Acer 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

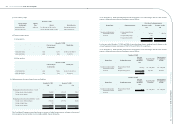

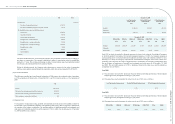

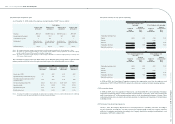

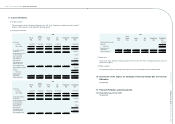

(c) Capital surplus

December 31, 2008 December 31, 2009

NT$ NT$ US$

Share premium:

Paid-in capital in excess of par value 857,759 1,784,258 55,706

Surplus from merger 29,800,881 29,800,881 930,405

Premium on common stock issued from conversion of

convertible bonds 4,552,585 4,552,585 142,135

Forfeited interest from conversion of convertible

bonds 1,006,210 1,006,210 31,415

Surplus related to treasury stock transactions by

subsidiary companies 431,161 501,671 15,662

Employee stock options 174,372 360,630 11,259

Other:

Surplus from equity-method investments 306,984 487,883 15,232

37,129,952 38,494,181 1,201,814

According to the ROC Company Act, any realized capital surplus could be transferred to common stock as

stock dividends after deducting accumulated decit, if any. Realized capital surplus includes share premium

and donations from shareholders. Distribution of stock dividends from realized capital surplus is subject to

certain restrictions imposed by the governmental authorities.

(d) Legal reserve, unappropriated earnings, and dividend policy

The Company’s articles of incorporation stipulate that at least 10% of annual net income after deducting

accumulated deficit, if any, must be retained as legal reserve until such retention equals the amount of

authorized common stock. In addition, a special reserve in accordance with applicable laws and regulations

shall be set aside. The remaining balance of annual net income, if any, can be distributed as follows:

. at least 5% as employee bonuses; employees entitled to stock bonus may include subsidiaries’ employees

that meet certain criteria set by the board of directors;

. 1% as remuneration to directors and supervisors; and

. the remainder, after retaining a certain portion for business considerations, as dividends to stockholders.

Since the Company operates in an industry experiencing rapid change and development, distribution of

earnings shall be made in view of the year’s earnings, the overall economic environment, the related laws and

decrees, and the Company’s long-term development and steady nancial position. The Company has adopted

a steady dividend policy, in which a cash dividend comprises at least 10% of the total dividend distributed.

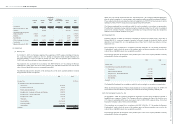

According to the ROC Company Act, the legal reserve can be used to offset an accumulated decit and may

be distributed in the following manner: (i) when it reaches an amount equal to one-half of the paid-in capital,

it can be transferred to common stock at the amount of one-half of legal reserve; and (ii) when it reaches an

amount exceeding one-half of the authorized common stock, dividends and bonuses can be distributed from

the excess portion of the legal reserve.

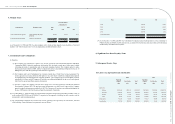

Pursuant to regulations promulgated by the Financial Supervisory Commission, and effective from the

distribution of earnings for fiscal year 1999 onwards, a special reserve equivalent to the total amount of

items that are accounted for as deductions to the stockholders’ equity shall be set aside from current earnings,

and not distributed. This special reserve shall be made available for appropriation to the extent of reversal

of deductions to stockholders’ equity in subsequent periods. As of December 31, 2009, the Company

appropriated a special reserve of NT$1,991,615 that is equal to the sum of the amount by which the market

price of the treasury stock was less than the book value thereof and other deduction items of shareholder’s

equity.

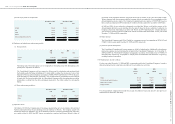

The appropriation of 2007 and 2008 earnings was approved by the shareholders at meetings on June 13, 2008,

and June 19, 2009, respectively. The appropriations of employee bonus and remuneration to directors and

supervisors and dividends per share were as follows:

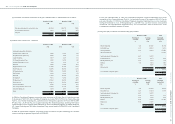

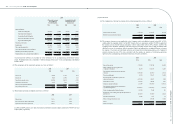

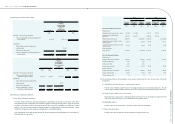

2007 2008

NT$ NT$

Dividends per share (NT$)

Cash dividends $ 3.60 2.00

Stock Dividends 0.15 0.10

$ 3.75 2.10

Employee bonus – stock $ 330,000 900,000

Employee bonus – cash 544,728 600,000

Remuneration to directors and supervisors 116,630 85,763

$ 991,358 1,585,763

The 2008 employee bonus in stock of 16,234 thousand common shares was determined by the closing

price of the Company’s common shares (after considering the effect of dividends) on the day preceding

the shareholder’s meeting, which was NT$58 (dollars). The above appropriations were consistent with the

resolutions approved by the Company’s directors.

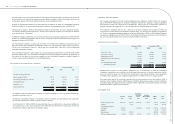

The Company estimated and accrued employee bonus of NT$1,000,000 and directors’ and supervisors’

remuneration of NT$122,096 for the year ended December 31, 2009 based on the total amount of bonus

expected to be distributed to employees and the Company’s article of incorporation, under which,

remuneration for directors and supervisors is distributed at 1% of the remainder of annual net income.

If the actual amounts subsequently resolved by the stockholders differ from the estimated amounts, the

differences are treated as a change in accounting estimate and are recorded as income or expense in the year

of stockholder’s resolution. If bonus to employees is resolved to be distributed in stock, the number of shares

is determined by dividing the amount of stock bonus by the closing price (after considering the effect of

dividends) of the shares on the day preceding the shareholder’s meeting.

Distribution of 2009 earnings has not been proposed yet by the board of directors and is still subject to

approval by the stockholders. After the resolutions, related information can be obtained from the public

information website.

Acer Incorporated 2009 Annual Report

102.

Acer Incorporated 2009 Annual Report

103. Financial Standing