Acer 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

114

FINANCIAL STANDING

115

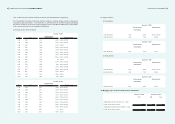

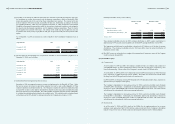

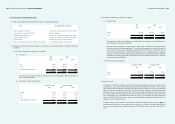

December 31, 2009 December 31, 2010

Number of

Shares

Book

Value

Market

Price

Number of

Shares

Book

Value

Market

Price

NT$ NT$ NT$ NT$

Common stock 21,787 1,050,341 2,095,930 21,809 1,050,341 1,964,990

GDRs 4,982 2,472,257 2,393,831 4,987 2,472,257 2,266,441

3,522,598 4,489,761 3,522,598 4,231,431

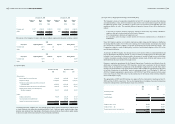

Movements of the Company’s treasury stock were as follows (expressed in thousands of shares or units):

2009

Description Beginning Balance Additions Disposal Ending Balance

Common Stock 21,571 216 - 21,787

GDRs 4,933 49 - 4,982

2010

Description Beginning Balance Additions Disposal Ending Balance

Common Stock 21,787 22 - 21,809

GDRs 4,982 5 - 4,987

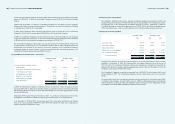

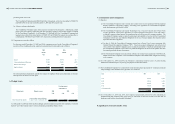

(c) Capital surplus

December 31, 2009 December 31, 2010

NT$ NT$ US$

Share premium:

Paid-in capital in excess of par value 1,784,258 2,262,989 77,686

Surplus from merger 29,800,881 29,800,881 1,023,030

Premium on common stock issued from conversion of

convertible bonds 4,552,585 4,552,585 156,285

Forfeited interest from conversion of convertible bonds 1,006,210 1,006,210 34,542

Surplus related to treasury stock transactions by

subsidiary companies 501,671 620,089 21,287

Others:

Employee stock options 360,630 632,175 21,702

Conversion right of convertible bonds - 295,494 10,144

Surplus from equity-method investments 487,883 408,492 14,023

38,494,118 39,578,915 1,358,699

According to the ROC Company Act, any realized capital surplus could be transferred to common stock

as stock dividends after deducting accumulated decit, if any. Realized capital surplus includes share

premium and donations from shareholders. Distribution of stock dividends from realized capital surplus

is subject to certain restrictions imposed by the governmental authorities.

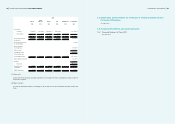

(d) Legal reserve, unappropriated earnings, and dividend policy

The Company’s articles of incorporation stipulate that at least 10% of annual net income after deducting

accumulated deficit, if any, must be retained as legal reserve until such retention equals the amount

of authorized common stock. In addition, a special reserve in accordance with applicable laws and

regulations shall be set aside. The remaining balance of annual net income, if any, can be distributed as

follows:

. at least 5% as employee bonuses; employees entitled to stock bonus may include subsidiaries’

employees that meet certain criteria set by the board of directors;

. 1% as remuneration to directors and supervisors; and

. the remainder, after retaining a certain portion for business considerations, as dividends to

stockholders.

Since the Company operates in an industry experiencing rapid change and development, distribution

of earnings shall be made in view of the year’s earnings, the overall economic environment, the related

laws and decrees, and the Company’s long-term development and steady financial position. The

Company has adopted a steady dividend policy, in which a cash dividend comprises at least 10% of the

total dividend distribution.

According to the ROC Company Act, the legal reserve can be used to offset an accumulated decit and

may be distributed in the following manner: (i) when it reaches an amount equal to one-half of the paid-

in capital, it can be transferred to common stock at the amount of one-half of legal reserve; and (ii) when

it reaches an amount exceeding one-half of the authorized common stock, dividends and bonuses can be

distributed from the excess portion of the legal reserve.

Pursuant to regulations promulgated by the Financial Supervisory Commission, and effective from the

distribution of earnings for scal year 1999 onwards, a special reserve equivalent to the total amount

of items that are accounted for as deductions to the stockholders’ equity shall be set aside from current

earnings, and not distributed. This special reserve shall be made available for appropriation to the extent

of reversal of deductions to stockholders’ equity in subsequent periods. As of December 31, 2009 and

2010, the Company appropriated a special reserve of NT$1,991,615 and NT$0, respectively, that is equal

to the sum of excess of the book value over the market price of the treasury stock and other deduction

items of shareholder’s equity.

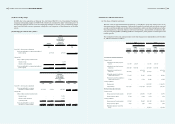

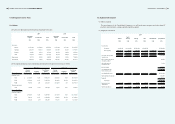

The appropriation of 2008 and 2009 earnings was approved by the shareholders at meetings on June 18,

2009, and June 18, 2010, respectively. The resolved appropriations of employee bonus and remuneration

to directors and supervisors and dividends per share were as follows:

2008 2009

NT$ NT$

Dividends per share

Cash dividends $ 2.00 3.10

Stock Dividends 0.10 0.01

$ 2.10 3.11

Employee bonus – stock $ 900,000 200,000

Employee bonus – cash 600,000 800,000

Remuneration to directors and supervisors 85,763 122,096

$ 1,585,763 1,122,096