Acer 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

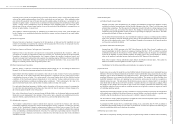

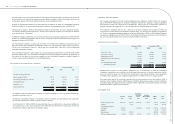

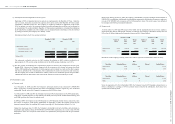

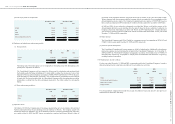

2009

Plan assets in excess

of accumulated

benet obligation

Accumulated benet

obligation in excess

of plan assets

NT$ US$ NT$ US$

Benet obligation:

Vested benet obligation (180,819) (5,645) (22,077) (689)

Nonvested benet obligation (385,033) (12,021) (45,676) (1,426)

Accumulated benet obligation (565,852) (17,666) (67,753) (2,115)

Projected compensation increases (319,849) (9,986) (114,991) (3,590)

Projected benet obligation (885,701) (27,652) (182,744) (5,705)

Plan assets at fair value 664,033 20,731 60,408 1,886

Funded status (221,668) (6,921) (122,336) (3,819)

Unrecognized pension loss 434,772 13,574 43,661 1,363

Unrecognized transition (assets) obligation (1,592) (49) 20,799 649

Minimum pension liability adjustment - - (3,731) (116)

Prepaid pension cost (accrued pension liabilities) 211,512 6,604 (61,607) (1,923)

Accrued pension liabilities are included in “other liabilities” in the accompanying consolidated balance

sheets. Prepaid pension cost is included in “deferred changes other assets” in the accompanying consolidated

balance sheets.

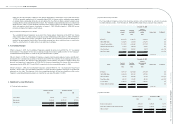

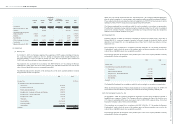

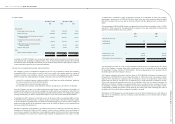

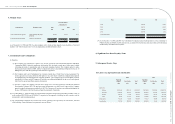

(b) The components of the net periodic pension cost were as follows:

2008 2009

NT$ NT$ US$

Service cost 49,808 51,634 1,612

Interest cost 34,453 26,954 841

Actual return on plan assets (18,586) (6,087) (190)

Amortization and deferral 31,937 7,222 225

Effect of pension plan curtailments - 52,502 1,640

Net periodic pension cost 97,612 132,225 4,128

(c) The principal actuarial assumptions used were as follows:

2008 2009

Discount rate 2.50% 2.25%

Rate of increase in future compensation 3.00% 3.00%

Expected rate of return on plan assets 2.50% 2.25%

In 2008 and 2009, pension cost under the dened contribution retirement plans amounted to NT$367,627 and

NT$331,469, respectively.

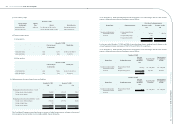

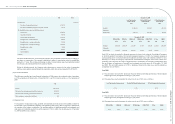

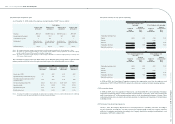

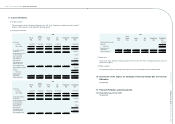

(18) Income taxes

(a) The components of income tax expense from continuing operations were as follows:

2008 2009

NT$ NT$ US$

Current income tax expense 2,383,360 4,581,450 143,036

Deferred income tax (benet) expense 786,086 (951,327) (29,701)

3,169,446 3,630,123 113,335

(b) The statutory income tax rate applicable to the Company and its subsidiaries located in the ROC is 25%.

Additionally, the amended Article 5 of the ROC Income Tax Law announced on May 27, 2009, requires that

the income tax rate of prot-seeking enterprises will be reduced from 25% to 20%, effective in 2010. The

Company and its domestic subsidiaries which are subject to the ROC Income Tax Act had recalculated their

deferred tax assets in accordance with the amended Article and adjusted the resulting difference to income

tax expense. The income tax calculated on the pre-tax income from continuing operations at the Company’s

statutory income tax rate (25%) was reconciled with the income tax expense of continuing operations

reported in the accompanying consolidated statements of income as follows.

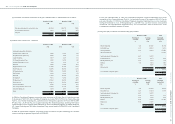

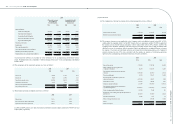

2008 2009

NT$ NT$ US$

Expected income tax 3,701,682 3,745,746 116,945

Effect of different tax rates applied to the

Company’s subsidiaries 720,278 1,032,938 32,249

Tax-exempt investment income from domestic

investees (154,526) (86,873) (2,712)

Prior-year adjustments 52,938 523,617 16,348

Gain on disposal of marketable securities not

subject to income tax (697,934) 124,873 3,899

Investment tax credits 295,939 198,804 6,207

Change in valuation allowance 225,493 (350,794) (10,952)

Tax-exempt investment income resulting from

operational headquarters (1,386,033) (2,556,360) (79,811)

Surtax on unappropriated retained earrings 165,109 17,646 551

Deferred tax assets resulting from spin off adjustment (set

note 5(2) (c)) (511,425) (72,449) (2,262)

Alternative minimum tax 44,430 1,417 44

Effect of change in income tax rate - 438,368 13,686

Others 713,495 613,190 19,143

Income tax expense 3,169,446 3,630,123 113,335

Acer Incorporated 2009 Annual Report

96.

Acer Incorporated 2009 Annual Report

97. Financial Standing