Acer 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

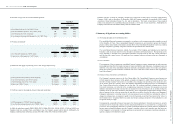

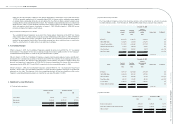

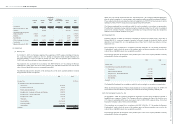

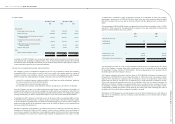

Goodwill Patents

Trademarks

and trade

names

Customer

Relationships Others Total

NT$ NT$ NT$ NT$ NT$ NT$

Amortization - (122,344) (32,805) (156,552) (137,346) (449,047)

Balance at December 31, 2008 22,574,040 692,838 8,067,556 1,517,349 1,894,982 34,746,765

Additions - 369,000 - - 2,536,507 2,905,507

Adjustments made subsequent to

business acquisition (138,067) - - - - (138,067)

Disposals (9,624) (39,275) - - (9,759) (58,658)

Reclassication - - - - 16,867 16,867

Effect of exchange rate changes (448,895) (3,073) (161,298) (28,110) (6,842) (648,218)

Amortization - (217,701) (43,793) (178,933) (939,701) (1,380,128)

Balance at December 31, 2009 21,977,454 801,789 7,862,465 1,310,306 3,492,054 35,444,068

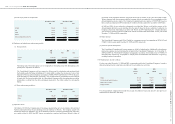

(a) Acquisitions

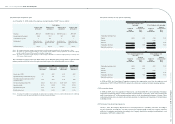

(i) Gateway, Inc.

On October 15, 2007, the Company completed the acquisition of 100% equity ownership of Gateway,

Inc., a personal computer company in the U.S., through its indirectly wholly owned subsidiary Acer

American Holding, at a price of US$1.90 (dollars) per share. The total purchase price amounted to

US$711,420, which was inclusive of direct transaction costs.

The acquisition was accounted for in accordance with ROC SFAS No. 25 “Accounting for Business

Combinations”, under which, the excess of the purchase price and direct transaction costs over the fair

value of the net identiable assets was recognized as goodwill.

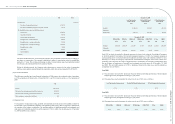

The following represents the allocation of the purchase price to the assets acquired, liabilities assumed,

and goodwill at the date of acquisition:

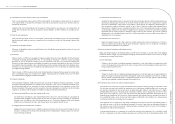

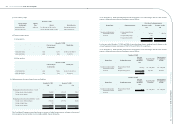

NT$ NT$

Purchase Price 23,507,016

The identiable assets acquired and liabilities assumed:

Current assets 32,139,646

Investments carried at cost 277,057

Property, plant and equipment 2,808,517

Intangible assets ‒ trademarks of Gateway and eMachines 5,504,220

Intangible assets ‒ customer relationships 1,551,042

Intangible assets ‒ others 1,687,210

Other assets 58,355

Current liabilities (24,576,616)

Long-term liabilities (9,673,377)

Other liabilities (2,923,302) 6,852,752

Goodwill 16,654,264

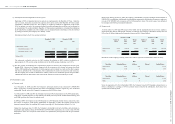

Within one year from the acquisition date (the “allocation period”), the Company identied adjustments,

after the initial recognition, to certain property and equipment and pre-acquisition contingent liabilities.

These adjustments decreased property, plant and equipment by NT$77,564 and increased current

liabilities by NT$1,766,474, which also increased goodwill by NT$1,844,038.

The Gateway trademark has an indefinite useful life and, accordingly, is not subject to amortization.

The eMachines trademark is being amortized using the straight-line method over 20 years, the estimated

period of its economic benefits. Customer relationships are being amortized using the straight-line

method over the estimated useful life of 10 years.

(ii) Packard Bell B.V.

In March and June of 2008, the Company completed the acquisition of 100% equity ownership of

Packard Bell B.V., a personal computer company in Europe, through its indirectly wholly owned

subsidiary Acer Europe B.V., at a total purchase price of Euro 66,117, which was inclusive of direct

transaction costs.

The acquisition was accounted for in accordance with ROC SFAS No. 25 “Accounting for Business

Combinations”, under which, the excess of the purchase price and direct transaction costs over the fair

value of the net identiable assets was recognized as goodwill.

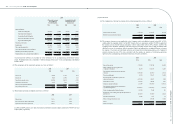

The following represents the allocation of the purchase price to the assets acquired, liabilities assumed,

and goodwill at the date of acquisition:

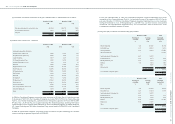

NT$ NT$

Purchase Price 3,172,080

The identiable assets acquired and liabilities assumed:

Current assets 9,587,790

Property, plant and equipment 351,162

Intangible assets – Packard Bell trademark 2,163,744

Current liabilities (10,665,179)

Other liabilities (39,608) 1,397,908

Goodwill 1,774,172

The Packard Bell trademark has an indenite useful life and, accordingly, is not subject to amortization.

Within the allocation period, the Company made adjustments to decrease deferred charges by NT$33,768

and to decrease current liabilities by NT$174,307, which also decreased goodwill by NT$140,539.

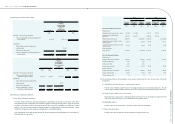

(iii) E-Ten Information Systems Co., Ltd

On September 1, 2008, the Company completed its acquisition of 100% equity ownership of E-TEN, a

handheld device company in Taiwan. The Company offered to exchange one share of its stock for every

1.07 shares of outstanding E-Ten stock, and issued a total of 168,158,878 common shares. E-Ten then

became the Company’s direct wholly owned subsidiary.

The acquisition was accounted for in accordance with ROC SFAS No. 25 “Accounting for Business

Combinations”, under which, the excess of the purchase price and direct transaction costs over the fair

value of the net identiable assets was recognized as goodwill.

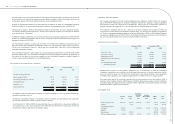

The following represents the allocation of the purchase price to the assets acquired, liabilities assumed,

and goodwill at the date of acquisition:

Acer Incorporated 2009 Annual Report

90.

Acer Incorporated 2009 Annual Report

91. Financial Standing