Acer 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

38

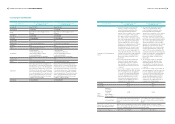

CAPITAL AND SHARES

39

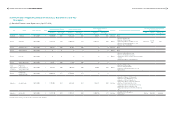

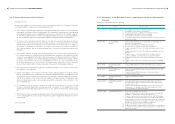

4.2 Corporate Bonds:

Corporate Bonds The 1st Overseas Unsecured

Convertible Bonds

The 2nd Overseas Unsecured

Convertible Bonds

Issuing Date August 10,2010 August 10,2010

Denomination US$100,000 US$100,000

Listing Expected to be on the Singapore Stock

Exchange

Expected to be on the Singapore Stock

Exchange

Issue Price US$100.0000 US$100.0000

Issue Size US$300,000,000 US$200,000,000

Coupon Rate 0% 0%

Maturity Date 5 years from the Issuing Date 7 years from the Issuing Date

Cuarantor None None

Trustee Citigroup International Limited Citigroup International Limited

Underwriters

Lead Underwriters:

J. P. Morgan Securities Ltd.

Citigroup Global Markets Limited

Local Lead Underwriter:

Grand Cathay Securities Corporation

Lead Underwriters:

J. P. Morgan Securities Ltd.

Citigroup Global Markets Limited

Local Lead Underwriter:

Grand Cathay Securities Corporation

Legal Counsel None None

Auditor Sonia Chang and Agnes Yang Sonia Chang and Agnes Yang

Repayment

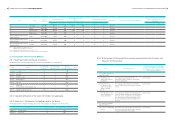

Unless previously redeemed, repurchased

and cancelled or converted, the Bonds will be

redeemed by the Issuer on the Maturity Date

at the amount which represents for the holder

of the Bonds the par value of the Bonds plus

a gross yield of 0.43% per annum, calculated

on a semi-annual basis.The actual gross yield

shall be jointly determined by the Issuer and

the Lead Underwriters based on the market

conditions on the pricing date.

Unless previously redeemed, repurchased

and cancelled or converted, the Bonds will be

redeemed by the Issuer on the Maturity Date

at the amount which represents for the holder

of the Bonds the par value of the Bonds plus

a gross yield of 2.5% per annum, calculated

on a semi-annual basis.The actual gross yield

shall be jointly determined by the Issuer and

the Lead Underwriters based on the market

conditions on the pricing date.

Outstanding US$300,000,000 US$200,000,000

Corporate Bonds The 1st Overseas Unsecured

Convertible Bonds

The 2nd Overseas Unsecured

Convertible Bonds

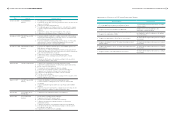

Redemption or Early Repayment

Clause

A.The Issuer may early redeem the Bonds

in whole or in part at any time after 3

years following the Issuing Date at the

Bonds’applicable Early Redemption

Amount, if the Closing Price of the common

shares of Acer traded on TSE (using the

price after conversion of such price into

U.S. dollars at the then prevailing exchange

rate on the relevant dates) reaches 130% or

above of the applicable Early Redemption

Amount divided by the Conversion Ratio,

defined to be the principal amount of Bonds

divided by the Conversion Price at that

time (translated into U.S. dollars at a fixed

exchange rate determined on the pricing

date) for 20 consecutive trading days. The

actual date from which the Issuer may early

redeem the Bonds will be jointly determined

by the Issuer and the Lead Underwriters

based on the market conditions on the

pricing date.

B. The Issuer may redeem all outstanding

Bonds at the Bonds’ applicable Early

Redemption Amount, in the event that

more than 90% of the Bonds have been

redeemed, repurchased and cancelled or

converted.

C. If as a result of changes to the relevant tax

laws and regulations in the ROC, the Issuer

becomes obligated to pay any additional

costs, the Issuer may redeem all Bondsat

the Bonds’ applicable Early Redemption

Amount. Bondholders may elect not to

have their bonds redeemed but with no

entitlement to any additional amounts or

reimbursement of additional tax.

A.The Issuer may early redeem the Bonds

in whole or in part at any time after 3

years following the Issuing Date at the

Bonds’applicable Early Redemption

Amount, if the Closing Price of the common

shares of Acer traded on TSE (using the

price after conversion of such price into

U.S. dollars at the then prevailing exchange

rate on the relevant dates) reaches 130% or

above of the applicable Early Redemption

Amount divided by the Conversion Ratio,

defined to be the principal amount of Bonds

divided by the Conversion Price at that

time (translated into U.S. dollars at a fixed

exchange rate determined on the pricing

date) for 20 consecutive trading days. The

actual date from which the Issuer may early

redeem the Bonds will be jointly determined

by the Issuer and the Lead Underwriters

based on the market conditions on the

pricing date.

B. The Issuer may redeem all outstanding

Bonds at the Bonds’ applicable Early

Redemption Amount, in the event that

more than 90% of the Bonds have been

redeemed, repurchased and cancelled or

converted.

C. If as a result of changes to the relevant tax

laws and regulations in the ROC, the Issuer

becomes obligated to pay any additional

costs, the Issuer may redeem all Bondsat

the Bonds’ applicable Early Redemption

Amount. Bondholders may elect not to

have their bonds redeemed but with no

entitlement to any additional amounts or

reimbursement of additional tax

Covenants None None

Credit Rating None None

Other

rights of

Bondholders

Amount of

Converted or

Exchanged

Common

Shares,GDRs or

Other Securities

US$0 US$0

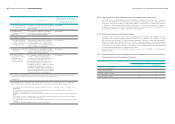

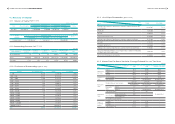

Conversion Right

In accordance with indicative Offering Plan for

an Issue of Overseas Unsecured Convertible

Bonds

In accordance with indicative Offering Plan for

an Issue of Overseas Unsecured Convertible

Bonds

Diluyion Effect and Other Adverse

Effects on Existing Shareholders

When all The 1st and 2nd Overseas Unsecured Convertible Bonds convert into common

shares, the maximum share dilution will be 6.14%. And this CB is issued at premium; therefore,

it will not be a material adverse effect on the shareholders equity.

Paying & Conversion Agent Citibank N.A. London Branch Citibank N.A. London Branch