Acer 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

88

FINANCIAL STANDING

89

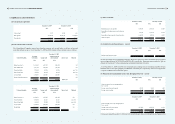

(14) Intangible assets

Goodwill is recognized when the purchase price exceeds the fair value of identiable net assets acquired in

a business combination. In accordance with the SFAS No. 25 “Accounting for Business Combinations”,

goodwill is not amortized but is tested for impairment annually.

Other intangible assets, including patents, trademarks and trade names, customer relationships, developed

technology, sales and marketing channels and purchased software, are initially stated at cost. Intangible

assets with nite useful lives are amortized over the following estimated useful life using the straight-line

method from the date that the asset is available for use: patents - 4 to 16 years; acquired software - 1 to 3

years; customer relationships - 7 to 10 years; developed technology - 10 years; channel resource - 8.8 years;

and trademarks and trade names - 7 to 20 years.

The Gateway, Packard Bell and Eten trademarks and trade names are intangible assets with indenite useful

lives. Such intangible assets are not amortized, but are tested for impairment annually. The useful life of an

intangible asset not subject to amortization is reviewed annually at each scal year-end to determine whether

events and circumstances continue to support an indenite useful life assessment for that asset. Any change

in the useful life assessment from indenite to nite is accounted for as a change in accounting estimate.

(15) Non-nancial asset impairment

The Consolidated Companies assess at each balance sheet date whether there is any indication that an asset

(an individual asset or cash-generating unit associated with the asset, other than goodwill) may have been

impaired. If any such indication exists, the Consolidated Companies estimate the recoverable amount of the

assets. An impairment loss is recognized for an asset whose carrying amount is higher than the recoverable

amount. If there is any evidence that the accumulated impairment loss of an asset other than goodwill no

longer exists or has decreased, the amount previously recognized as impairment is reversed and the carrying

amount of the asset is increased to the recoverable amount. The increased carrying amount of an asset other

than goodwill attributable to a reversal of an impairment loss shall not exceed the carrying amount that

would have been determined (net of depreciation or amortization) had no impairment loss been recognized

in prior periods.

Goodwill, assets that have an indenite useful life and intangible assets not yet available for use are tested

annually for impairment. An impairment loss is recognized for the excess of the asset’s carrying amount

over its recoverable amount. A subsequent reversal of the impairment loss is prohibited.

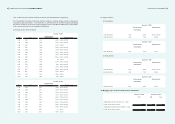

(16) Deferred charges

Deferred charges are stated at cost and primarily consist of improvements to office buildings and other

deferred charges. These costs are amortized using the straight-line method over their estimated useful lives.

(17) Convertible bonds

Convertible bonds issued by the Company contain both a nancial liability and an equity component. The

equity component grants an option to the bondholder to convert a xed number of bonds into a xed number

of the Company’s common shares. On initial recognition, the carrying amount of the liability component

is measured at the fair value of a similar liability that does not have an associated equity component. The

carrying amount of the equity component is then determined by deducting the fair value of the nancial

liability from the proceeds of the issuance of convertible bonds. Transaction costs directly attributable to the

issuance of the bonds are allocated to the liability and equity components in proportion to the allocation of

the proceeds.

The difference between the initial carrying amount of the liability component and the redeemable amount

that is payable on maturity is amortized and charged to interest expense using the effective interest rate

method over the life of the bond. The embedded nancial instruments (redemption options) are accounted

for as financial liabilities at fair value through profit and loss and measured at fair value. The equity

component of the convertible bonds is recognized in capital surplus upon initial recognition and is not

subject to valuation in subsequent periods.

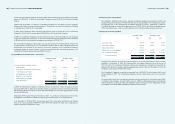

(18) Treasury stock

Common stock repurchased by the Company that is treated as treasury stock is accounted for at acquisition

cost. Upon disposal of the treasury stock, the sale proceeds in excess of cost are accounted for as capital

surplus-treasury stock. If the sale proceeds are less than cost, the deciency is accounted for as a reduction

of the remaining balance of capital surplus-treasury stock. If the remaining balance of capital surplus-

treasury stock is insufcient to cover the deciency, the remainder is recorded as a reduction of retained

earnings. The cost of treasury stock is computed using the weighted-average method.

If treasury stock is retired, the weighted-average cost of the retired treasury stock is written off to offset the

par value and the capital surplus premium, if any, of the stock retired on a pro rata basis. If the weighted-

average cost written off exceeds the sum of the par value and the capital surplus, the difference is accounted

for as a reduction of capital surplus-treasury stock, or a reduction of retained earnings for any deciency

where capital surplus-treasury stock is insufcient to cover the difference. If the weighted-average cost

written off is less than the sum of the par value and capital surplus, if any, of the stock retired, the difference

is accounted for as an increase in capital surplus-treasury stock.

The Company’s common stock held by its subsidiaries is accounted for as treasury stock. Cash dividends

paid by the Company to its consolidated subsidiaries that hold the treasury stock are accounted for as capital

surplus-treasury stock.

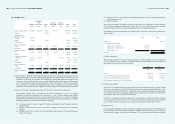

(19) Revenue recognition

Revenue from sales of products is recognized at the time products are delivered and the signicant risks and

rewards of ownership are transferred to customers. Revenue generated from service is recognized when the

service is provided and the amount becomes billable.

(20) Employee bonuses and directors’ and supervisors’ remuneration

Effective January 1, 2008, employee bonuses and remuneration to directors and supervisors which are

appropriated from earnings are estimated and charged to operating expense according to Interpretation

(2007) 052 issued by the Accounting Research and Development Foundation. Differences between the

amounts of these bonuses and remuneration approved by the shareholders in the subsequent year and those

recognized in the year when such earnings are incurred and services are rendered, if any, are accounted for

as changes in accounting estimates and charged to prot or loss in the period during which stockholders’

approval is obtained.

(21) Share-based payment transactions

The Consolidated Companies adopted SFAS No. 39 “Accounting for Share-based Payment” for share-based

payment arrangements granted on or after January 1, 2008.

Equity-settled share-based payments are measured at fair value at the date of grant. The fair value

determined at grant date is expensed over the vesting period, with a corresponding increase in equity. The

vesting period is the period during which all the specied vesting conditions of the share-based payment

arrangement are to be satised. Vesting conditions include service conditions and performance conditions

(including market conditions). When estimating the fair value of an equity-settled share-based award, only

the effect of market conditions is taken into account.

For cash-settled share-based payments, a liability equal to the portion of the services received is recognized

at its current fair value determined at each balance sheet date and at the date of settlement, with any changes