Acer 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

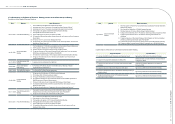

5.1 Acer’s Winning Formula

Acer dedicates its resources toward research and development, marketing, sales and after-services of IT and

communications devices. Today, our product offering includes notebooks, desktop PCs, LCD monitors, projectors,

servers and smartphones. In 2009, our consolidated revenue was NT$573.98B (US$17.9B) and operating income

reached NT$15.34B (US$479M). In the same year, Acer captured the No. 2 position for Total PCs and notebooks

worldwide.

Over the past few years, Acer has demonstrated a strong growing momentum in global PC shipments. According to

2009 PC shipment data by Gartner Dataquest, Acer maintained steady annual growth with 28.9% despite the worldwide

nancial downturn, far surpassing the top PC players and securing its position as the world’s No. 2 total PC vendor.

The successful mergers of Gateway (2007) and Packard Bell (2008) together completed Acer’s global footprint by

strengthening our presence in the U.S. and allowing a deeper penetration into the European and Asian markets.

These acquisitions also marked the beginning of a new era for Acer with a multi-brand strategy that targets different

geographic- and consumer segments. The Acer Group umbrella now consists of four brands – Acer, Gateway, Packard

Bell and eMachines.

In 2008 Acer entered the smartphone market, a decision that reects our expectation of the accelerating convergence

between PC and handheld communication devices in the coming years. Through the convergence of the 4Cs, a new

ICT industry is emerging and will present new opportunities in the form of products and services.

5.2 Keys to a Sustainable Future

5.2.1 Multi-brand Strategy

The PC is becoming a commodity. Acer is aware of the vast diversity among consumer tastes, that a single brand

cannot cover the preferences of all market segments. Acer saw the opportunity for a multi-brand strategy by acquiring

Gateway and Packard Bell. After extensive research and planning, Acer created a global multi-brand management

framework, which has become an essential pillar of our success forward.

5.2.2 Sustainable and Protable Business Model

Acer adheres to a channel business model that involves collaboration with first-class suppliers and distributors,

leveraging their resources and ultimately, sharing the fruits of success among all partners. Besides, our low capital- and

operating expense policy has been benecial to the steady growth of our business operations.

5.2.3 Efcient and Competitive Global Operations

Based upon the management philosophy of upholding a “simple” and “focused” approach, Acer is focused on building

its brand name business, developing mainstream products and maintaining competitive operating costs. In addition,

Acer has a exible and dynamic global logistics network to ensure our products’ time-to-market.

5.2.4 Fast Response and Decision Making

With a solid, global management force and efcient internal communication, Acer has the advantage of being able to

make key decisions within a short timeframe. Precise, follow-up implementation enables us to capture and gain from

business opportunities as they arise.

5.2.5 Customer-centric End-to-End Marketing Strengths

To begin with, our products are designed around customer needs – that means listening to and understanding exactly

what our customers want, and using our knowledge and skills to exceed their expectations by making technology simple

to use, stylish to own and accessible to everyone. Combined with Acer’s fast decision making, call to action and timely

release of products to market, form an end-to-end marketing prowess that ensures continuing business success ahead.

5.2.6 Growth and Scale

The recent mergers and combined scales have already created new synergies as predicted. With remarkable growths

in revenue, operating income and market share worldwide, Acer is today more competitive than ever.

Appendix

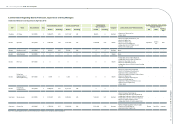

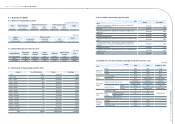

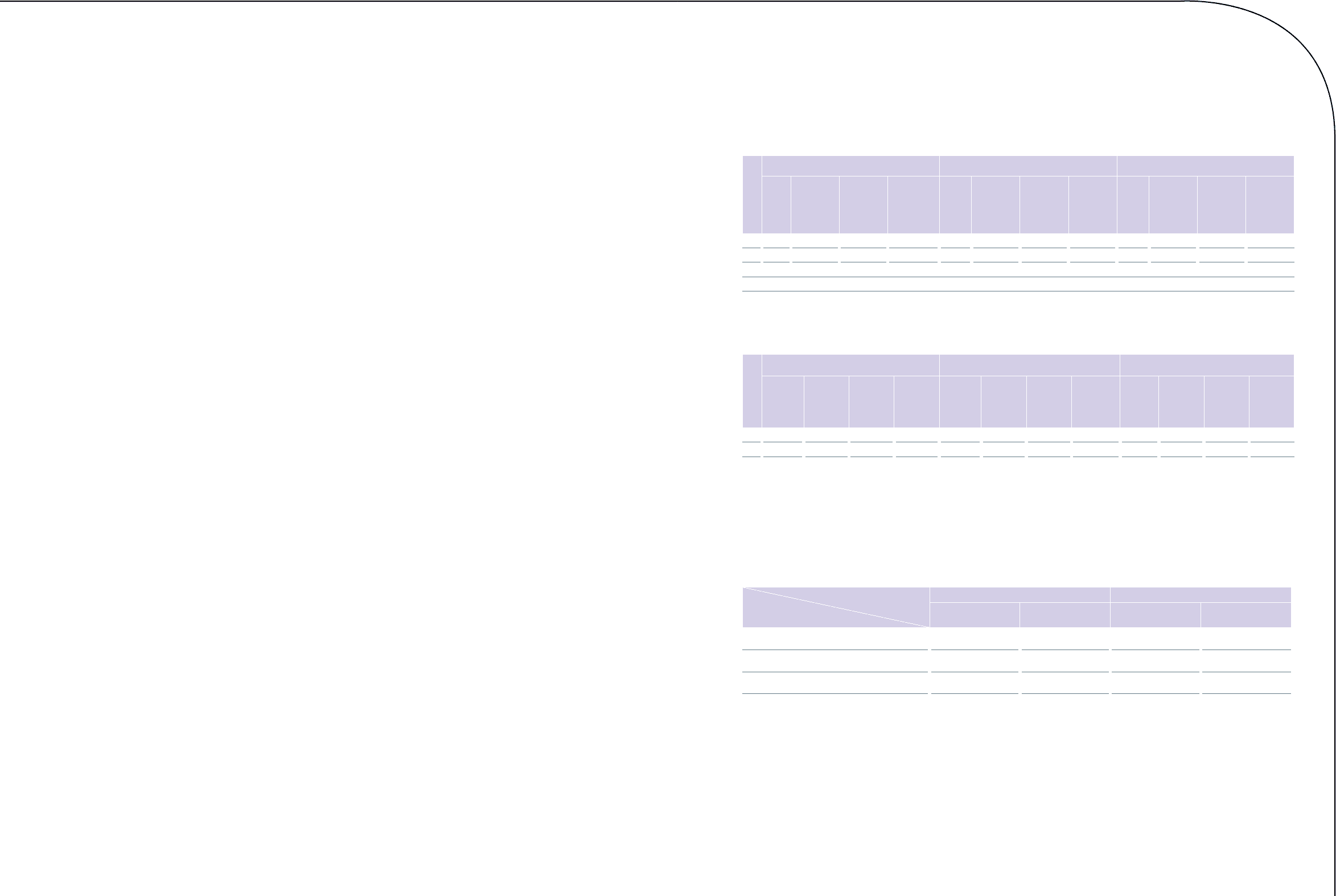

1. Key Buyers and Suppliers Accounting Over 10% of Total Net Sales and Purchase:

(1) Key Buyers for Acer Inc. (Parent Company)

Unit: NT$ Thousand

Item

Year 2008 Year 2009 Current year as of Mar. 31, 2010

From Amount

Percentage

of total net

sales (%)

Relationship

with

Acer Inc.

From Amount

Percentage

of total net

sales (%)

Relationship

with

Acer Inc.

From Amount

Percentage

of total net

sales (%)

Relationship

with

Acer Inc.

1 AEG 175,166,900 41.81 (Note 1) AEG 194,250,207 39.98 (Note 1) AEG 52,544,586 37.57 (Note 1)

2 AAC 77,740,860 18.56 (Note 1) AAC 130,941,632 26.95 (Note 1) AAC 34,788,672 24.88 (Note 1)

3 AAPH 39,997,623 9.55 (Note 1) AAPH 60,788,774 12.51 (Note 1) AAPH 20,956,084 14.98 (Note 1)

Note 1: Subsidiary of the Company.

(2) Key Suppliers for Acer Inc. (Parent Company)

Unit: NT$ Thousand

Item

Year 2008 Year 2009 Current year as of Mar. 31, 2010

From Amount

Percentage

of total net

purchase

(%)

Relationship

with

Acer Inc.

From Amount

Percentage

of total net

purchase

(%)

Relationship

with

Acer Inc.

From Amount

Percentage

of total net

purchase

(%)

Relationship

with

Acer Inc.

1 Supplier A 132,799,596 20.53 none Supplier A 177,956,728 23.36 none Supplier A 64,719,557 29.24 none

2 Supplier B 80,334,992 12.42 none Supplier B 83,823,914 11.00 none

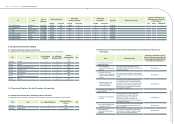

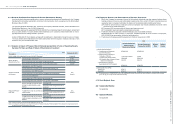

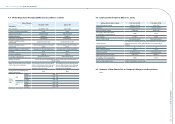

2. Production Value in the Last Two Years:

Not applicable.

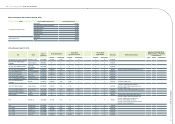

3. The Sales Value in the Last Two Years:

Unit: NT$ Thousand

Year

Major production

2008 2009

Domestic Sales Foreign Sales Domestic Sales Foreign Sales

Computer 12,048,647 330,534,725 13,414,825 392,305,898

Peripherals & Others 65,184,369 11,171,274 58,265,156 21,937,100

Total 77,233,016 341,705,999 71,679,981 414,242,998

Acer Incorporated 2009 Annual Report

38.

Acer Incorporated 2009 Annual Report

39. Acer’s Winning Formula