Acer 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

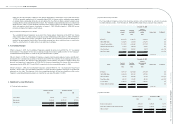

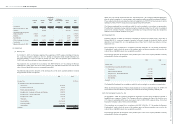

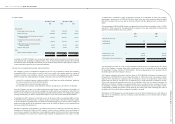

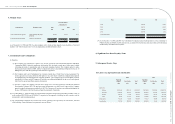

(c) The components of deferred income tax assets (liabilities) as of December 31, 2008 and 2009, were as

follows:

December 31, 2008 December 31, 2009

NT$ NT$ US$

Deferred income tax assets – current:

Unrealized cost of revenues 1,093,887 902,570 28,179

Inventory provisions 620,737 1,058,032 33,033

Loss (gain) on valuation of nancial instruments 156,932 (279,622) (8,730)

Accrued advertising expense 181,323 87,747 2,739

Accrued sales discounts 111,826 149,501 4,667

Warranty provision 894,085 778,287 24,299

Allowance for doubtful accounts 397,292 118,924 3,713

Accrued non-recurring engineering cost 86,315 58,825 1,837

Deferred revenue 34,904 5,614 175

Accrued royalty 82,975 494 16

Net operating loss carryforwards 77,977 143,674 4,485

Investment tax credits - 64,027 1,999

Unrealized foreign exchange (gains) losses (386,944) 299,738 9,358

Others 467,468 396,570 12,381

3,818,777 3,784,381 118,151

Valuation allowance (1,535,834) (1,571,166) (49,053)

2,282,943 2,213,215 69,098

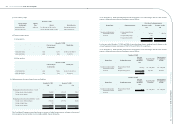

December 31, 2008 December 31, 2009

NT$ NT$ US$

Deferred income tax liabilities – current:

Inventory provisions (125,802) (84,598) (2,641)

Allowance for doubtful accounts (462,980) (559,274) (17,461)

Unrealized exchange gains (58,994) (15,078) (471)

Others (8,834) (21,764) (679)

(656,610) (680,714) (21,252)

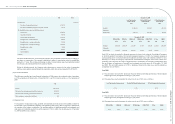

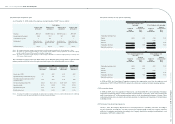

December 31, 2008 December 31, 2009

NT$ NT$ US$

Deferred income tax assets – non-current:

Investment loss under the equity method 44,649 66,861 2,087

Difference in depreciation for tax and nancial purposes 20,638 16,462 514

Net operating loss carryforwards 773,919 410,104 12,804

Other 117,235 101,897 3,181

956,441 595,324 18,586

Valuation allowance (826,526) (387,735) (12,105)

129,915 207,589 6,481

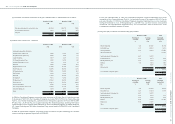

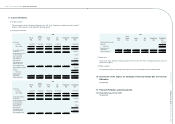

December 31, 2008 December 31, 2009

NT$ NT$ US$

Deferred income tax liabilities – non-current:

Difference in amortization of intangible assets for

tax and nancial purposes (2,705,258) (3,507,908) (109,519)

Investment income under the equity method (3,804,043) (2,867,839) (89,536)

Net operating loss carryforwards 14,326,766 13,313,903 415,670

Difference in depreciation for tax and nancial

purposes 1,026,013 811,822 25,346

Provision for asset impairment loss 313,148 245,347 7,660

Investment tax credits 418,227 - -

Software development cost 731,804 28,553 891

Unrealized investment loss 244,421 239,877 7,489

Foreign currency translation adjustment - (237,330) (7,410)

Other 463,409 316,950 9,895

11,014,487 8,343,375 260,486

Valuation allowance (17,288,586) (13,887,322) (433,572)

(6,274,099) (5,543,947) (173,086)

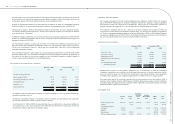

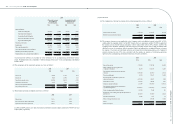

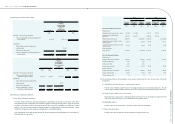

(d) The domestic Consolidated Companies were granted investment tax credits for the purchase of automatic

machinery and equipment, for research and development expenditures, and for personnel training

expenditures. These tax credits may be applied over a period of ve years. The amount of the credit that may

be applied in any year is limited to 50% of the income tax payable for that year, but there is no limitation on

the amount of investment tax credit that may be applied in the nal year.

As of December 31, 2009, investment tax credits available to the Consolidated Companies were as follows:

Expiration date NT$ US$

December 31, 2012 1,646 52

December 31, 2013 49,412 1,542

December 31, 2014 12,969 405

64,027 1,999

(e) The tax effects of net operating loss carryforwards available to the Consolidated Companies as of December

31, 2009, were as follows:

Expiration date NT$ US$

December 31, 2010 845 26

December 31, 2011 805,840 25,159

December 31, 2012 1,042,362 32,543

December 31, 2013 579,938 18,106

Thereafter 11,438,696 357,125

13,867,681 432,959

Acer Incorporated 2009 Annual Report

98.

Acer Incorporated 2009 Annual Report

99. Financial Standing