Acer 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

118

FINANCIAL STANDING

119

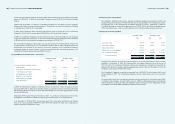

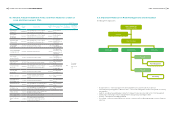

(23) Restructuring charges

In 2009, due to the acquisition of Gateway Inc. and Packard Bell B.V., the Consolidated Companies

recognized restructuring charges of NT$164,595, which were accounted for under “restructuring cost” of

non-operating expenses and loss in the accompanying statements of income. These restructuring charges

were associated with severance payments to employees and integration of the information technology

system.

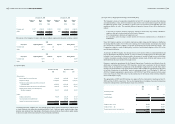

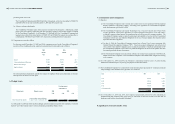

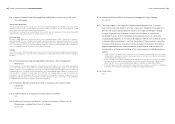

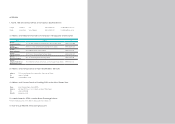

(24) Earnings per common share (“EPS”)

2009

Amount

(in thousands)

Weighted-

average number

of outstanding

shares of

common stock

(in thousands)

EPS (in dollars)

NT$ NT$

Basic EPS-after retroactive adjustments

Net income attributable to common shareholders of

parent company

11,353,374

2,635,011 4.31

Diluted EPS

Effect of dilutive potential common shares:

Employee bonus - 23,175

Employee stock option plan - 10,953

Net income attributable to common shareholders of

parent company

11,353,374 2,669,139 4.25

2010

Amount (in thousands)

Weighted-

average number

of outstanding

shares of common

stock

(in thousands) EPS (in dollars)

NT$ US$ NT$ US$

Basic EPS-after retroactive adjustments

Net income attributable to common

shareholders of parent company 15,117,997 518,984 2,647,466 5.71 0.20

Diluted EPS

Effect of dilutive potential common shares:

Employee bonus - - 23,328

Employee stock option plan - - 17,153

Convertible bonds 171,597 5,891 56,052

Net income attributable to common

shareholders of parent company

15,289,594 524,875 2,743,999

5.57

0.19

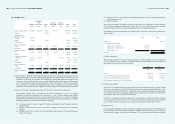

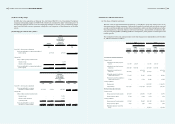

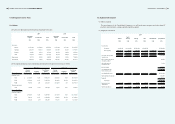

(25) Disclosure of nancial instruments

(a) Fair values of nancial instruments

The book value of short-term financial instruments is considered to be the fair value because of the

short-term maturity of these instruments. Such method is applied to cash and cash equivalents, notes and

accounts receivable (including receivables from related parties), other receivables (including receivables

from related parties), restricted deposits, short-term borrowings, current portion of long-term debt,

notes and accounts payables (including payables to related parties), other payables to related parties and

royalties payable.

The estimated fair values and carrying amounts of all other nancial assets and liabilities as of December

31, 2009 and 2010 were as follows:

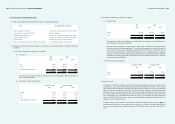

2009 2010

Fair value Fair value

Carrying

amount

Public

quoted

price

Valuation

amount

Carrying

amount

Public

quoted

price

Valuation

amount

NT$ NT$ NT$ NT$ NT$ NT$

Non-derivative nancial instruments

Financial assets:

Available-for-sale nancial assets-

current 223,437 223,437 - 225,710 225,710 -

Available-for-sale nancial assets-

noncurrent 3,306,742 3,306,742 - 2,274,902 2,274,902 -

Financial assets carried at cost-

noncurrent 2,251,058 -

see below

(b) 1,722,677 -

see below

(b)

Refundable deposits (classied as

“other nancial assets”) 771,957 - 771,957 956,241 - 956,241

Noncurrent receivables (classied as

“other nancial assets”) 17,754 - 17,754 82,260 - 82,260

Financial liabilities:

Bonds payable - - - 13,103,887 - 13,668,171

Long-term debt 12,371,856 - 12,371,856 6,221,933 6,221,933

Derivative nancial instruments

Financial assets:

Foreign currency forward contracts 1,414,672 - 1,414,672 118,753 - 118,753

Foreign currency options 18,144 - 18,144 8,514 - 8,514

Financial liabilities:

Foreign currency forward contracts 354,562 - 354,562 1,049,142 - 1,049,142

Foreign currency options 4,691 - 4,691 9,722 - 9,722

Redemption option of convertible

bonds - - - 1,338,524 - 1,338,524