Acer 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

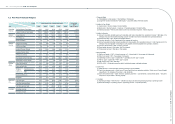

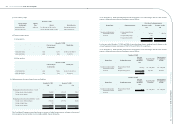

(4) Research, design, and sale of smart handheld products:

Percentage of

Ownership

At December 31,

Investor 2008 2009

(a) E-ten Information System Co., Ltd. (“ETEN”, Taiwan) The Company 100.00 100.00

(b) Eten China Information System Co., Ltd. (“CETEN”, China) EIH 100.00 100.00

(c) AGP Technology AG (“AGP”, Switzerland) AHN 100.00 100.00

(d) Acer Information Technology R&D (Shanghai) Co., Ltd. (“ARD”, China) AGC -100.00

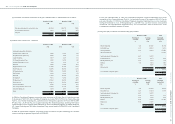

(5) Property development:

Percentage of

Ownership

At December 31,

Investor 2008 2009

(a) Acer Property Development Inc. (“APDI”, Taiwan) ADSC 100.00 100.00

(b) Aspire Service & Development Inc. (“ASDI”, Taiwan) ADSC 100.00 100.00

(6) Electronic data supply or processing service, data storage and processing:

Percentage of

Ownership

At December 31,

Investor 2008 2009

(a) EB Easy Business Services Limited (“AGES”, Hong Kong) ADSCC 85.00 -

(b) Acer Cyber Center Services Ltd. (“ACCSI”, Taiwan) The Company 100.00 100.00

(c) Lottery Technology Service Corp. (“LTS”, Taiwan) The Company 100.00 100.00

(d) Minly Corp. (“MINLY”, Taiwan) The Company 100.00 100.00

(7) Software research, development, design, trading and consultation:

Percentage of

Ownership

At December 31,

Investor 2008 2009

(a) TWP International Inc. (“TWP BVI”, British Virgin Islands) ACCSI 100.00 100.00

(b) Acer Third Wave Software (Beijing) Co., Ltd. (“TWPBJ”, China) TWPBVI 100.00 100.00

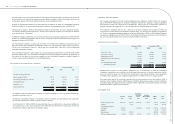

In 2009, the subsidiaries namely PBSE, PBFE, PBCN, GBM, GFR, AFA, WSHI, ACBVI, ACAP, and AGES were

liquidated and were excluded from consolidation since the Company ceased control thereof. Additionally, the

Company established new subsidiaries namely APX, ARU, ATB, AGU, ARD, and AHB in 2009.

In March and June of 2008, the Company completed its acquisition of 100% equity ownership of PB Holding

Company S.A.R.L and its subsidiaries. In September 2008, the Company completed its acquisition of 100% equity

ownership of E-ten Information System Co., Ltd. and its subsidiaries. The results of operations of these acquired

entities were included in the consolidated nancial statements as of the date of each acquisition. Additionally, the

Company established new subsidiaries namely AGP and AAPH in 2008.

2. Summary of Signicant Accounting Policies

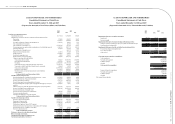

(1) Accounting principles and consolidation policy

The consolidated nancial statements are prepared in accordance with accounting principles generally accepted

in the Republic of China. These consolidated financial statements are not intended to present the financial

position and the related results of operations and cash ows of the Consolidated Companies based on accounting

principles and practices generally accepted in countries and jurisdictions other than the ROC.

The consolidated financial statements include the accounts of the Company and subsidiaries in which the

Company is able to exercise control over the subsidiary’s operations and nancial policies. The operating activity

of the subsidiary is included in the consolidated statements of income from the date that control commences

until the date that control ceases. All significant inter-company balances and transactions are eliminated in

consolidation.

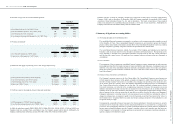

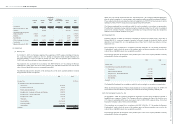

(2) Use of estimates

The preparation of the accompanying consolidated nancial statements requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and

liabilities at the date of the consolidated financial statements and reported amounts of revenues and expenses

during the reporting periods. Economic conditions and events could cause actual results to differ signicantly

from such estimates.

(3) Foreign currency transactions and translations

The Company’s reporting currency is the New Taiwan dollar. The Consolidated Companies record transactions

in their respective local currencies of the primary economic environment in which these entities operate. Non-

derivative foreign currency transactions are recorded at the exchange rates prevailing at the transaction date.

At the balance sheet date, monetary assets and liabilities denominated in foreign currencies are translated into

New Taiwan dollars using the exchange rates on that date. The resulting unrealized exchange gains or losses

from such translations are reflected in the accompanying statements of income. Non-monetary assets and

liabilities denominated in foreign currency that are measured in terms of historical cost are translated using the

exchange rate at the date of the transaction. Non-monetary assets and liabilities denominated in foreign currency

that are measured at fair value are reported at the rate that was in effect when the fair values were determined.

Subsequent adjustments to carrying values of such non-monetary assets and liabilities, including the effects of

changes in exchange rates, are reported in prot or loss for the period, except that if movement in fair value of a

non-monetary item is recognized directly in equity, any foreign exchange component of that adjustment is also

recognized directly in equity.

In preparing the consolidated financial statements, the foreign subsidiaries’ financial statements are initially

remeasured into the functional currency and the remeasuring differences are accounted for as exchange gains

or losses in the accompanying statements of income. Translation adjustments resulting from the translation of

foreign currency nancial statements into the Company’s reporting currency and a monetary item that forms part

of the Company’s net investment in a foreign operation are accounted for as cumulative translation adjustment, a

separate component of stockholders’ equity.

Acer Incorporated 2009 Annual Report

70.

Acer Incorporated 2009 Annual Report

71. Financial Standing