Acer 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

106

FINANCIAL STANDING

107

A. At any time on or after August 10, 2013 and prior to the maturity date, the closing price

(translated into US dollars at the prevailing rate) of its common shares on the Taiwan Stock

Exchange is at least 130% of the 2015 Early Redemption Amount for 20 consecutive trading

days.

B. If more than 90% of 2015 Bond has been redeemed, repurchased and cancelled, or converted;

C. The change in the tax regulations of ROC causes the Company become obliged to pay

additional amounts in respect of taxes or expenses.

viii Redemption at maturity

Unless previously redeemed, repurchased and cancelled, or converted, the Company shall redeem

the 2015 Bonds at a redemption price of their principal amount plus a gross yield of 0.43% per

annum (calculated on a semi-annual basis) on August 10, 2015.

(b) The 2017 Bonds

i. Par value US$200,000

ii. Issue date August 10, 2010

iii. Maturity date August 10, 2017

iv. Coupon rate 0%

v. Conversion

Bondholders may convert bonds into the Company’s common shares at any time starting the 41th

day from the issue date until 10 days prior to the maturity date. The conversion price will initially

be NT$113.96 per common share, with a fixed exchange rate of NT$31.83 = US$ 1.00, subject

to adjustment by the formula provided in the issue terms if the Company’s outstanding common

shares are increased

vi Redemption at the option of the bondholders

A. Bondholders shall have the right, at such holder’s option, to require the Company to redeem, in

whole or in part, the 2017 Bonds held by such holder at a redemption price of 113.227% of their

principal amount in US dollars on August 10, 2015.

B. In the event that the Company’s common shares are officially delisted from the Taiwan

Securities Exchange, each bondholder shall have the right, at such holder’s option, to require the

Company to redeem the 2017 Bonds, in whole or in part, at 2017 Early Redemption Amount.

The 2017 Early Redemption Amount represents an amount equal to 100% of the principal

amount of the 2017 Bonds plus a gross yield of 2.5% per annum (calculated on a semi-annual

basis) at the relevant date.

C. If a change of control (as dened in the issue terms) occurs, each bondholder shall have the

right, at such holder’s option, to require the Company to redeem the 2017 Bonds, in whole or in

part, at 2017 Early Redemption Amount.

vii. Redemption at the option of the Company

The Company shall redeem the 2017 Bonds, in whole or in part, at the 2017 Early Redemption

Amount, in the following cases:

A. At any time on or after August 10, 2013 and prior to the maturity date, the closing price

(translated into US dollars at the prevailing rate) of its common shares on the Taiwan Stock

Exchange is at least 130% of the 2017 Early Redemption Amount for 20 consecutive trading

days.

B. If more than 90% of 2017 Bond has been redeemed, repurchased and cancelled, or converted;

C. The change in the tax regulations of ROC causes the Company become obliged to pay

additional amounts in respect of taxes or expenses.

viii. Redemption Amount at Maturity

Unless previously redeemed, repurchased and cancelled, or converted, the Company shall redeem

the 2017 Bonds at a redemption price of their principal amount plus a gross yield of 2.5% per

annum (calculated on a semi-annual basis) on August 10, 2017.

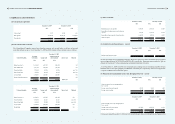

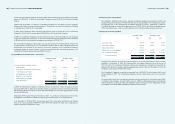

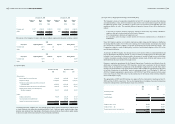

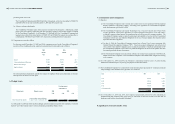

As of December 31, 2010, the liability and equity components of the aforementioned convertible bonds

were as follows:

NT$

Proceeds of issuance $ 15,950,000

Transaction cost (84,212)

Net proceeds of issuance 15,865,788

Amortization of bonds payable discount and transaction cost (recognized as interest expense) 171,597

Unrealized exchange gain on bonds payable (1,239,955)

Evaluation gain on redemption options of the convertible bonds (59,525)

Recognized as capital surplus-conversion right (295,494)

Recognized as nancial liabilities at fair value through prot and

loss (redemption options of the convertible bonds)

(1,338,524)

Carrying amount of bonds payable (straight bond value) $ 13,103,887

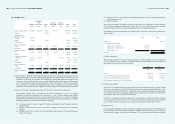

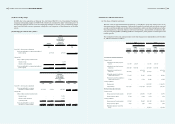

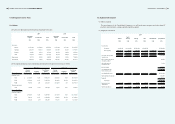

(18) Long-term debts

December 31, 2009 December 31, 2010

NT$ NT$ US$

Citibank syndicated loan 12,200,000 12,200,000 418,812

Other bank loans 171,856 121,933 4,186

Less: current installments - (6,100,000) (209,406)

12,371,856 6,221,933 213,592

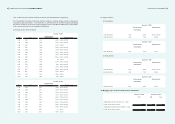

The Company entered into a syndicated loan agreement with Citibank, the managing bank of the syndicated

loan, on October 11, 2007, and the terms of this loan agreement were as follows:

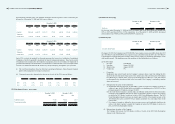

December 31,

2009

December 31,

2010

Type of Loan Creditor Credit Line Term NT$ NT$

Unsecured

loan

Citibank

and other

banks

Term tranche of NT$16.5

billion; ve-year limit

during which revolving

credits disallowed

The original loan amounted to

NT$16.5 billion; an advance

repayment of NT$4.3 billion was

made in the rst quarter of 2008.

The loan is repayable in 4 semi-

annual installments starting from

April 2011.

12,200,000 12,200,000

Revolving tranche of

NT$3.3 billion; three-year

limit

One-time repayment in full in

October 2010. The Company did

not use this credit facility. - -

Less: current installment - (6,100,000)

12,200,000 6,100,000

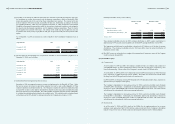

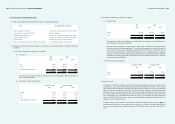

The above syndicated loan bore interest at an average rate of 1.67% in 2009 and 1.55% in 2010. According

to the loan agreement, the Company is required to maintain certain financial ratios calculated based on

annual and semi-annual audited consolidated financial statements. If the Company fails to meet any of

the financial ratios, the managing bank will request the Company in writing to take action to improve

within agreed days. No assertion of breach of contract will be tenable if the nancial ratios are met within