Acer 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ACER INCORPORATED

2010 ANNUAL REPORT

96

FINANCIAL STANDING

97

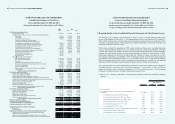

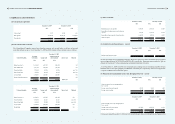

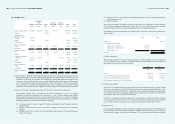

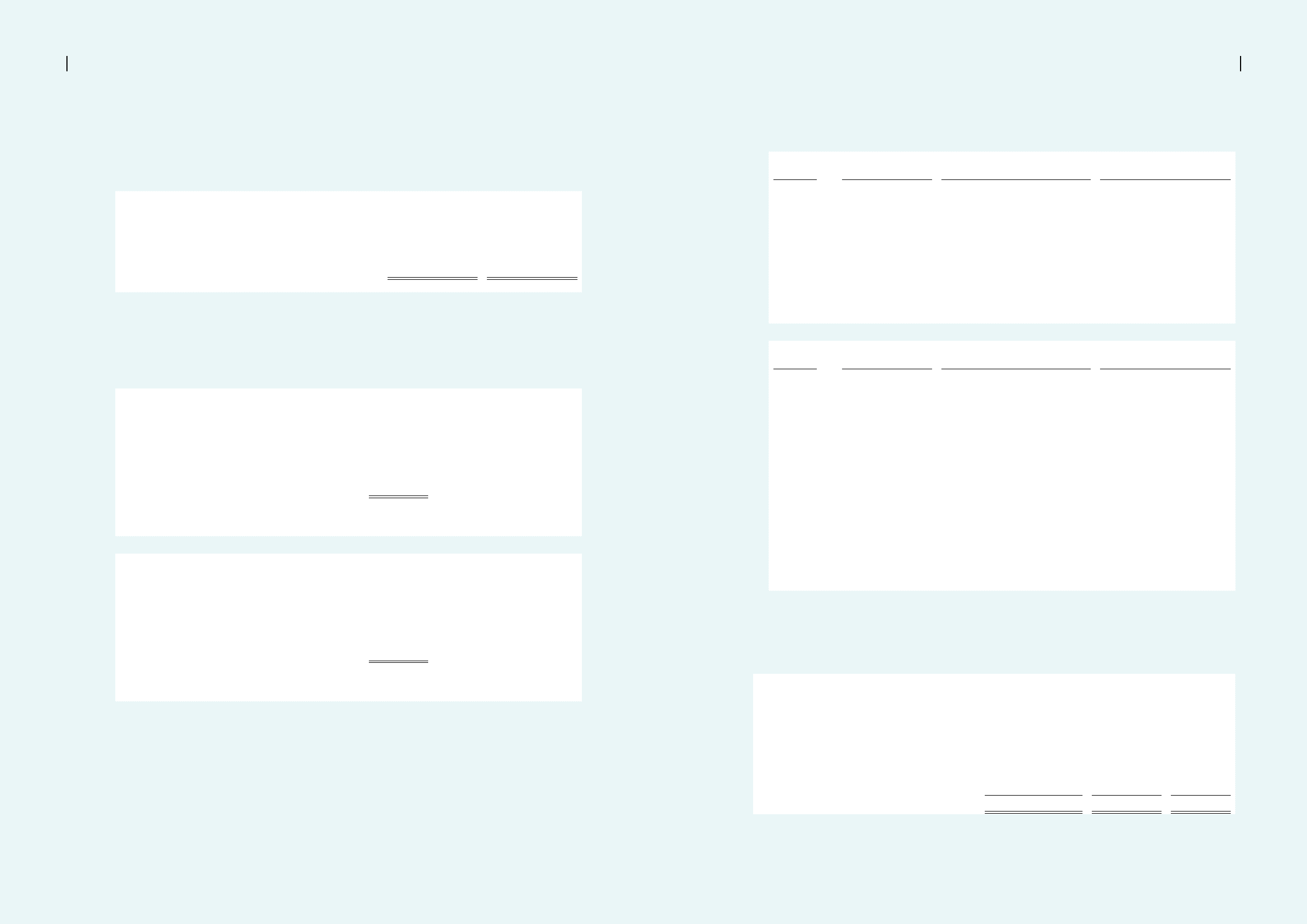

The Consolidated Companies entered into derivative contracts to hedge foreign currency exchange

risk associated with a recognized asset or liability or with a highly probable forecast transaction. As

of December 31, 2009 and 2010, hedged items designated as fair value hedges and fair value of their

respective hedging derivative nancial instruments were as follows:

Fair value of hedging instruments

Hedged Items Hedging instruments December 31, 2009 December 31, 2010

NT$ NT$

Accounts receivable/ payable

denominated in foreign currencies

Foreign currency forward

contracts

1,066,045 (638,082)

For the years ended December 31, 2009 and 2010, the unrealized gains (losses) resulting from the changes

in fair value of hedging instruments amounted to NT$641,736 and NT$(1,704,127), respectively.

As of December 31, 2009 and 2010, hedged items designated as cash ow hedges and the fair value of

their respective hedging derivative nancial instruments were as follows:

December 31, 2009

Hedged items Hedging instruments

Fair value

of hedging

instruments

Expected period

of cash ow

Expected period

of recognition in

earnings

NT$

Accounts receivable/payable Foreign currency forward 12,398 Jan.~ Mar 2010 Jan.~ Mar 2010

denominated in foreign contracts

currencies

December 31, 2010

Hedged items Hedging instruments

Fair value

of hedging

instruments

Expected period

of cash ow

Expected period

of recognition in

earnings

NT$

Accounts receivable/payable Foreign currency forward (33,412) Jan.~ May 2011 Jan.~ May 2011

denominated in foreign contracts

currencies

As of December 31, 2009 and 2010, unrealized gains (losses) on derivative nancial instruments effective

as cash ow hedges, amounted to NT$12,398 and NT$(33,412), respectively, which were accounted for

as “unrealized gain (loss) on nancial instruments”, a separate component of stockholder’s equity.

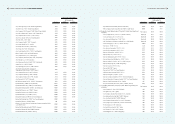

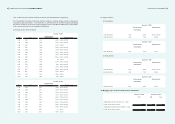

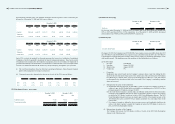

The details of outstanding hedging derivative nancial instruments described above as of December 31,

2009 and 2010 were as follows:

(a) Foreign currency forward contracts

December 31, 2009

Buy Sell Contract amount (in thousands) Maturity period

USD / AUD USD 51,000 2010/01~2010/02

USD / CAD USD 58,265 2010/01~2010/02

USD / EUR EUR 870,918 2010/01~2010/03

EUR / GBP EUR 237,105 2010/01~2010/03

USD / NZD USD 3,900 2010/01~2010/03

AUD / NZD AUD 2,150 2010/01~2010/02

USD / CNY USD 160,000 2010/01~2010/04

USD / NTD USD 25,000 2010/01

December 31, 2010

Buy Sell Contract amount (in thousands) Maturity period

AUD / NZD AUD 4,750 2011/01~2011/05

EUR / GBP EUR 93,133 2011/01~2011/04

EUR / NOK EUR 5,000 2011/01

EUR / SEK EUR 26,646 2011/01

EUR / CHF EUR 11,193 2011/01~2011/02

EUR / PLN EUR 34,832 2011/01~2011/04

USD / CAD USD 133,858 2011/01~2011/03

USD / AUD USD 121,000 2011/01~2011/05

USD / NZD USD 5,250 2011/01~2011/05

USD / NTD USD 21,000 2011/01

USD / EUR EUR 1,024,805 2011/01~2011/03

USD / CNY USD 5,000 2011/01

NOK / EUR EUR 1,023 2011/01

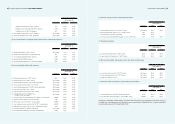

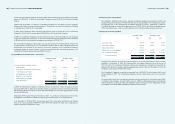

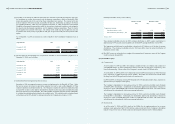

(7) Inventories

(a) Inventories (net of provision for obsolescence and slow-moving inventories) as of December 31, 2009

and 2010, were as follows:

December 31, 2009 December 31, 2010

NT$ NT$ US$

Raw materials 18,489,941 16,422,852 563,778

Work in process 45,089 17,353 595

Finished goods and merchandise 15,471,217 12,150,905 417,127

Spare parts 2,477,522 1,759,398 60,398

Inventories in transit 14,701,184 10,889,545 373,826

51,184,953 41,240,053 1,415,724