Acer 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Deferred credits of long-term equity investments represent the unamortized balance of deferred gains and losses

derived from the sale of equity investment among the afliated companies. Such deferred gains and losses are

realized upon disposal of the equity-method investments to non-consolidated entities.

In 2008, the Consolidated Companies invested NT$73,841 in FuHu Inc. In 2009, the Consolidated Companies

invested in Olidata S.p.A. and increased investment in FuHu Inc. for an aggregate amount of NT$244,702.

Commencing on August 1, 2008, the Consolidated Companies lost the ability to exercise signicant inuence

over Apacer’s operating and nancial policies. Therefore, the investments in Apacer were reclassied as “nancial

assets carried at cost ‒ noncurrent”.

In 2008, the Company sold portions of its investment in Wistron and recognized a gain thereon of NT$1,441,906.

In 2009, the Consolidated Companies sold all of their investments in The Eslite Bookstore and recognized an

aggregate loss thereon of NT$5,455.

The Consolidated Companies recognized an investment loss of NT$7,263 in 2008 and an investment gain of

NT$4,236 in 2009 due to liquidation of EB EASY (TWN) Corp. and Hungtung Venture Capital, respectively.

The loss was recorded under “other loss” and the gain was recorded under “other gain” in the accompanying

consolidated statements of income.

The Consolidated Companies’ capital surplus was increased (reduced) by NT$(78,255) and NT$180,899 in 2008

and 2009, respectively, as the Consolidated Companies did not make additional investments proportionally to

the issuance of new shares by the investee companies or the Consolidated Companies recognized changes in

investees’ equity accounts in proportion to its ownership percentage.

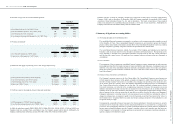

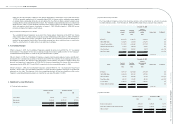

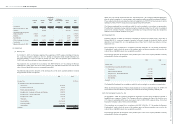

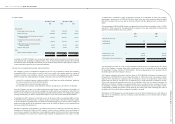

(10) Available-for-sale nancial assets ‒ noncurrent

December 31, 2008 December 31, 2009

NT$ NT$ US$

Investment in publicly listed stock:

Qisda Corporation (“Qisda”) 520,718 1,606,215 50,147

Silicon Storage Technology Inc. (“Silicon”) 8,192 8,938 279

Yosun Industrial Corp. 386,660 844,416 261363

RoyalTek Co., Ltd. 93,390 539,319 16,838

Quanta Computer Inc. 151,527 307,854 9,612

1,160,487 3,306,742 103,239

In September 2008, the Consolidated Companies invested in RoyalTek Co., Ltd. and Quanta Computer Inc.

through the acquisition of E-Ten.

In 2009, the Consolidated Companies sold portions of their investments in Yosun Industrial and recognized a

gain thereon of NT$57,894. In 2008, no disposal activities occurred.

As of December 31, 2008 and 2009, the unrealized gain (losses) resulting from re-measuring available-for-

sale financial assets to fair value amounted to NT$(1,456,066) and NT$1,001,919, respectively, which were

recognized as a separate component of stockholders’ equity.

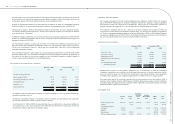

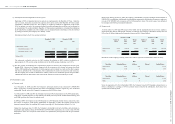

(11) Property, plant and equipment

The Company’s subsidiary, ACI, sold its ofce building located in Singapore in March 2008, with a disposal

gain of NT$788,944. Additionally, the Company’s subsidiary, Gateway Inc., disposed of computer equipment

and machinery in 2008 with a disposal loss of NT$269,057. The net gain was recorded under “gain/loss on

disposal of property and equipment, net” in the accompanying consolidated statements of income.

The Company’s subsidiary, Gateway Inc., disposed of computer equipment and machinery in 2009, and

recognized a loss from disposal of NT$102,532 classied under “loss on disposal of property and equipment,

net” in the accompanying consolidated statements of income. Additionally, in 2009, the Consolidated Companies

recognized an impairment loss of NT$395,109 for the buildings and improvements of the E-Ten and Gateway

Inc., as the recoverable amount was less than the carrying amount of such assets.

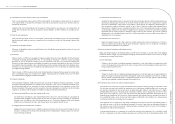

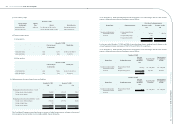

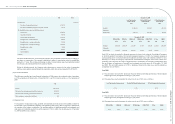

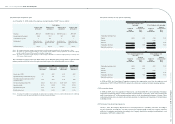

(12) Property not used in operation

December 31, 2008 December 31, 2009

NT$ NT$ US$

Leased assets ‒ land 807,538 807,538 25,212

Leased assets ‒ buildings 2,827,810 2,827,810 88,286

Damaged ofce premises 457,558 463,181 14,461

Property held for sale and development 1,391,260 1,415,014 44,178

Others 29,019 - -

Less: Accumulated depreciation (570,088) (595,606) (18,595)

Accumulated impairment (1,946,376) (1,946,395) (60,768)

2,996,721 2,971,542 92,774

Damaged office premises are office premises damaged by fire. As of December 31, 2008 the Consolidated

Companies concluded that the possibility for the damaged office premises to be fully repaired was remote;

hence, the accrual for repair cost of NT$161,308, recorded under “other current liabilities”, was reclassied as

accumulated asset impairment, and an additional impairment loss of NT$221,931 was recognized in 2008.

For certain land acquired, the ownership registration has not been transferred to the land acquirer, APDI, a

subsidiary of the Company. To protect APDI’s interests, APDI has obtained signed contracts from the titleholders

assigning all rights and obligations related to the land to APDI. Additionally, the land title certicates are held by

APDI, and APDI has registered its liens thereon.

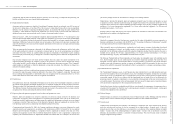

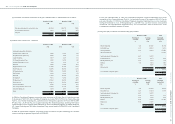

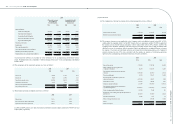

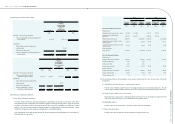

(13) Intangible assets

Goodwill Patents

Trademarks

and trade

names

Customer

Relationships Others Total

NT$ NT$ NT$ NT$ NT$ NT$

Balance at January 1, 2008 16,890,716 1,473,712 5,498,239 1,511,079 552,747 25,926,493

Additions - 89,177 - - 80,147 169,324

Acquisitions from business

combination 5,520,031 - 2,634,244 151,100 1,871,300 10,176,675

Disposals (32,532) - - - (4,339) (36,871)

Reclassication - (727,381) - - (453,200) (1,180,581)

Effect of exchange rate changes 195,825 (20,326) (32,122) 11,722 (14,327) 140,772

Acer Incorporated 2009 Annual Report

88.

Acer Incorporated 2009 Annual Report

89. Financial Standing