Acer 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

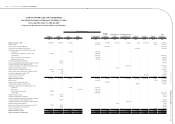

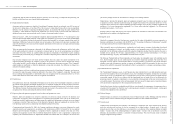

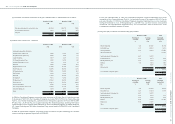

(c) Cross currency swaps

December 31, 2008

Contract amount

(in thousands)

Maturity

Date Interest Interest due date

Swap-in SGD35,000/ 2009/01/23 Pay xed rate in USD of 0.66% Principal and interest are

Swap-out USD 24,221 Receive xed rate in SGD of 1.00% paid in full when due

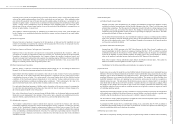

(d) Foreign currency options

(i) Long position

December 31, 2009

Contract amount Maturity date

(in thousands)

USD Call/EUR Put USD 22,500 2010/01/27~2010/02/12

USD Call/RUB Put USD 5,000 2010/02/24

(ii) Short position

December 31, 2009

Contract amount Maturity date

(in thousands)

EUR Call/USD Put USD 22,500 2010/01/27~2010/02/12

RUB Call/USD Put USD 7,500 2010/02/24

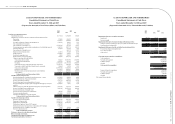

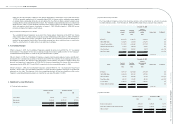

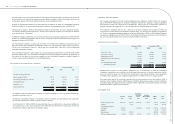

(6) Hedging purpose derivative nancial assets and liabilities

December 31, 2008 December 31, 2009

NT$ NT$ US$

Hedging purpose derivative nancial assets – current:

Foreign currency forward contracts 962,268 1,275,157 39,811

Foreign currency options 60,514 - -

1,022,782 1,275,157 39,811

Hedging purpose derivative nancial liabilities – current

Foreign currency forward contracts (848,726) (196,714) (6,142)

Foreign exchange swaps (14) -

Foreign currency options (23,298) - -

(872,038) (196,714) (6,142)

The Consolidated Companies entered into derivative contracts to hedge foreign currency exchange risk associated

with a recognized asset or liability or with a highly probable forecast transaction.

As of December 31, 2008 and 2009, hedged items designated as fair value hedges and fair value of their

respective hedging derivative nancial instruments were as follows:

Fair value of hedging instruments

Hedged Items Hedging instruments December 31, 2008 December 31, 2009

NT$ NT$

Accounts receivable/ payable

denominated in foreign

Foreign currency forward

contracts

386,420 1,066,045

currencies Foreign exchange swaps (14) -

Foreign currency options 37,903 -

424,309 1,066,045

For the years ended December 31, 2008 and 2009, the unrealized gains (losses) resulting from the changes in fair

value of hedging instruments amounted to NT$271,733 and NT$641,736, respectively.

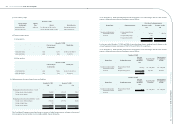

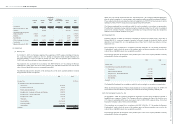

As of December 31, 2008 and 2009, hedged items designated as cash flow hedges and fair value of their

respective hedging derivative nancial instruments were as follows:

December 31, 2008

Hedged items Hedging instruments

Fair value

of hedging

instruments

Expected period

of cash ow

Expected period

of recognition in

earnings

NT$

Accounts receivable/ payable

denominated in foreign

Foreign currency forward

contracts (272,878) Jan .~ May 2009 Jan .~ May 2009

currencies Foreign currency options (687) Feb. 2009 Feb. 2009

(273,565)

December 31, 2009

Hedged items Hedging instruments

Fair value

of hedging

instruments

Expected period

of cash ow

Expected period

of recognition in

earnings

NT$

Accounts receivable/payable

denominated in foreign

Foreign currency forward

contracts 12,398 Jan .~ May 2010 Jan .~ May 2010

currencies

Acer Incorporated 2009 Annual Report

82.

Acer Incorporated 2009 Annual Report

83. Financial Standing