Acer 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

110

FINANCIAL STANDING

111

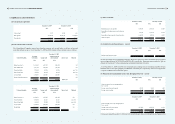

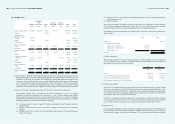

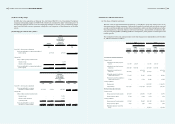

2009 2010

NT$ NT$ US$

Expected income tax 3,745,746 3,285,996 112,805

Effect of different tax rates applied to the Company’s subsidiaries 1,032,938 2,517,974 86,439

Tax-exempt investment income from domestic investees and

unremitted earnings of certain foreign subsidiaries (1,038,244) (1,065,017) (36,561)

Prior-year adjustments 523,617 200,692 6,890

Loss (gain) on disposal of marketable securities not

subject to income tax 124,873 (421,454) (14,468)

Investment tax credits 198,804 (7,534) (259)

Change in valuation allowance (350,794) (985,262) (33,823)

Tax-exempt investment income from operational headquarters (1,604,989) - -

Surtax on unappropriated retained earnings 17,646 384,593 13,203

Impairment loss of land - 69,997 2,403

Deferred tax assets resulting from spin off

adjustment (see note 5(2) (c)) (72,449) - -

Alternative minimum tax 1,417 61,344 2,105

Effect of change in income tax rate 438,368 260,478 8,942

Others 613,190 (90,560) (3,109)

Income tax expense 3,630,123 4,211,247 144,567

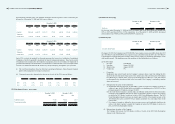

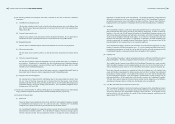

(c) The components of deferred income tax assets (liabilities) as of December 31, 2009 and 2010, were as

follows:

December 31,

2009 2010

NT$ NT$ US$

Deferred income tax assets – current:

Inventory provisions 1,058,032 909,065 31,207

Unrealized loss (gain) on valuation of nancial instruments (279,622) 77,521 2,661

Accrued advertising expense 87,747 10,679 367

Unrealized cost of sales 902,570 445,770 15,303

Warranty provision 778,287 910,516 31,257

Allowance for doubtful accounts 118,924 81,667 2,804

Accrued non-recurring engineering cost 58,825 53,277 1,829

Accrued sales allowance 149,501 244,756 8,402

Unused net operating loss carryforwards 143,674 32,024 1,099

Unused investment tax credits 64,027 - -

Unrealized foreign exchange (gains) losses 299,738 (429,652) (14,750)

Others 402,678 496,048 17,029

3,784,381 2,831,671 97,208

Valuation allowance (1,571,166) (1,175,953) (40,369)

2,213,215 1,655,718 56,839

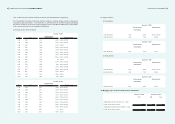

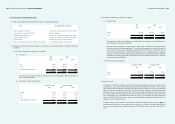

December 31,

2009 2010

NT$ NT$ US$

Deferred income tax liabilities – current:

Inventory provisions (84,598) (86,247) (2,961)

Allowance for doubtful accounts (559,274) (436,658) (14,990)

Unrealized exchange gains (15,078) (2,393) (82)

Others (21,764) (53,442) (1,834)

(680,714) (578,740) (19,867)

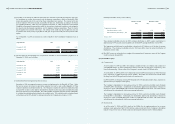

December 31,

2009 2010

NT$ NT$ US$

Deferred income tax assets – non-current:

Unrealized investment loss under the equity method 66,861 67,251 2,309

Difference in depreciation for tax and nancial purposes 16,462 478,326 16,420

Unused investment tax credits - 61,876 2,124

Unused net operating loss carryforwards 410,104 7,450,395 255,764

Difference in amortization of intangible assets for tax and

nancial purposes - 511,712 17,566

Unrealized investment loss - 200,993 6,900

Litigation provisions - 54,738 1,879

Others 101,897 155,117 5,325

595,324 8,980,408 308,287

Valuation allowance (387,735) (8,815,824) (302,637)

207,589 164,584 5,650

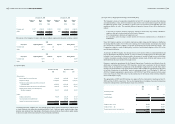

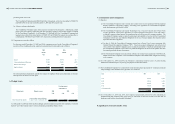

December 31,

2009 2010

NT$ NT$ US$

Deferred income tax liabilities – non-current:

Difference in amortization of intangible assets for tax and

nancial purposes (3,507,908) - -

Unrealized investment loss under the equity method 740,138 526,069 18,059

Unrealized foreign investment gain under the equity method (3,607,977) (4,062,822) (139,472)

Unused net operating loss carryforwards 13,313,903 - -

Difference in depreciation for tax and nancial purposes 811,822 - -

Accumulated asset impairment loss 245,347 198,443 6,812

Litigation provisions 87,619 - -

Unrealized investment loss 239,877 - -

Foreign currency translation adjustment (237,330) 1,028,224 35,298

Other 257,884 12,951 445

8,343,375 (2,297,135) (78,858)

Valuation allowance (13,887,322) (539,091) (18,506)

(5,543,947) (2,836,226) (97,364)