Acer 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

94

FINANCIAL STANDING

95

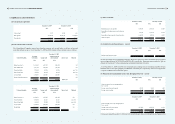

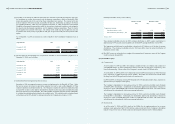

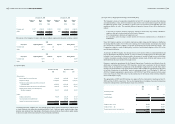

value of these derivative contracts amounted to NT$652,108 and NT$(255,223), respectively.

The Consolidated Companies entered into derivative contracts to manage foreign currency exchange risk

arising from operating activities. As of December 31, 2009 and 2010, the derivative nancial instruments

that did not conform to the criteria for hedge accounting and were classied as nancial assets and liabilities

at fair value through prot or loss consisted of the following:

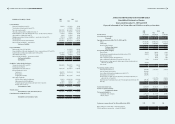

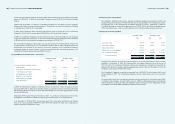

(a) Foreign currency forward contracts

December 31,2009

Buy Sell

Contract amount

(in thousands) Maturity period

USD / SGD USD 12,600 2010/01~2010/03

USD / MXN USD 96,100 2010/01~2010/03

USD / EUR EUR 47,000 2010/02

USD / INR USD 55,992 2010/01~2010/03

USD / MYR USD 15,400 2010/01~2010/03

USD / THB USD 20,670 2010/01~2010/02

USD / JPY USD 68,300 2010/01~2010/04

USD / RUB USD 124,000 2010/01~2010/04

USD / PHP USD 100 2010/01

USD / ZAR USD 21,500 2010/01~2010/03

USD / NTD USD 5,000 2010/01~2010/02

EUR / NOK EUR 17,403 2010/01~2010/04

EUR / SEK EUR 48,400 2010/01~2010/04

EUR / PLN EUR 23,000 2010/01

RUB / USD USD 36,689 2010/01

MXN / USD USD 2,900 2010/01

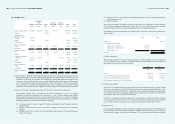

December 31,2010

Buy Sell

Contract amount

(in thousands) Maturity period

USD / SGD USD 15,000 2011/01~2011/03

USD / MYR USD 26,300 2011/01~2011/02

USD / THB USD 29,200 2011/01~2011/02

USD / INR USD 67,417 2011/01~2011/03

USD / JPY USD 68,000 2011/01~2011/04

USD / MXN USD 81,500 2011/01~2011/04

USD / RUB USD 258,821 2011/01~2011/04

USD / ZAR USD 36,000 2011/01~2011/04

USD / EUR EUR 45,685 2011/01~2011/02

AUD / USD USD 21 2011/01

RUB / USD USD 38,546 2011/01

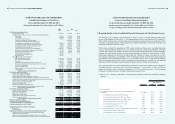

(b) Options contracts

(i) Long position

December 31, 2009

Contract amount Maturity period

(in thousands)

USD Call/EUR Put USD 22,500 2010/01~2010/02

USD Call/RUB Put USD 5,000 2010/02

December 31, 2010

Contract amount Maturity period

(in thousands)

EUR Call/GBP Put EUR 23,325 2011/01

(ii) Short position

December 31, 2009

Contract amount Maturity period

(in thousands)

EUR Call/USD Put USD 22,500 2010/01~2010/02

RUB Call/USD Put USD 7,500 2010/02

December 31, 2010

Contract amount Maturity period

(in thousands)

GBP Call/EUR Put EUR 28,528 2011/01

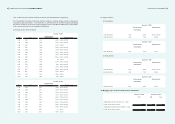

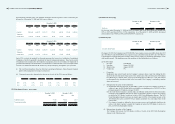

(6) Hedging purpose derivative nancial assets and liabilities

December 31, 2009 December 31, 2010

NT$ NT$ US$

Hedging purpose derivative nancial assets – current:

Foreign currency forward contracts 1,275,157 88,372 3,034

Hedging purpose derivative nancial liabilities – current

Foreign currency forward contracts (196,714) (759,866) (26,085)