Acer 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

72

FINANCIAL STANDING

73

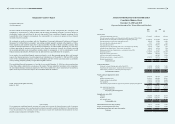

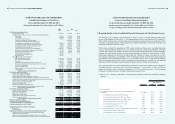

Independent Auditors’ Report

The Board of Directors

Acer Incorporated:

We have audited the accompanying consolidated balance sheets of Acer Incorporated (the “Company”) and

subsidiaries as of December 31, 2010 and 2009, and the related consolidated statements of income, changes in

stockholders’ equity, and cash flows for the years then ended. These consolidated financial statements are the

responsibility of the Company’s management. Our responsibility is to express an opinion on these financial

statements based on our audits.

We conducted our audits in accordance with the “Regulations Governing Auditing and Certication of Financial

Statements by Certied Public Accountants” and auditing standards generally accepted in the Republic of China.

Those regulations and standards require that we plan and perform the audit to obtain reasonable assurance about

whether the nancial statements are free of material misstatement. An audit includes examining, on a test basis,

evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing

the accounting principles used and signicant estimates made by management, as well as evaluating the overall

nancial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated nancial statements referred to in the rst paragraph present fairly, in all material

respects, the nancial position of Acer Incorporated and subsidiaries as of December 31, 2010 and 2009, and the

results of their consolidated operations and their consolidated cash ows for the years then ended, in conformity

with accounting principles generally accepted in the Republic of China.

The consolidated nancial statements as of and for the year ended December 31, 2010, have been translated into

United States dollars solely for the convenience of the readers. We have audited the translation, and in our opinion,

the consolidated financial statements expressed in New Taiwan dollars have been translated into United States

dollars on the basis set forth in note 2(27) to the consolidated nancial statements.

Taipei, Taiwan (the Republic of China)

March 11, 2011

Note to Readers

The accompanying consolidated nancial statements are intended only to present the nancial position, results of operations

and cash ows in accordance with accounting principles and practices generally accepted in the Republic of China and not those

of any other jurisdictions. The standards, procedures and practices to audit such consolidated financial statements are those

generally accepted and applied in the Republic of China.

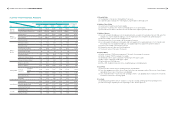

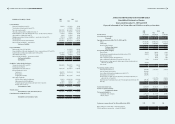

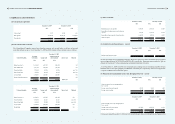

ACER INCORPORATED AND SUBSIDIARIES

Consolidated Balance Sheets

December 31, 2009 and 2010

(Expressed in thousands of New Taiwan dollars and US dollars)

Assets 2009 2010

NT$ NT$ US$

Current assets:

Cash and cash equivalents (note 4(1)) 53,616,067 68,456,386 2,350,030

Notes and accounts receivable, net of allowance for doubtful accounts of NT$1,681,844

and NT$1,159,472 as of December 31, 2009 and 2010, respectively (note 4(2)) 111,858,366 101,730,888 3,492,306

Notes and accounts receivables from related parties (note 5) 600,306 719,024 24,683

Other receivables from related parties (note 5) 21,507 46,914 1,611

Other receivables (note 4(3)) 9,263,152 7,860,935 269,857

Financial assets at fair value through prot or loss ‒ current (notes 4(5) and (25)) 157,659 38,895 1,335

Available-for-sale nancial assets ‒ current (notes 4(4) and (25)) 223,437 225,710 7,748

Hedging purpose derivative nancial assets ‒ current (notes 4(6) and (25)) 1,275,157 88,372 3,034

Inventories (note 4(7)) 51,184,953 41,240,053 1,415,724

Prepayments and other current assets 1,694,058 1,845,878 63,367

Non-current assets held for sale (note 4(8)) - 1,827,855 62,748

Deferred income tax assets ‒ current (note 4(20)) 2,213,215 1,655,718 56,839

Restricted deposits (note 6) - 24,197 831

Total current assets 232,107,877 225,760,825 7,750,113

Long-term investments:

Investments accounted for using equity method (note 4(10)) 3,314,950 2,235,701 76,749

Available-for-sale nancial assets ‒ noncurrent (notes 4(11) and (25)) 3,306,742 2,274,902 78,095

Financial assets carried at cost ‒ noncurrent (notes 4(9) and (25)) 2,251,058 1,722,677 59,138

Total long-term investments 8,872,750 6,233,280 213,982

Property, plant and equipment (note 4(12)):

Land 2,509,029 1,927,170 66,158

Buildings and improvements 5,386,921 4,629,090 158,911

Computer equipment and machinery 3,059,222 3,102,280 106,498

Other equipment 3,219,265 3,152,324 108,216

Construction in progress and advance payments for purchases of property and equipment 83,680 50,993 1,751

14,258,117 12,861,857 441,534

Less: accumulated depreciation (4,904,235) (5,040,515) (173,035)

accumulated impairment (677,709) (881,568) (30,263)

Net property, plant and equipment 8,676,173 6,939,774 238,236

Intangible assets (note 4(14))

Trademark 7,862,465 10,043,300 344,775

Goodwill 21,977,454 20,477,471 702,968

Other intangible assets 5,604,149 5,872,164 201,585

Total intangible assets 35,444,068 36,392,935 1,249,328

Other nancial assets (notes 4(15), (25) and 6) 789,711 1,038,501 35,651

Property not used in operation (note 4(13)) 2,971,542 2,355,522 80,862

Deferred charges and other assets (notes 4(19) and (20)) 2,162,567 1,777,693 61,026

Total assets 291,024,688 280,498,530 9,629,198