Acer 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

122

FINANCIAL STANDING

123

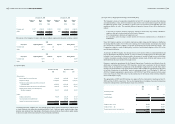

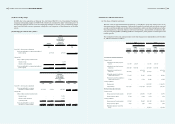

5. Transactions with Related Parties

(1) Names and relationships of related parties with the Consolidated Companies

Name Relationship with the Company

Wistron Corporation (“Wistron”) Investee of the Company accounted for by equity method

Cowin Worldwide Corporation (“COWIN”) Subsidiary of Wistron

Bluechip Infotech Pty Ltd. (“SAL”) Investee of the Company accounted for by equity method

E-Life Mall Corp. (“E-Life”) Investee of the Company accounted for by equity method

iDSoftCapital Inc. Its chairman is one of the Company’s supervisors

Directors, supervisors, chief executive ofcers and vice presidents The Consolidated Companies’ executive ofcers

(2) Signicant transactions with related parties as of and for the years ended December 31, 2009 and 2010 were

as follows:

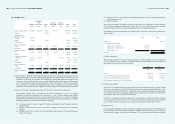

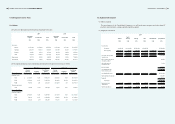

(a) Net sales and related notes and accounts receivable

(i) Net sales to:

2009 2010

NT$ NT$ US$

SAL 768,379 904,917 31,065

E-Life 690,738 680,814 23,371

Other (individually less than 5%) 77,605 97,149 3,335

1,536,722 1,682,880 57,771

The sales prices and payment terms to related parties were not signicantly different from those of

sales to non-related parties.

(ii) Notes and accounts receivable from:

December 31, 2009 December 31, 2010

NT$ NT$ US$

COWIN 315,929 411,850 14,138

SAL 116,156 104,956 3,603

E-Life 109,090 137,077 4,706

Others (individually less than 5%) 59,131 65,141 2,236

600,306 719,024 24,683

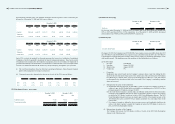

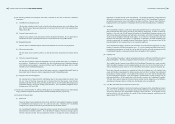

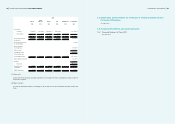

(b) Purchases and related notes and accounts payable

(i) Purchases from:

2009 2010

NT$ NT$ US$

Wistron 32,351,566 19,993,042 686,339

Others 214 109,302 3,752

32,351,780 20,102,344 690,091

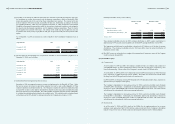

The trading terms with related parties are not comparable to the trading terms with third parties as

the specications of products are different.

The Consolidated Companies sold raw material to Wistron and its subsidiaries and purchased back

the nished goods after being manufactured. To avoid double-counting, the revenues from sales of

raw materials to Wistron and its subsidiaries amounting to NT$142,542,535 and NT$122,256,130

for the years ended December 31, 2009 and 2010, respectively, were excluded from the consolidated

revenues and cost of goods sold. Having enforceable rights, the Consolidated Companies offset the

outstanding receivables and payables resulting from the above-mentioned transactions. The offset

resulted in a net payable balance.

(ii) Notes and accounts payable to:

December 31, 2009 December 31, 2010

NT$ NT$ US$

Wistron 10,172,553 7,733,546 265,484

Others 59,811 32,552 1,118

10,232,364 7,766,098 266,602

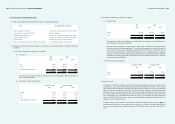

(c) Spin-off of assets

On February 28, 2002, the Company spun off its design, manufacturing and services business from its

brand business and transferred the related operating assets and liabilities to Wistron. The Company

agreed with Wistron that Wistron is obligated to pay for the deferred income tax assets being transferred

only when they are actually utilized. In 2006, the ROC income tax authorities examined and rejected

Wistron’s claim of investment credits transferred from the spin-off in the income tax returns for the years

from 2002 to 2004. Wistron disagreed with the assessment and led a request with the tax authorities

for a reexamination of the aforementioned income tax returns. The Company recognized income tax

expense of NT$875,802 based on the tax exposure estimated in 2006 and provided a valuation allowance

against the receivables from Wistron.

In 2008 and 2009, the tax authorities subsequently concluded that Wistron could utilize portions of the

aforementioned deferred tax assets resulting from the spin-off. As a result, the valuation allowance was

reversed to current income tax benefit in the amount of NT$72,449 for the year ended December 31,

2009.