Acer 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

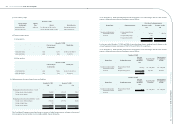

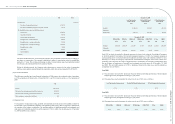

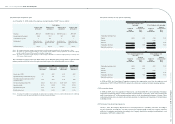

NT$ NT$

Purchase Price: 8,837,267

Fair value of common shares issued 8,700,751

Fair value of outstanding employee stock options assumed 136,516

The identiable assets acquired and liabilities assumed:

Current assets 2,574,588

Long-term investment 789,753

Property, plant and equipment 1,856,836

Intangible assets – ETEN trademark 450,900

Intangible assets – customer relationship 151,100

Intangible assets – developed technology 1,802,500

Intangible assets – others 88,400

Other assets 485,261

Current liabilities (1,263,892) 6,935,446

Goodwill 1,901,821

The ETEN trademark for the stock trading PDA product has an indenite useful life and, accordingly, is

not subject to amortization. The customer relationship is subject to amortization using the straight-line

method over 7 years. The developed technology is subject to amortization using the straight-line method

over 10 years, the estimated period of its economic benets.

Within the allocation period, the Company made adjustments to increase the fair value of outstanding

employee stock options assumed through the acquisition, which also increased goodwill by NT$2,472.

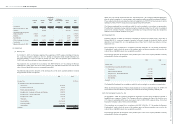

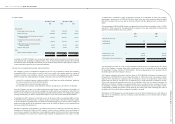

(b) Pro forma information

The following unaudited pro forma nancial information of 2008 presents the combined results of operations

as if the acquisitions of Gateway Inc., Packard Bell B.V., and E-Ten had occurred as of the beginning of

2008:

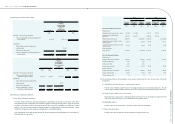

NT$

Revenue 550,172,239

Net income from continuing operations before income tax 14,676,395

Net income from continuing operations after income tax 11,521,166

Basic earnings per common share (in dollars) 4.43

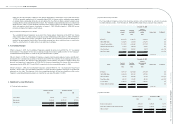

(c) Impairment test

For the purpose of impairment testing, goodwill and trademarks and trade names with indenite useful lives

are allocated to the Consolidated Companies’ cash-generating units (CGUs) that are expected to benet from

the synergies of the business combination. The carrying amounts of signicant goodwill and trademarks and

trade names with indenite useful lives and the respective CGUs to which they are allocated as of December

31, 2008 and 2009, were as follows:

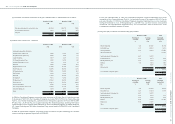

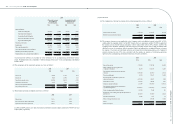

December 31, 2008

Acer Pan-America

business group

Packard Bell brand

business group

E-Ten Information

System group

NT$ NT$ NT$

Goodwill 18,768,929 1,699,593 1,901,821

Trademarks

& trade names 4,988,336 2,067,836 450,900

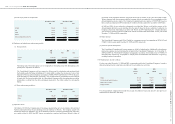

December 31, 2009

ITRO-EMEA ITRO-PA ITRO-AAP ITRO-China ITRO-TWN E-Ten SHBG

NT$ NT$ NT$ NT$ NT$ NT$ NT$

Goodwill 12,061,458 4,698,297 2,511,387 137,919 646,380 221,424 1,682,869

Trademarks

& trade names 3,328,857 2,308,646 1,149,623 45,180 62,867 450,900 -

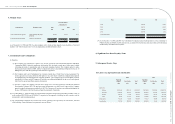

Each CGU to which the goodwill is allocated represents the lowest level within the Consolidated Companies

at which the goodwill is monitored for internal management purposes. In 2009, the Company reorganized

cash-generating units to which goodwill and trademark and trade names with indefinite useful lives were

allocated, as a result, the Company reallocated the aforementioned intangible assets to the related cash-

generating units. Based on the results of impairment tests conducted by the Company’s management, there

was no evidence of impairment of goodwill and trademarks and trade names as of December 31, 2008

and 2009. The recoverable amount of a CGU is determined based on the value in use, and the related key

assumptions were as follows:

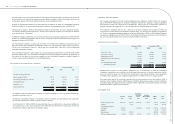

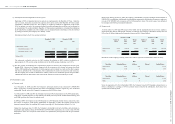

Year 2008:

(i) The assessment used cash ow projections based on historical operating performance, future nancial

budgets approved by management covering a 5-year period.

(ii) Discounted rates used to determine the value in use by each CGUs were as follows:

Acer Pan-America business group Packard Bell brand business group E-Ten Information System group

13.7% 11.8% 18.7%

Year 2009:

(i) The assessment used cash ow projections based on historical operating performance, future nancial

budgets approved by management covering a 5-year period.

(ii) Discounted rates used to determine the value in use by each CGUs were as follows:

ITRO-EMEA ITRO-PA ITRO-AAP ITRO-China ITRO-TWN E-Ten SHBG

12.9% 10.9% 16.9% 20.4% 15.7% 19.7% 16.0%

Acer Incorporated 2009 Annual Report

92.

Acer Incorporated 2009 Annual Report

93. Financial Standing