Acer 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

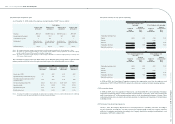

(f) Information about the integrated income tax system

Beginning in 1998, an integrated income tax system was implemented in the Republic of China. Under the

new tax system, the income tax paid at the corporate level can be used to offset Republic of China resident

stockholders’ individual income tax. The Company is required to establish an imputation credit account

(ICA) to maintain a record of the corporate income taxes paid and imputation credit that can be allocated to

each stockholder. The credit available to Republic of China resident stockholders is calculated by multiplying

the dividend by the creditable ratio. The creditable ratio is calculated based on the balance of the ICA divided

by earnings retained by the Company since January 1, 1998.

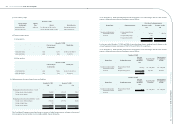

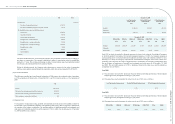

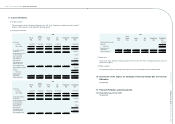

Information related to the ICA is summarized below:

December 31, 2008 December 31, 2009

NT$ NT$ US$

Unappropriated earnings:

Earned before January 1, 1998 6,776 6,776 212

Earned after January 1, 1998 13,978,542 16,615,824 518,758

13,985,318 16,622,600 518,970

Balance of ICA 198,401 611,323 19,086

The estimated creditable ratio for the 2009 earnings distribution to ROC resident stockholders is

approximately 13.35%; and the actual creditable ratio for the 2008 earnings distribution was 5.01%.

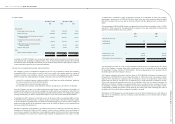

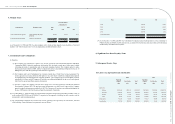

(g) The ROC income tax authorities have examined the income tax returns of the Company for all scal years

through 2006. However, the Company disagreed with the assessments of its income tax returns from scal

2004 to 2006 regarding the adjustments of certain expenses and investment tax credits and has led a request

with the tax authorities for a reexamination. The reexamination of income tax returns was still in process,

and the Company has accrued an additional tax liability related to the disallowed expenses and provided a

valuation allowance on deferred tax assets based on the amount of assessed investment tax credits.

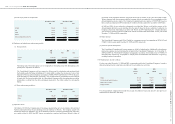

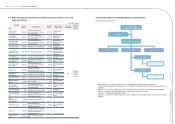

(19) Stockholders’ equity

(a) Common stock

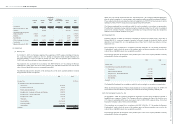

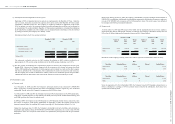

As of December 31, 2008 and 2009, the Company’s authorized common stock consisted of 3,500,000,000

shares, respectively, of which 2,642,855,993 shares and 2,688,228,278 shares, respectively, were issued and

outstanding. The par value of the Company’s common stock is NT$10 per share.

As of December 31, 2008 and 2009, the Company had issued 8,412 thousand units and 18,284 thousand units,

respectively, of global depository receipts (GDRs). The GDRs were listed on the London Stock Exchange, and

each GDR represents ve shares of common stock.

In 2008 and 2009, the Company issued 124 thousand and 2,709 thousand common shares, respectively, upon

the exercise of employee stock options. Additionally, on September 1, 2008, the Company issued 168,159

thousand common shares for acquiring 100% equity ownership of E-Ten Information Systems Co., Ltd.

During their meeting on June 13, 2008, the Company’s shareholders resolved to distribute stock dividends to

shareholders and employees bonus of NT$390,823 and NT$330,000, respectively. As a result, a total of 69,082

thousand new shares were issued. The stock issuance was authorized by and registered with the governmental

authorities.

During their meeting on June 19, 2009, the Company‘s shareholders resolved to distribute stock dividends of

NT$264,298 to stockholders. Additionally, the shareholders approved the distribution of bonuses to employees

in stock of NT $900,000 with an issuance of 16,234 thousand new shares. The stock issuance was authorized

by and registered with the governmental authorities.

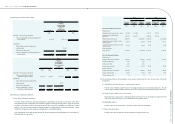

(b) Treasury stock

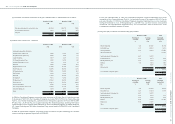

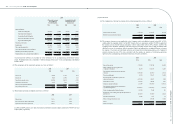

As of December 31, 2008 and 2009, details of the GDRs (for the implementation of an overseas employee

stock option plan) held by AWI and the common stock held by the Company’s subsidiaries namely CCI and

E-Ten were as follows (expressed in thousands of shares and New Taiwan dollars):

December 31, 2008 December 31, 2009

Number of

Shares

Book

Value

Market

Price

Number of

Shares

Book

Value

Market

Price

NT$ NT$ NT$ NT$

Common stock 21,571 1,050,341 918,946 21,787 1,050,341 2,095,930

GDRs 4,933 2,472,257 1,100,893 4,982 2,472,257 2,393,831

3,522,598 2,019,839 3,522,598 4,489,761

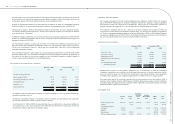

Movements of the Company’s treasury stock were as follows (expressed in thousands of shares or units):

2008

Description Beginning Balance Additions Disposal Ending Balance

Common Stock 17,057 4514 - 21,571

GDRs 4,860 73 - 4,933

2009

Description Beginning Balance Additions Disposal Ending Balance

Common Stock 21,571 216 - 21,787

GDRs 4,933 49 - 4,982

Upon the acquisition of E-Ten in September 2008, the Company issued 4,259 thousand common shares to

E-Ten’s subsidiaries in exchange of E-Ten’s common shares owned by the subsidiaries. Such shares were

accounted for as treasury stock.

Acer Incorporated 2009 Annual Report

100.

Acer Incorporated 2009 Annual Report

101. Financial Standing