Acer 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

92

FINANCIAL STANDING

93

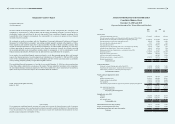

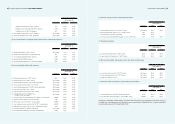

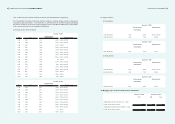

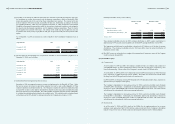

4. Signicant Account Disclosures

(1) Cash and cash equivalents

December 31, 2009 December 31, 2010

NT$ NT$ US$

Cash on hand 8,217 18,805 646

Bank deposits 34,278,393 48,641,345 1,669,802

Time deposits 19,329,457 19,796,236 679,582

53,616,067 68,456,386 2,350,030

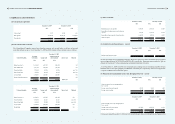

(2) Notes and accounts receivable

The Consolidated Companies entered into factoring contracts with several banks to sell part of accounts

receivable without recourse. As of December 31, 2009 and 2010, details of these contracts were as follows:

December 31, 2009

Underwriting bank

Factoring

credit limit Amount sold

Amount advanced

(derecognized)

Interest rate

Collateral

NT$ NT$ NT$

Italia Factor S.p.A. 11,219,842 6,877,785 2,091,300 Nil

ABN AMRO Bank 7,881,189 3,480,028 3,227,242 Nil

China Trust Bank 1,750,000 218,706 218,706 note 7(4)

Taipei Fubon Bank 968,500 442,145 442,145 note 7(4)

La Caixa Bank 3,724,657 3,200,041 3,200,041 Nil

Emirates Bank International 960,900 - - Nil

26,505,088 14,218,705 9,179,434 0.83%~5%

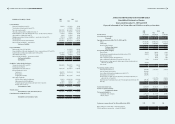

December 31, 2010

Underwriting bank

Factoring

credit limit Amount sold

Amount advanced

(derecognized)

Interest rate

Collateral

NT$ NT$ NT$

Italia Factor S.p.A. 10,650,633 3,615,597 3,461,056 Nil

China Trust Bank 1,000,000 227,217 227,217 note 7(4)

Taipei Fubon Bank 600,000 398,989 398,989 note 7(4)

La Caixa Bank 5,698,038 5,569,479 5,049,844 Nil

Taishin Bank 22,261,932 8,184,158 8,168,602 Nil

40,210,603 17,995,440 17,305,708 0.84%~5%

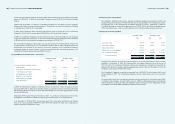

(3) Other receivable

December 31, 2009 December 31, 2010

NT$ NT$ US$

Refundable income tax and VAT 1,690,263 2,465,753 84,647

Receivables of reimbursement of advertisement

expense

917,452 1,553,181 53,319

Receivables of patent royalty allocated to others 1,164,992 422,769 14,513

Other receivables 5,490,445 3,419,232 117,378

9,263,152 7,860,935 269,857

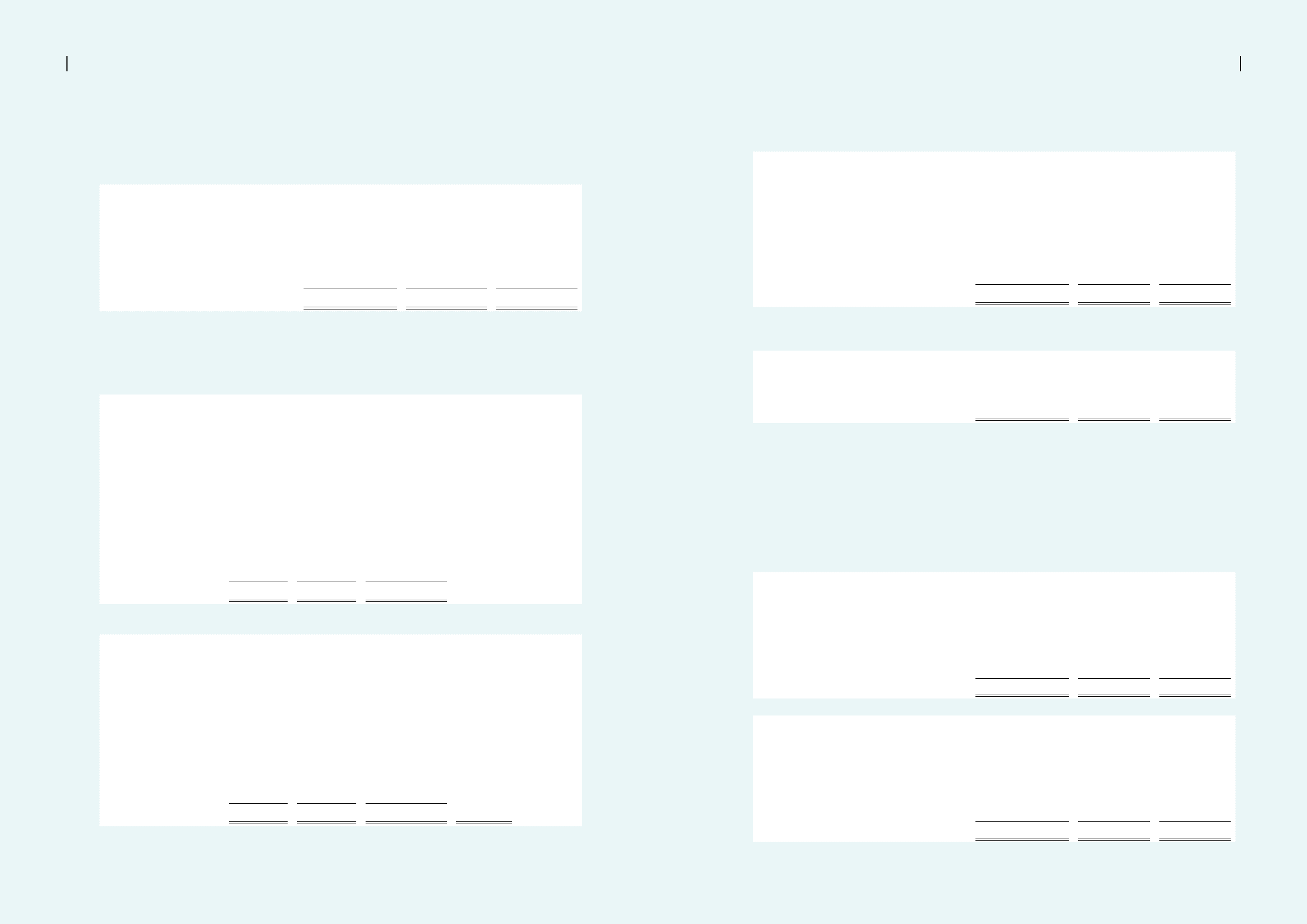

(4) Available-for-sale nancial assets-current

December 31, 2009 December 31, 2010

NT$ NT$ US$

Publicly traded equity securities 223,437 225,710 7,748

In 2009 and 2010, the Consolidated Companies disposed of portions of these investments and recognized

gains on disposal thereof of NT$24,022 and NT$16,545, respectively. These gains were recorded as “gain on

disposal of investments” in the accompanying consolidated statements of income.

As of December 31, 2009 and 2010, the unrealized gain resulting from re-measuring available-for-sale

nancial assets to fair value amounted to NT$92,843 and NT$96,717, respectively, which was recognized as

a separate component of stockholders’ equity.

(5) Financial assets and liabilities at fair value through prot or loss-current

December 31, 2009 December 31, 2010

NT$ NT$ US$

Financial assets at fair value through prot or

loss-current:

Foreign currency forward contracts 139,515 30,381 1,043

Foreign currency options 18,144 8,514 292

157,659 38,895 1,335

December 31, 2009 December 31, 2010

NT$ NT$ US$

Financial liability at fair value through prot or

loss-current:

Foreign currency forward contracts (157,848) (289,276) (9,931)

Foreign currency options (4,691) (9,722) (333)

(162,539) (298,998) (10,264)

For the years ended December 31, 2009 and 2010, unrealized gains (losses) resulting from the changes in fair