Acer 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

86

FINANCIAL STANDING

87

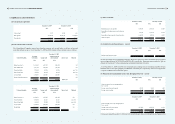

(d) Financial assets carried at cost

Equity investments whose fair value cannot be reliably measured are carried at original cost. If there is

objective evidence which indicates that an equity investment is impaired, a loss is recognized.

(e) Financial liabilities measured at amortized cost

Financial liabilities not measured at fair value through profit or loss and not designated as hedging

instruments are measured at amortized cost.

(9) Derivative nancial instruments and hedging activities

Hedge accounting recognizes the offsetting effects on profit or loss of changes in the fair values of the

hedging instrument and the hedged item. The designated hedging instruments that conform to the criteria for

hedge accounting are accounted for as follows:

(a) Fair value hedges

Changes in the fair value of a hedging instrument designated as a fair value hedge are recognized in prot

or loss. The hedged item is also stated at fair value in respect of the risk being hedged, with any gain or

loss thereon recognized in prot or loss.

(b) Cash ow hedges

Changes in the fair value of a hedging instrument designated as a cash ow hedge are recognized directly

in equity. If a hedge of a forecasted transaction subsequently results in the recognition of an asset or

a liability, then the amount recognized in equity is reclassied into prot or loss in the same period or

periods during which the asset acquired or liability assumed affects prot or loss.

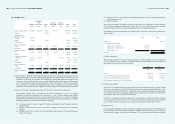

(10) Non-current assets held for sale

Non-current assets and groups of assets and liabilities which comprise disposal groups are classied as held

for sale when the assets are available for immediate sale in their present condition subject only to terms that

are usual and customary for sales of such assets (or disposal groups), and their sale within one year is highly

probable. Non-current assets or disposal groups classied as held for sale are measured at the lower of their

book value or fair value less costs to sell, and ceased to be depreciated or amortized. Non-current assets

or disposal groups classied as held for sale are presented separately on the consolidated balance sheets.

Interest and other expenses attributable to the liabilities of a disposal group classied as held for sale are

continued to be recognized until the related assets are disposed.

An impairment loss is recognized for any initial or subsequent write-down of the assets (or disposal

groups) to fair value less costs to sell in the consolidated statements of income. A gain from any subsequent

increase in fair value less costs to sell of an asset (or a disposal group) is recognized, but not in excess of the

cumulative impairment loss that has been recognized.

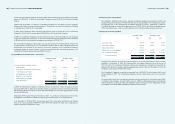

(11) Equity method investments

Long-term equity investments in which the Consolidated Companies, directly or indirectly, own 20% or

more of the investee’s voting shares, or less than 20% of the investee’s voting shares but are able to exercise

signicant inuence over the investee’s operating and nancial policies, are accounted for using the equity

method.

Effective January 1, 2006, under the amended ROC SFAS No. 5, “Long-term Investments under Equity

Method,” the difference between acquisition cost and carrying amount of net equity of the investee as of

the acquisition date is allocated proportionately based on the excess of fair value over the carrying value of

noncurrent assets on the investee’s books. Allocated amounts are amortized based on the method used for

the related assets. Any unallocated difference is treated as investor-level goodwill. If the allocation reduces

non-current assets to zero value, the remaining excess over acquisition cost is recognized as an extraordinary

gain. Prior to January 1, 2006, investor-level goodwill was amortized over ve years on a straight-line basis.

Commencing January 1, 2006, as required by the amended ROC SFAS No. 5, investor-level goodwill is no

longer amortized but tested for impairment.

Upon the sale of equity-method investment, the difference between the selling price and carrying amount

of the investment at the date of sale is recognized as a disposal gain or loss. In proportion to the percentage

disposed of, capital surplus and other equity adjustment items arising from the long-term investment are

debited against disposal gain or loss.

If an investee company issues new shares and the Company does not acquire new shares in proportion to

its original ownership percentage, the Company’s equity in the investee’s net assets will be changed. The

change in the equity interest is adjusted through the capital surplus and long-term investment accounts. If

the Company’s capital surplus is insufcient to offset the adjustment to long-term investment, the difference

is charged as a reduction of retained earnings.

Unrealized inter-company profits and losses resulting from transactions between the Consolidated

Companies and investees accounted for under the equity method are deferred to the extent of the Company’s

ownership. The prots and losses resulting from transactions relating to depreciable or amortizable assets

are recognized over the estimated useful lives of such assets. Prots and losses arising from transactions

relating to other assets are recognized when realized.

(12) Capital leases

For capital leases, where the Consolidated Companies act as the lessor, all periodic rental payments plus

bargain purchase price or estimated residual value are accounted for as lease payment receivables. The

present value of all lease payment receivables, discounted at the implicit interest rate, is recorded as revenue.

The difference between the lease payment receivables and the revenue is the unearned interest revenue,

which is recognized over the lease term using the effective interest method.

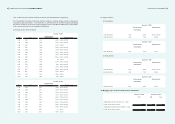

(13) Property, plant and equipment, property leased to others, and property not in use

Property, plant and equipment are stated at acquisition cost. Interest expense related to the purchase and

construction of property, plant and equipment is capitalized and included in the cost of the related asset.

Significant renewals, improvements and replacements are capitalized. Maintenance and repair costs are

charged to expense as incurred. Gains and losses on the disposal of property, plant and equipment are

recorded in the non-operating section in the accompanying consolidated statements of income.

Commencing from November 20, 2008, the Company capitalizes retirement or recovery obligation for

property and equipment in accordance with Interpretation (2008) 340 issued by the Accounting Research

and Development Foundation. A component which is signicant in relation to the total cost of the property

and equipment and for which a different depreciation method or rate is appropriate is depreciated separately.

Depreciation is provided for property, plant and equipment, property leased to others, and property not used

in operation over the estimated useful life using the straight-line method. The range of the estimated useful

lives of the respective classes of assets is as follows: buildings and improvements - 30 to 50 years; computer

equipment and machinery - 3 to 10 years; and other equipment - 3 to 20 years.

The estimated useful lives, depreciation method and residual value are evaluated at the end of each year and

any changes thereof are accounted for as changes in accounting estimates.

Property leased to others and property not used in operation is classied to other assets and continue to be

depreciated and are subject to an impairment test.