Acer 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

34

CAPITAL AND SHARES

35

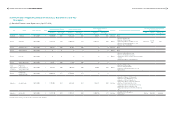

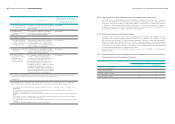

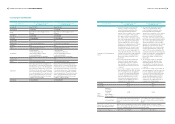

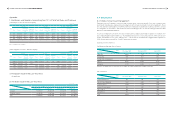

4.1 Sources of Capital

4.1.1 Sources of Capital (April 17, 2011)

Unit: Share/NT$ Thousand

Date Price of Issuance Authorized Common stock Paid-in Common stock Notes

Shares Value Shares Value

April, 2011 Share/NT$10 3,500,000,000 35,000,000 2,703,605,497 27,036,055 -

Unit: Share

Shares

Category

Authorized capital Notes

Issued shares Non-issued Total

Common shares 2,703,605,497 796,394,503 3,500,000,000 -

4.1.2 Shareholding Structure (April 17, 2011)

Unit: Share

Category/Number Government

Institution

Financial

Institution

Other

Institution Individual FINI and Foreign

Investors Total

No. of Shareholders 19 30 555 328,673 1,081 330,358

Shares 47,006,999 39,084,519 207,548,670 1,205,178,364 1,204,786,945 2,703,605,497

Percentage 1.74% 1.45% 7.67% 44.58% 44.56% 100.00%

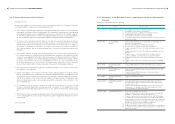

4.1.3 Distribution of Shareholdings (April 17, 2011)

Category No. of Shareholders Shares Percentage

1 ~ 999 144,144 42,166,700 1.560 %

1,000 ~ 5,000 143,587 303,682,849 11.233 %

5,001 ~ 10,000 23,860 175,831,816 6.504 %

10,001 ~ 15,000 7,243 87,979,315 3.254 %

15,001 ~ 20,000 3,844 69,080,114 2.555 %

20,001 ~ 30,000 3,095 76,398,165 2.826 %

30,001 ~ 50,000 2,127 82,445,975 3.050 %

50,001 ~ 100,000 1,280 90,137,668 3.334 %

100,001 ~ 200,000 521 71,833,601 2.657 %

200,001 ~ 400,000 239 68,350,793 2.528 %

400,001 ~ 600,000 101 49,169,932 1.819 %

600,001 ~ 800,000 54 38,143,135 1.411 %

800,001 ~ 1,000,000 43 38,446,912 1.422 %

1,000,001 and above 220 1,509,938,522 55.849 %

Total 330,358 2,703,605,497 100.000 %

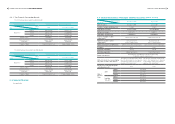

4.1.4 List of Major Shareholders (April 17, 2011)

Item

Name Shares Percentage

JPMorgan Chase Bank N.A. Taipei Branch in custody for Capital World Growth and

Income Fund Inc. 143,445,687 5.31 %

MAGELLAN 75,000,000 2.77 %

Stan Shih 74,806,719 2.77 %

Hung Rouan Investment Corp. 67,799,202 2.51 %

JPMorgan Chase Bank N.A. Taipei Branch in custody for Capital Income Builder 56,751,864 2.10 %

Acer GDR 47,143,325 1.74 %

COMGEST GROWTH PLC 47,050,940 1.74 %

JPMorgan Chase Bank N.A. Taipei Branch in custody for EuroPacific Growth Fund 41,706,024 1.54 %

VANGUARD EMERGING MARKETS STOCK INDEX FUND, A SERIES OF VANGUARD

INTERNATIONAL EQUITY INDEX FUNDS 39,911,105 1.48 %

Labor Pension Fund Supervisory Committee 28,360,628 1.05 %

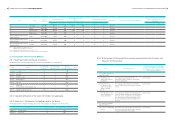

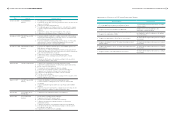

4.1.5 Market Price Per Share, Net Value, Earning& Dividend For Last Two Years

Unit: NT$

Period

Item 2009 2010 Until Mar. 31st, 2011

Market Price

Per Share

Highest 96.20 103.00 90.00

Lowest 39.65 73.50 60.00

Average 65.58 86.47 75.63

Net Value Per

Share

Before Distribution 34.98 35.32 36.30

After Distribution 31.82 Un-appropriated Un-appropriated

Earning Per

Share

Weighted Average Share Numbers

2,635,011 2,647,466 2,655,826

Thousand shares Thousand shares Thousand shares

Earning Per

Share

Current 4.31 5.71 0.45

Adjusted 4.31 Un-appropriated Un-appropriated

Dividend Per

Share

Cash Dividend (NT$) 3.1 3.6

Un-appropriated

Stock Dividend

Retained Earning (%) 0.01 -

Capital Surplus (%) - -

Accumulated unpaid dividends - - -

Return on

Investment

Analysis

P/E Ratio 15.22 15.14 -

P/D Ratio 21.15 24.02 -

Cash Dividend Yield 4.73% 4.16% -