Acer 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

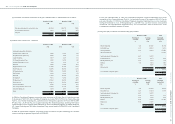

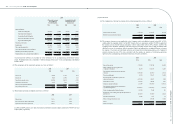

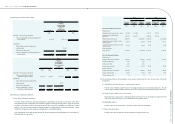

(20) Stock-based compensation plans

As of December 31, 2009, details of the employee stock option plans (“ESOP”) were as follows:

Stock Options

Employee stock

option plan 1

Employee stock

option plan 2

Employee stock

option plan 3

Employee stock

option plan 4

Grant date 2008/11/31 2008/09/01 (note 1) 2008/09/01 (note 1) 2009/10/30

Granted shares (in thousands) 14,000 8,717 1,067 14,000

Contractual life (in years) 3 4.97 2 3

Vesting period 2 years of service

subsequent to grant

date

1~3 years of service

subsequent to grant

date

1 year of service

subsequent to grant

date

2 years of service

subsequent to grant

date

Qualied employees (note 2) (note 3) (note 3) (note 2)

Note 1: The Company assumed the employee stock option plans 2 and 3 through the acquisition of E-Ten on September 1, 2008.

Note 2: The options are granted to eligible employees of the Company and its domestic or foreign subsidiaries, in which the Company

directly or indirectly, owns 50% or more of the subsidiary’s voting shares.

Note 3: The options are granted to eligible employees of the Company’s subsidiaries, in which the Company directly or indirectly owns

50% or more of equity interests.

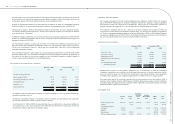

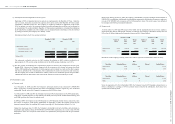

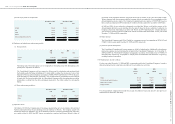

The Consolidated Company utilized the Black-Scholes or the binomial option pricing model to value the stock

options granted, and the fair value of the option and main inputs to the valuation models were as follows:

2008 2009

Employee stock

option plan 1

Employee stock

option plan 2

Employee stock

option plan 3

Employee stock

option plan 4

Exercise price (NT$) 25.28 44.50 16.90 42.90

Expected remaining contractual life (in years) 34.26 0.56 3

Fair market value for underlying securities –

Acer shares (NT$) 45.95 59.10 59.10 78.00

Fair value of options granted (NT$) 25.124 25.47 ~ 26.11 42.20 ~ 42.58 40.356

Expected volatility 45.01% 34.98% 37.35% 40.74%

Expected dividend yield note 4 note 4 note 4 note 4

Risk-free interest rate 2.50% 2.40% 1.84% 1.03%

Note 4: According to the employee stock option plan, the option prices are adjusted to take into account dividends paid on the underlying

security. As a result, the expected dividend yield is excluded from the calculation.

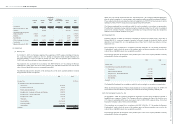

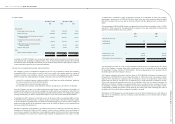

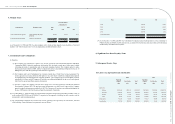

Movements in number of stock options outstanding:

2008

The Company’s employee stock

option plan E-Ten’s Employee stock option plan

Number of

options

(in thousands)

Weighted-

average exercise

price

(NT$)

Number of

options

(in thousands)

Weighted-

average exercise

price

(NT$)

Outstanding, beginning of year - - - -

Granted 14,000 25.28 9,784 41.49

Forfeited - - (518) -

Exercised - - (173) 16.90

Outstanding, end of year 14,000 25.28 9,,093 41.66

Exercisable, end of year - 406

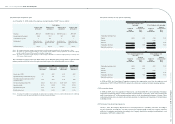

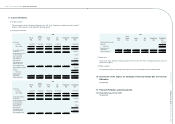

2009

The Company’s Employee stock

option plan

E-Ten’s Employee stock

Option plan

Number of

options

(in thousands)

Weighted-

average exercise

price

(NT$)

Number of

options

(in thousands)

Weighted-

average exercise

price

(NT$)

Outstanding, beginning of year 14,000 25.28 9,093 41.90

Granted 14,000 42.90 - -

Forfeited - - (890) -

Exercised - - (3,083) 38.12

Outstanding, end of year 28,000 33.62 5,120 41.52

Exercisable, end of year - 1,541

In 2008 and 2009, the Consolidated Companies recognized the compensation costs from the employee stock

option plans of NT$37,856 an NT$298,952, respectively, which were accounted for under operating expenses.

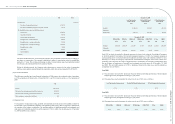

(21) Restructuring charges

In 2008 and 2009, due to the acquisition of Gateway Inc. and Packard Bell B.V., the Consolidated Companies

recognized restructuring charges of NT$1,582,408 and NT$164,595, respectively, which were accounted for

under “restructuring cost” of non-operating expenses and loss in the accompanying statements of income. These

restructuring charges were associated with severance payments to employees and integration of the information

technology system.

(22) Net income from discontinued operations

On July 1, 2007, the Company disposed all of its ownership interest in a subsidiary, Sertek Inc. According to

the sales agreement, if Sertek Inc. was able to achieve the stipulated profit in 2007, the Company would be

entitled to a contingent consideration. Accordingly, the Company obtained the contingent consideration in cash

amounting to NT$99,843 in March 2008.

Acer Incorporated 2009 Annual Report

104.

Acer Incorporated 2009 Annual Report

105. Financial Standing