Acer 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

78

FINANCIAL STANDING

79

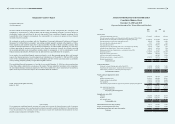

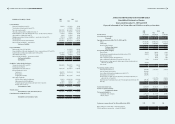

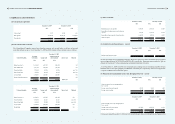

ACER INCORPORATED AND SUBSIDIARIES

Consolidated Statements of Cash Flows

Years ended December 31, 2009 and 2010

(Expressed in thousands of New Taiwan dollars and US dollars)

2009 2010

NT$ NT$ US$

Cash ows from operating activities:

Consolidated net income 11,352,860 15,118,140 518,989

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation 846,303 704,486 24,184

Amortization 1,860,284 1,891,118 64,920

Stock-based compensation cost 298,592 458,736 15,748

Unrealized exchange gain on bonds payable - (1,239,955) (42,566)

Amortization of bond discount and transaction costs - 171,597 5,891

Investment gain recognized using equity method, net (463,810) (414,351) (14,224)

Cash dividends received from equity method investments 143,037 280,117 9,616

Loss (gain) on disposal of property and equipment, net 103,055 (82,974) (2,849)

Gain on disposal of investments, net (79,162) (2,376,407) (81,579)

Valuation loss (gain) on nancial assets and liabilities (1,293,844) 1,899,825 65,219

Impairment loss of non-nancial assets, net of reversal gain 395,109 378,178 12,982

Deferred income tax expense (benet) (951,327) 826,484 28,372

Other investment loss (gain), net 227,698 (30,085) (1,033)

Gain on disposal of intangible assets (46,037) - -

Restructuring cost 164,595 - -

Changes in operating assets and liabilities:

Notes and accounts receivable (4,032,056) 10,127,478 347,665

Receivables from related parties 241,158 (118,718) (4,076)

Inventories (11,173,624) 9,882,344 339,250

Other receivable, prepayments and other current assets (951,160) 1,007,844 34,598

Non-current receivable (under other nancial assets ‒ non-current) 69,926 (64,506) (2,214)

Notes and accounts payable 31,466,106 (11,597,095) (398,115)

Payables to related parties 2,384,367 (2,021,186) (69,385)

Royalties payable, accrued expenses and other current liabilities 8,088,125 (11,509,119) (395,095)

Other liabilities (458,091) (54,044) (1,855)

Cash provided by operating activities 38,192,104 13,237,907 454,443

Cash ows from investing activities:

Proceeds from disposal of investments 1,042,680 4,069,972 139,718

Acquisition of long-term investments (259,905) (149,289) (5,125)

Proceeds from capital return or liquidation of investees 231,897 480,100 16,481

Additions to property, plant and equipment and property not used in operation (771,575) (1,113,394) (38,222)

Proceeds from disposal of property and equipment and property not used in operation 75,067 527,724 18,116

Decrease (increase) in advances to related parties 23,666 (25,407) (872)

Decrease (increase) in restricted deposits 922,794 (24,197) (831)

Additions to intangible assets (2,785,947) (6,211,750) (213,242)

Proceeds from disposal of intangible assets 25,000 - -

Increase in refundable deposits, deferred charges, and other assets (291,932) (186,000) (6,385)

Cash used in by investing activities (1,788,255) (2,632,241) (90,362)

Cash ows from nancing activities:

Increase (decrease) in short-term borrowings (538,792) 1,103,571 37,884

Issuance of convertible bonds - 15,865,788 544,655

Repayment of long-term debt (10,702) (49,923) (1,714)

Distribution of cash dividends (5,215,456) (8,218,416) (282,129)

Proceeds from exercise of employee stock option 103,590 205,812 7,065

Decrease in minority interests (63,768) (81,273) (2,790)

Cash provided by (used in) nancing activities (5,725,128) 8,825,559 302,971

Effects of exchange rate changes 795,621 (4,590,906) (157,601)

Net increase in cash and cash equivalents 31,474,342 14,840,319 509,451

Cash and cash equivalents at beginning of period 22,141,725 53,616,067 1,840,579

Cash and cash equivalents at end of period 53,616,067 68,456,386 2,350,030

Supplemental disclosures of cash ow information:

Interest paid 444,067 839,977 28,835

Income taxes paid 3,196,014 5,794,408 198,915

Supplementary disclosures of non-cash investing and nancing activities:

Change in unrealized valuation gain (loss) on nancial instruments 2,743,948 (553,717) (19,008)

Current portion of long-term debt - 6,100,000 209,406

Additions to property and equipment included in other current liabilities - 99,670 3,422

Decrease in valuation allowance of deferred income tax assets against goodwill - 1,770,123 60,766

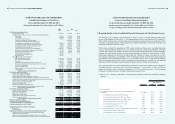

ACER INCORPORATED AND SUBSIDIARIES

Notes to Consolidated Financial Statements

As of and for the years ended December 31, 2009 and 2010

(amounts expressed in thousands of New Taiwan dollars and US dollars,

except for earnings per share information and unless otherwise noted)

1. Reporting Entities of the Consolidated Financial Statements and Their Business Scopes

Acer Sertek Inc. (the “Company”) was incorporated on August 1, 1976, as a company limited by shares under

the laws of the Republic of China (“ROC”). The Company merged with Acer Incorporated (“AI”) on March 27,

2002, with the Company as the surviving entity from the merger but renaming itself as Acer Incorporated. After

the merger, the principal activities of the Company focus on globally marketing its brand-name IT products, and

promoting E-commerce solutions to clients.

The Company completed the acquisition of 100% equity ownership of Gateway, Inc. (including eMachines

brand), a personal computer company in the U.S., through its indirectly wholly owned subsidiary on October

15, 2007. The Company also acquired the 100% equity ownership of Packard Bell B.V., a personal computer

company in Europe, through its indirectly wholly owned subsidiary on March 14, 2008 and June 30, 2008.

Following the acquisitions of Gateway and Packard Bell, the Company has dened a clear path for its multi-

brand strategy. Additionally, on September 1, 2008, the Company entered the smart phone market following

the acquisition of E-Ten Information Systems Co., Ltd. In October 2010, in order to expand into the market in

China, the Company acquired the PC business, management team and employees, regional sales and marketing

channels of Founder Technology Group Corporation, through its indirectly wholly owned subsidiary.

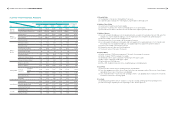

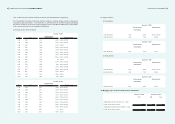

The reporting entities of the consolidated financial statements include the Company and its subsidiaries

(hereinafter referred to collectively as the “Consolidated Companies”). On December 31, 2009 and 2010, the

number of employees of the Consolidated Companies was 7,757 and 6,624, respectively. The Consolidated

Companies are summarized below according to their primary business activity.

(1) Sale of “Acer”, “Gateway”, “eMachines”, “Packard Bell” and “Founder” brand-name information technology

products:

Percentage of Ownership

At December 31,

Investor 2009 2010

(a) Acer Incorporated

(b) Acer Greater China (B.V.I.) Corp. (“AGC”, British Virgin Islands) and

subsidiaries The Company 100.00 100.00

.Acer Market Services Limited (“AMS”, Hong Kong) AGC 100.00 100.00

.Acer Computer (Far East) Limited (“AFE”, Hong Kong) AGC 100.00 100.00

.Acer Information (Zhong Shan) Co., Ltd. (“AIZS”, China) AMS 100.00 100.00

.Beijing Acer Information Co., Ltd. (“BJAI”, China) AMS 100.00 100.00

.Acer Computer (Shanghai) Ltd. (“ACCN”, China) AMS 100.00 100.00

.Acer (Chongqing) Ltd. (“ACCQ”, China) AMS - 100.00

(c) Acer European Holding B.V. (“AEH”, Netherlands Antilles ) and subsidiaries The Company 100.00 100.00

.Acer Europe B.V. (“AHN”, the Netherlands) AEH 100.00 100.00

.Acer Computer B.V. (“ACH”, the Netherlands) AEH 100.00 100.00