Acer 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

84

FINANCIAL STANDING

85

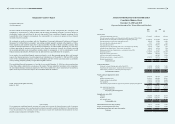

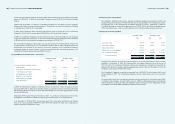

2. Summary of Signicant Accounting Policies

(1) Accounting principles and consolidation policy

The consolidated financial statements are prepared in accordance with accounting principles generally

accepted in the Republic of China. These consolidated nancial statements are not intended to present the

nancial position and the related results of operations and cash ows of the Consolidated Companies based

on accounting principles and practices generally accepted in countries and jurisdictions other than the ROC.

The consolidated nancial statements include the accounts of the Company and subsidiaries in which the

Company is able to exercise control over the subsidiary’s operations and nancial policies. The operating

activity of the subsidiary is included in the consolidated statements of income from the date that control

commences until the date that control ceases. All signicant inter-company balances and transactions are

eliminated in consolidation.

(2) Use of estimates

The preparation of the accompanying consolidated financial statements requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of

contingent assets and liabilities at the date of the consolidated nancial statements and reported amounts of

revenues and expenses during the reporting periods. Economic conditions and events could cause actual

results to differ signicantly from such estimates.

(3) Foreign currency transactions and translations

The Company’s reporting currency is the New Taiwan dollar. The Consolidated Companies record

transactions in their respective local currencies of the primary economic environment in which these entities

operate. Non-derivative foreign currency transactions are recorded at the exchange rates prevailing at the

transaction date. At the balance sheet date, monetary assets and liabilities denominated in foreign currencies

are translated into New Taiwan dollars using the exchange rates on that date. The resulting unrealized

exchange gains or losses from such translations are reflected in the accompanying statements of income.

Non-monetary assets and liabilities denominated in foreign currency that are measured in terms of historical

cost are translated using the exchange rate at the date of the transaction. Non-monetary assets and liabilities

denominated in foreign currency that are measured at fair value are reported at the rate that was in effect

when the fair values were determined. Subsequent adjustments to carrying values of such non-monetary

assets and liabilities, including the effects of changes in exchange rates, are reported in prot or loss for the

period, except that if movement in fair value of a non-monetary item is recognized directly in equity, any

foreign exchange component of that adjustment is also recognized directly in equity.

In preparing the consolidated nancial statements, the foreign subsidiaries’ nancial statements are initially

remeasured into the functional currency and the remeasuring differences are accounted for as exchange gains

or losses in the accompanying statements of income. Translation adjustments resulting from the translation

of foreign currency financial statements into the Company’s reporting currency and a monetary item that

forms part of the Company’s net investment in a foreign operation are accounted for as cumulative translation

adjustment, a separate component of stockholders’ equity.

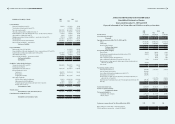

(4) Classication of current and non-current assets and liabilities

Cash or cash equivalents, and assets that will be held primarily for the purpose of being traded or are expected

to be realized within 12 months after the balance sheet date are classied as current assets; all other assets are

classied as non-current.

Liabilities that will be held primarily for the purpose of being traded or are expected to be settled within 12 months

after the balance sheet date are classified as current liabilities; all other liabilities are classified as non-current.

(5) Cash and cash equivalents

Cash and cash equivalents consist of cash on hand, cash in banks, miscellaneous petty cash, and other highly

liquid investments which do not have a signicant level of market or credit risk from potential interest rate

changes.

(6) Allowance for doubtful accounts

Allowance for doubtful accounts is provided based on the collectibility, aging and quality analysis of notes

and accounts receivable.

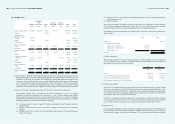

(7) Inventories

Effective January 1, 2009, the Consolidated Companies adopted the revised Republic of China Statement

of Financial Accounting Standards (SFAS) No. 10 “Accounting for Inventories”. The cost of inventories

comprises all costs of purchase and other costs incurred in bringing the inventories to their present location

and condition. Inventories are measured individually at the lower of cost and net realizable value. Cost of

inventory is determined using the weighted-average method. Net realizable value is determined based on the

estimated selling price in the ordinary course of business, less all estimated costs of completion and selling

expenses at the balance sheet date.

(8) Financial instruments

The Consolidated Companies adopted trade date accounting for nancial instrument transactions. At initial

recognition, nancial instruments are accounted for at fair value plus, in the case of a nancial instrument not

at fair value through prot or loss, transaction costs that are directly attributable to the acquisition or issue

of the financial instrument. Subsequent to initial recognition, financial instruments are classified into the

following categories in accordance with the purpose of holding or issuing of such nancial instruments:

(a) Financial assets/liabilities at fair value through prot or loss

An instrument is classied as nancial asset/liability reported at fair value through prot or loss if it is

held for trading or is designated as such upon initial recognition. Derivatives that do not meet the criteria

for hedge accounting are classified as financial assets or liabilities at fair value through profit or loss.

Financial instruments reported at fair value through prot or loss are measured at fair value, and changes

therein are recognized in prot or loss.

(b) Hedging derivative nancial assets / liabilities

Hedging derivative nancial assets / liabilities represent derivatives that are intended to hedge the risk of

changes in exchange rates resulting from operating activity transactions denominated in foreign currencies

and conform to the criteria for hedge accounting.

(c) Available-for-sale nancial assets

Available-for-sale nancial assets are measured at fair value and changes therein, other than impairment

losses and foreign exchange gains and losses on available-for-sale monetary items, are recognized as a

separate line item of stockholders’ equity. When an investment is derecognized, the cumulative unrealized

gain or loss recognized in equity is transferred to profit or loss. If there is objective evidence which

indicates that a nancial asset is impaired, a loss is recognized in prot or loss. If, in a subsequent period,

events or changes in circumstances indicate that the amount of impairment loss decreases, reversal of a

previously recognized impairment loss for equity securities is charged to equity; while for debt securities,

the reversal is allowed through prot or loss provided that the decrease is clearly attributable to an event

which occurred after the impairment loss was recognized.