - 369,000 - - 2,536,507 2,905,507

Adjustments made

subsequent to business

acquisition (138,067) - - - - - (138,067)

Disposals (9,624) - (39,275) - - (9,759) (58,658)

Reclassication - - - - - 16,867 16,867

Effect of exchange rate

changes (448,895) (161,298) (3,073) (28,110) - (6,842) (648,218)

Amortization - (43,793) (217,701) (178,933) - (939,701) (1,380,128)

Balance at December 31,

2009 21,977,454 7,862,465 801,789 1,310,306 - 3,492,054 35,444,068

Additions - - 272 - - 264,162 264,434

Acquisitions from business

combination 2,143,875 2,386,473 - - 1,342,391 74,577 5,947,316

Disposals (1,770,123) - - - - (5,892) (1,776,015)

Reclassication - - 351,500 - - 21,389 372,889

Effect of exchange rate

changes (1,873,735) (95,741) (6,752) (95,530) (81,953) (255,057) (2,408,768)

Amortization - (109,897) (272,594) (172,263) (36,156) (860,079) (1,450,989)

Balance at December 31,

2010 20,477,471 10,043,300 874,215 1,042,513 1,224,282 2,731,154 36,392,935

(a) On December 6, 2007, the Consolidated Companies entered into a Basic Term Agreement with the

International Olympic Committee regarding participation in the Olympic Partners Program (the “Top

Programme”). Pursuant to such agreement, the Consolidated Companies have agreed to pay a certain amount

of money in cash, merchandise and service to obtain marketing rights and become one of the partners

in the “Top Programme” for the period from January 1, 2009 to December 31, 2012. Such expenditure

on sponsorship was capitalized as “Intangible Assets” in the accompanying consolidated financial

statements, and amortized using the straight-line method during the aforementioned four-year period.

(b) Purchase of Founder Technology Group Corp.’s PC business in China and the related assets

The Company, together with its subsidiaries Acer Greater China (B.V.I.) Corp., Acer Computer

(Shanghai) Ltd. and Acer (Chongqing) Ltd. (collectively as “Acer”) formally contracted with Founder

Group, Founder Technology Group Corp., and their subsidiaries (collectively as “Founder”) to purchase

for NT$5,946,316 the PC business and the related assets, and transfer the related employees of Founder

Technology Group Corp. in China, which include the following:

(1) Seven-year exclusive license in Founder PC business and products related trademarks owned by

Founder Group;

(2) Founder PC business and IT systems, trade names, copyrights, and domain names of Founder’s

products;

(3) Intangible assets such as customer lists and distribution channel resources of Founder Technology

Group’s PC business;

(4) Intangible assets such as customer lists and distribution channel resources of Founder Group and its

non-related partners; and

(5) Product warranties.

The purchase of Founder’s PC business in China was accounted for in accordance with ROC SFAS No.

25 “Accounting for Business Combination”, under which, the excess of the purchase price and direct

transaction costs over the fair value of net identiable assets was recognized as goodwill.

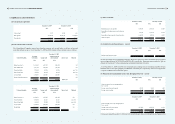

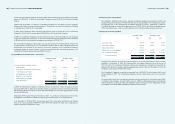

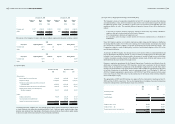

The following represents the allocation of the purchase price to the assets acquired and goodwill at the

date of purchase:

NT$ NT$

Purchase cost 5,947,316

The identiable assets purchased:

Intangible assets – Trademark 2,386,473

Intangible assets – Channel resources 1,342,391

Other intangible assets 74,577 3,803,441

Goodwill 2,143,875

Pro forma information

The following unaudited pro forma financial information of 2009 and 2010 presents the combined

results of operations as if the purchase of Founder’s PC business and related assets had occurred as of

the beginning of each of the scal years presented:

2009 2010

NT$ NT$

Revenue 605,540,935 648,713,091

Income from continuing operations before income tax 14,226,101 19,032,363

Income from continuing operations after income tax 10,582,693 14,800,672

Basic earnings per common share (in New Taiwan dollars) 4.02 5.59

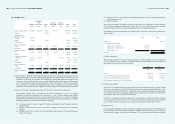

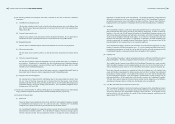

(c) Adjustment to goodwill

In 2009, the Consolidated Companies made adjustments to decrease deferred charges by NT$33,768 and

to decrease current liabilities by NT$174,307 resulted from the acquisition of Packard Bell B.V., which

also decreased goodwill by NT$140,539. Additionally, the Consolidated Companies made adjustments

to increase the fair value of outstanding employee stock options assumed through the acquisition of

ETEN in 2009, which increased goodwill by NT$2,472.

In 2010, the Consolidated Companies utilized the net operating loss carryforwards (NOLs) acquired

from the acquisition of Gateway Inc., and consequently eliminated the valuation allowance of deferred

tax assets related to NOLs recognized on the acquisition date against goodwill by NT$1,770,123.

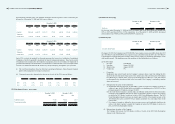

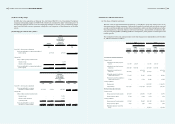

(d) Impairment test

For the purpose of impairment testing, goodwill and trademarks and trade names with indenite useful

lives are allocated to the Consolidated Companies’ cash-generating units (CGUs) that are expected to

benet from the synergies of the business combination. The carrying amounts of signicant goodwill