Acer 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

108

FINANCIAL STANDING

109

agreed days. As of December 31, 2009 and 2010, the Company was in compliance with all such nancial

covenants.

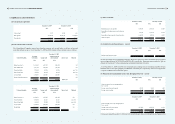

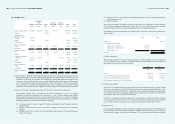

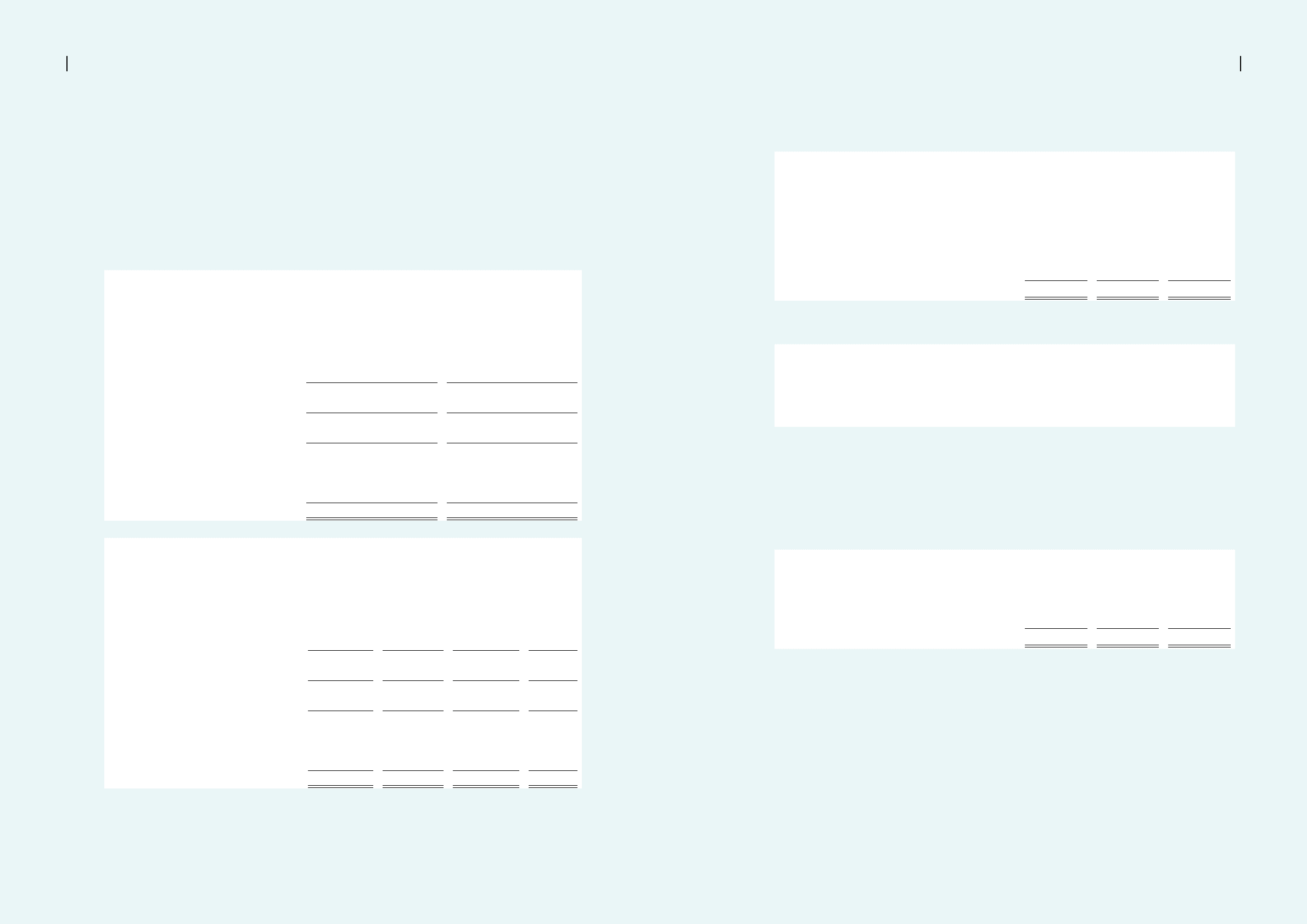

(19) Retirement plans

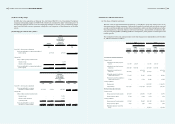

The following table sets forth the actuarial information related to the Consolidated Companies’ defined

benet retirement plans:

(a) Reconciliation of funded status of the retirement plans to prepaid pension cost (accrued pension

liabilities):

2009

Plan assets in excess of

accumulated benet obligation

Accumulated benet obligation in

excess of plan assets

NT$ NT$

Benet obligation:

Vested benet obligation (180,819) (22,077)

Non-vested benet obligation (392,082) (38,627)

Accumulated benet obligation (572,901) (60,704)

Projected compensation increases (389,885) (44,955)

Projected benet obligation (962,786) (105,659)

Plan assets at fair value 724,116 21,861

Funded status (238,670) (83,798)

Unrecognized pension loss 433,063 45,370

Unrecognized transition obligation 15,891 3,316

Minimum pension liability adjustment - (3,731)

Prepaid pension cost (accrued pension liabilities) 210,284 (38,843)

2010

Plan assets in excess of accumulated

benet obligation

Accumulated benet obligation

in excess of plan assets

NT$ US$ NT$ US$

Benet obligation:

Vested benet obligation (156,087) (5,358) (15,463) (531)

Non-vested benet obligation (551,322) (18,926) (48,745) (1,673)

Accumulated benet obligation (707,409) (24,284) (64,208) (2,204)

Projected compensation increases (843,628) (28,961) (50,197) (1,723)

Projected benet obligation (1,551,037) (53,245) (114,405) (3,927)

Plan assets at fair value 860,013 29,523 23,268 799

Funded status (691,024) (23,722) (91,137) (3,128)

Unrecognized pension loss 978,940 33,606 62,732 2,154

Unrecognized transition obligation 20,672 709 2,947 101

Minimum pension liability adjustment - - (15,482) (532)

Prepaid pension cost (accrued pension liabilities) 308,588 10,593 (40,940) (1,405)

Accrued pension liabilities are included in “other liabilities” in the accompanying consolidated balance

sheets. Prepaid pension cost is included in “deferred charges and other assets” in the accompanying

consolidated balance sheets.

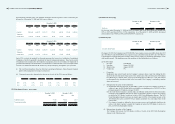

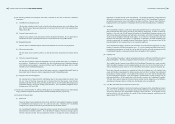

(b) The components of the net periodic pension cost were as follows:

2009 2010

NT$ NT$ US$

Service cost 51,634 44,870 1,540

Interest cost 26,954 26,801 920

Actual return on plan assets (6,087) (9,856) (338)

Amortization and deferral 7,222 7,134 245

Effect of pension plan curtailments 52,502 - -

Net periodic pension cost 132,225 68,949 2,367

(c) The principal actuarial assumptions used were as follows:

2009 2010

Discount rate 2.25% 1.75%

Rate of increase in future compensation 3.00% 3.00%~5.00%

Expected rate of return on plan assets 2.25% 1.75%

In 2009 and 2010, pension cost under the dened contribution retirement plans amounted to NT$331,469

and NT$439,411, respectively.

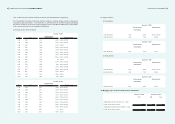

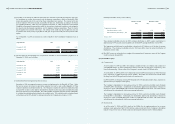

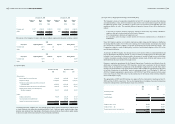

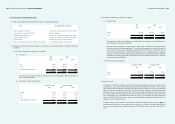

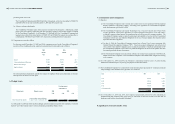

(20) Income taxes

(a) Income tax returns of the Consolidated Companies are led individually by each entity and not on a

combined basis. The components of income tax expense from continuing operations were as follows:

2009 2010

NT$ NT$ US$

Current income tax expense 4,581,450 5,154,886 176,961

Deferred income tax benet (951,327) (943,639) (32,394)

3,630,123 4,211,247 144,567

(b) The 2010 statutory corporate income tax rate for prot-seeking enterprises was reduced from 25% to

20% according to the amended ROC Income Tax Act announced issued on May 27, 2009, and was

further reduced from 20% to 17%, according to the amended ROC Income Tax Act announced on

June 15, 2010. Therefore, the statutory income tax rates applicable to the Company and its domestic

subsidiaries which are subject to the ROC Income Tax Act for the years ended December 31, 2009

and 2010 were 25% and 17%, respectively. In addition, an alternative minimum tax (“AMT”) in

accordance with the Income Basic Tax Act is calculated. Other foreign subsidiaries calculated income

tax in accordance with tax laws and regulations of the countries and jurisdictions where the respective

subsidiaries were incorporated.

The income tax calculated on the pre-tax income at the Company’s statutory income tax rate was

reconciled with the income tax expense reported in the accompanying consolidated statements of income

as follows.