Acer 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

112

FINANCIAL STANDING

113

(d) According to the Statue for Industrial Innovation, the domestic Consolidated Companies may apply

for investment tax credits from research and development expenditures, which are deductible from

income tax payable only in the year when these expenditures are incurred. The amount of the tax

credit is limited to 30% of the income tax payable for that year. Additionally, according to the Statue

for Upgrading Industries, which has been repealed on December 31, 2009, the domestic Consolidated

Companies were granted investment tax credits for the purchase of automatic machinery and equipment,

for research and development expenditures, and for employee training expenditures. These tax credits

may be applied over a period of ve years. The amount of the credit that may be applied in any year

is limited to 50% of the income tax payable for that year, except for the nal year when such tax credit

expires.

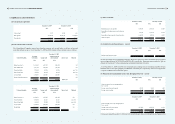

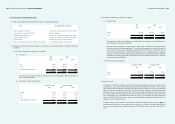

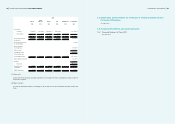

As of December 31, 2010, investment tax credits available to the Consolidated Companies were as

follows:

Expiration date NT$ US$

December 31, 2012 49,412 1,696

December 31, 2013 12,464 428

61,876 2,124

(e) The tax effects of net operating loss carryforwards available to the Consolidated Companies as of

December 31, 2010, were as follows:

Expiration date NT$ US$

December 31, 2011 21,296 731

December 31, 2012 20,805 714

December 31, 2013 151,978 5,217

December 31, 2014 99,713 3,423

Thereafter 7,188,627 246,778

7,482,419 256,863

(f) Information about the integrated income tax system

Beginning in 1998, an integrated income tax system was implemented in the Republic of China. Under

the new tax system, the income tax paid at the corporate level can be used to offset Republic of China

resident stockholders’ individual income tax. The Company is required to establish an imputation credit

account (ICA) so that a record shall be maintained for corporate income taxes paid and imputation credit

that can be allocated to each stockholder. The credit available to Republic of China resident stockholders

is calculated by multiplying the dividend by the creditable ratio. The creditable ratio is calculated based

on the balance of the ICA divided by earnings retained by the Company since January 1, 1998.

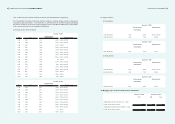

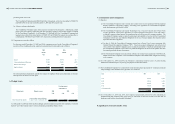

Information related to the ICA was as follows:

December 31, 2009 December 31, 2010

NT$ NT$ US$

Unappropriated earnings:

Earned before January 1, 1998 6,776 6,776 233

Earned commencing from January 1, 1998 16,615,824 24,226,370 831,664

16,622,600 24,233,146 831,897

Balance of ICA 611,323 2,214,361 76,016

The estimated creditable ratio for the 2010 earnings distribution to ROC resident stockholders is

approximately 8.64%; and the actual creditable ratio for the 2009 earnings distribution was 12.40%.

The imputation credit allocated to stockholders is based on the ICA balance as of the date of earnings

distribution. The estimated creditable ratio for 2010 may differ when the actual distribution of

imputation credit is made.

(g) The ROC income tax authorities have completed the examination of income tax returns of the Company

for all scal years through 2008.

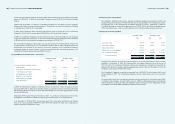

(21) Stockholders’ equity

(a) Common stock

As of December 31, 2009 and 2010, the Company’s authorized shares of common stock consisted of

3,500,000,000 shares, of which 2,688,228,278 shares and 2,700,179,258 shares, respectively, were

issued and outstanding. The par value of the Company’s common stock is NT$10 per share.

As of December 31, 2009 and 2010, the Company had issued 18,284 thousand units and 10,323 thousand

units, respectively, of global depository receipts (GDRs). The GDRs were listed on the London Stock

Exchange, and each GDR represents ve shares of common stock.

In 2009 and 2010, the Company issued 2,709 thousand and 6,613 thousand common shares, respectively,

upon the exercise of employee stock options.

The Company’s shareholders in the meeting on June 19, 2009, resolved to distribute stock dividends

of NT$264,298 to shareholders. Additionally, the shareholders approved the distribution of bonuses to

employees in stock of NT$900,000 with an issuance of 16,234 thousand new shares. The stock issuance

was authorized by and registered with the governmental authorities.

The Company’s shareholders in the meeting on June 18, 2010, resolved to distribute stock dividends

of NT$26,893 to stockholders. Additionally, the shareholders approved the distribution of bonuses to

employees in stock of NT$200,000 with an issuance of 2,648 thousand new shares. The stock issuance

was authorized by and registered with the governmental authorities.

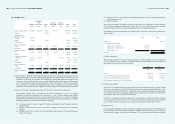

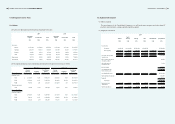

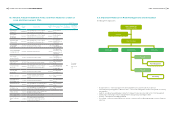

(b) Treasury stock

As of December 31, 2009 and 2010, details of the GDRs (for the implementation of an overseas

employee stock option plan) held by AWI and the common stock held by the Company’s subsidiaries

namely CCI and E-Ten were as follows (expressed in thousands of shares and New Taiwan dollars):