Acer 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

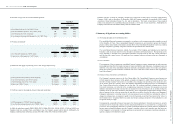

Independent Auditors’ Report

The Board of Directors

Acer Incorporated:

We have audited the accompanying consolidated balance sheets of Acer Incorporated (the “Company”) and subsidiaries

as of December 31, 2008 and 2009, and the related consolidated statements of income, changes in stockholders’ equity,

and cash ows for the years then ended. These consolidated nancial statements are the responsibility of the Company’s

management. Our responsibility is to express an opinion on these nancial statements based on our audits.

We conducted our audits in accordance with the “Regulations Governing Auditing and Certification of Financial

Statements by Certied Public Accountants” and auditing standards generally accepted in the Republic of China. Those

regulations and standards require that we plan and perform the audit to obtain reasonable assurance about whether the

nancial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting

the amounts and disclosures in the nancial statements. An audit also includes assessing the accounting principles used

and signicant estimates made by management, as well as evaluating the overall nancial statement presentation. We

believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to in the first paragraph present fairly, in all material

respects, the financial position of Acer Incorporated and subsidiaries as of December 31, 2008 and 2009, and the

results of their consolidated operations and their consolidated cash ows for the years then ended, in conformity with

accounting principles generally accepted in the Republic of China.

As discussed in note 3 to the consolidated nancial statements, effective on January 1, 2008, Acer Incorporated and

subsidiaries recognized, measured and disclosed employee bonuses and directors’ and supervisors’ remunerations

according to Interpretation (2007) 052 issued by the Accounting Research and Development Foundation of the Republic

of China. The changes in accounting principle decreased the consolidated net income and basic earnings per share for

the year ended December 31, 2008, by NT$1,483,776 thousand and NT$0.59, respectively.

The consolidated financial statements as of and for the year ended December 31, 2009, have been translated into

United States dollars solely for the convenience of the readers. We have audited the translation, and in our opinion, the

consolidated nancial statements expressed in New Taiwan dollars have been translated into United States dollars on the

basis set forth in note 2(26) to the consolidated nancial statements.

Taipei, Taiwan (the Republic of China)

March 19, 2010

Note to Readers

The accompanying consolidated nancial statements are intended only to present the nancial position, results of operations and cash

ows in accordance with accounting principles and practices generally accepted in the Republic of China and not those of any other

jurisdictions. The standards, procedures and practices to audit such consolidated nancial statements are those generally accepted

and applied in the Republic of China.

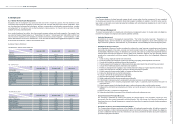

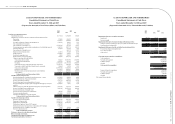

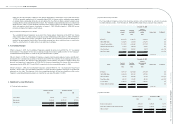

ACER INCORPORATED AND SUBSIDIARIES

Consolidated Balance Sheets

December 31, 2008 and 2009

(Expressed in thousands of New Taiwan dollars and US dollars)

Assets 2008 2009

NT$ NT$ US$

Current assets:

Cash and cash equivalents (note 4(1)) 22,141,725 53,616,067 1,673,933

Notes and accounts receivable, net of allowance for doubtful accounts of NT$1,681,844 and

NT$2,356,672 as of December 31, 2009 and 2008, respectively (note 4(2))

107,826,311

111,858,366

3,492,300

Notes and accounts receivable from related parties (note 5) 841,465 600,306 18,742

Other receivable from related parties (note 5) 45,173 21,507 671

Other receivables (note 4(3)) 8,807,454 9,263,152 289,202

Financial assets at fair value through prot or loss ‒ current (notes 4(4) and 4(24)) 354,751 157,659 4,922

Available-for-sale nancial assets ‒ current (notes 4(6) and 4(24)) 591,444 223,437 6,976

Hedging purpose derivative nancial assets ‒ current (notes 4(6) and 4(24)) 1,022,782 1,275,157 39,811

Inventories (note 4(7)) 40,028,195 51,184,953 1,598,032

Prepayments and other current assets 1,525,555 1,694,058 52,890

Deferred income tax assets ‒ current (note 4(18)) 2,282,943 2,213,215 69,098

Restricted deposits (note 6) 922,794 - -

Total current assets 186,390,592 232,107,877 7,246,577

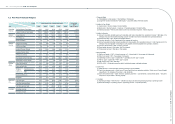

Long-term investments:

Investments accounted for using equity method (note 4(9)) 2,928,790 3,314,950 103,495

Available-for-sale nancial assets ‒ noncurrent (notes 4(10) and 4(24)) 1,160,487 3,306,742 103,239

Financial assets carried at cost (notes 4(8) and 4(24)) 2,684,270 2,251,058 70,280

Total long-term investments 6,773,547 8,872,750 277,014

Property, plant and equipment (notes 4(11) and 6):

Land 2,678,408 2,509,029 78,334

Buildings and improvements 5,294,056 5,386,921 168,184

Computer equipment and machinery 3,348,086 3,059,222 95,511

Transportation equipment 120,069 110,866 3,461

Ofce equipment 1,128,167 977,582 30,521

Leasehold improvements 816,904 959,257 29,948

Other equipment 1,136,428 1,171,560 36,577

Construction in progress and advance payments for purchases of property and equipment 30,692 83,680 2,612

14,552,810 14,258,117 445,148

Less: accumulated depreciation (4,922,662) (4,904,235) (153,114)

accumulated impairment (293,927) (677,709) (21,158)

Net property, plant and equipment 9,336,221 8,676,173 270,876

Intangible assets (note 4(13)) 34,746,765 35,444,068 1,106,590

Property not used in operation (note 4(12)) 2,996,721 2,971,542 92,774

Other nancial assets (notes 4(14), 4(24) and 6) 868,760 789,711 24,655

Deferred charges and other assets (notes 4(17) and 4(18)) 2,329,619 2,162,567 67,517

Total assets

243,442,225

291,024,688

9,086,003

Acer Incorporated 2009 Annual Report

58.

Acer Incorporated 2009 Annual Report

59. Financial Standing