Acer 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(d) On December 6, 2007, the Consolidated Companies entered into a Basic Term Agreement with the

International Olympic Committee regarding participation in the Olympic Partners Program (the “Top

Programme”). Pursuant to such agreement, the Consolidated Companies have agreed to pay a certain amount

of money in cash, merchandise and service to obtain marketing rights and become one of the partners in “Top

Porgramme” across the period from January 1, 2009 to December 31, 2012. Such expenditure on sponsorship

was capitalized as “Intangible assets” in the accompanying consolidated nancial statements, and amortized

using the straight-line method during the aforementioned four-year period.

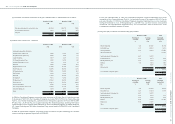

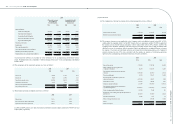

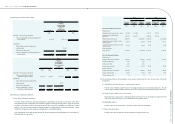

(14) Other nancial assets – noncurrent

December 31, 2008 December 31, 2009

NT$ NT$ US$

Refundable deposits 781,080 771,957 24,101

Noncurrent receivables 87,680 17,754 554

868,760 789,711 24,655

(15) Short-term borrowings

December 31, 2008 December 31, 2009

NT$ NT$ US$

Bank loans 1,086,851 548,059 17,111

The Consolidated Companies pledged certain assets as collateral for these loans according to the bank loan

contracts. Refer to note 6 for a description of the pledged assets.

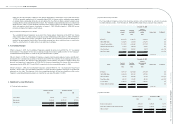

(16) Long-term debts

December 31, 2008 December 31, 2009

NT$ NT$ US$

Citibank syndicated loan 12,200,000 12,200,000 380,893

Other bank loans 184,920 171,856 5,365

Less: current installments (8,250,000) - -

4,134,920 12,371,856 386,258

The Company entered into a syndicated loan agreement with Citibank, the managing bank of the syndicated

loan, on October 11, 2007, and the terms of this loan agreement were as follows:

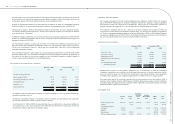

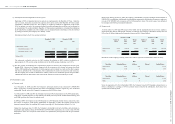

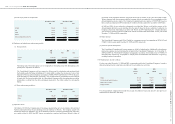

December 31,

2008

December 31,

2009

Type of Loan Creditor Credit Line Term NT$ NT$

Unsecured

loan

Citibank and

other banks

Term tranche of

NT$16.5 billion;

re-year limit

during which

revolving credits

disallowed

Repayable in 4 semi-annual

installments starting from April 2009.

An advance repayment of NT$4.3

billion was made in the rst quarter of

2008. In May 2009, an amendment to

the agreement was made, under which,

the loan is repayable in 4 semi-annual

installments starting from April 2011.

12,200,000 12,200,000

Revolving tranche

of NT$3.3 billion;

three-year limit

One-time repayment in full in October

2010.

- -

Less: current installment (8,250,000) -

3,950,000 12,200,000

The above syndicated loan bore interest at a rate of 3.06% in 2008 and 1.67% in 2009. According to the loan

agreement, the Company is required to maintain certain nancial ratios calculated based on annual and semi-

annual audited financial statements. If the Company fails to meet any of the financial ratios, the managing

bank will request the Company in writing to take action to improve within agreed days. No assertion of breach

of contract will be tenable if the financial ratios are met within agreed days. As of December 31, 2009, the

Company was in compliance with all such nancial covenants.

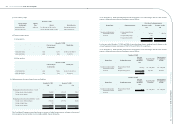

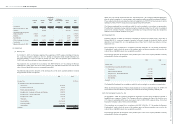

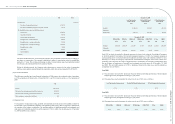

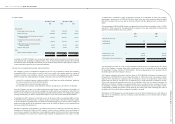

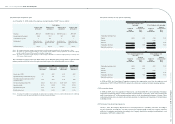

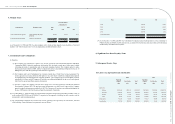

(17) Retirement plans

The following table sets forth the actuarial information related to the Consolidated Companies’ dened benet

retirement plans:

(a) Reconciliation of funded status of the plans to prepaid pension cost (accrued pension liabilities):

2008

Plan assets in excess

of accumulated

benet obligation

Accumulated benet

obligation in excess

of plan assets

NT$ NT$

Benet obligation:

Vested benet obligation (124,967) (33,041)

Nonvested benet obligation (469,607) (100,237)

Accumulated benet obligation (594,574) (133,278)

Projected compensation increases (335,873) (52,666)

Projected benet obligation (930,447) (185,944)

Plan assets at fair value 643,793 59,610

Funded status (286,654) (126,334)

Unrecognized prior service cost - 6,596

Unrecognized pension loss 459,393 39,982

Unrecognized transition (assets) obligation (2,187) 25,426

Minimum pension liability adjustment - 659

Prepaid pension cost (accrued pension liabilities) 170,552 (53,671)

Acer Incorporated 2009 Annual Report

94.

Acer Incorporated 2009 Annual Report

95. Financial Standing