Supercuts 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6.

COMMITMENTS AND CONTINGENCIES:

Operating Leases:

The Company is committed under long-term operating leases for the rental of most of its company-owned salon, beauty school and hair

restoration center locations. The original terms of the leases range from one to 20 years, with many leases renewable for an additional five to

ten year term at the option of the Company, and certain leases include escalation provisions. For certain leases, the Company is required to pay

additional rent based on a percent of sales in excess of a predetermined amount and, in most cases, real estate taxes and other expenses. Rent

expense for the Company’s international department store salons is based primarily on a percent of sales.

The Company also leases the premises in which the majority of its franchisees operate and has entered into corresponding sublease

arrangements with the franchisees. These leases, generally with terms of approximately five years, are expected to be renewed on expiration.

All additional lease costs are passed through to the franchisees.

During fiscal year 2005, the Company entered into a lease agreement for a 102,448 square foot building, located in Edina, Minnesota. The

Company began to recognize rent expense related to this property during the three months ended September 30, 2005, which was the date that

it obtained the legal right to use and control the property. The original lease term ends in 2016 and the aggregate amount of lease payments to

be made over the remaining original lease term are approximately $9.6 million. The lease agreement includes an option to purchase the

property or extend the original term for two successive periods of five years.

Rent expense in the Consolidated Statement of Operations excludes $27.4, $28.9 and $31.1 million in fiscal years 2007, 2006 and 2005,

respectively, of rent expense on premises subleased to franchisees. These amounts are netted against the related rental income on the sublease

arrangements with franchisees. In most cases, the amount of rental income related to sublease arrangements with franchisees approximates the

amount of rent expense from the primary lease, thereby having no net impact on rent expense or net income. However, in limited cases, the

Company charges a ten percent mark-up in its sublease arrangements. The net rental income resulting from such arrangements totaled $0.5

million in each of fiscal years 2007, 2006 and 2005, and was classified in the royalties and fees caption of the Consolidated Statement of

Operations.

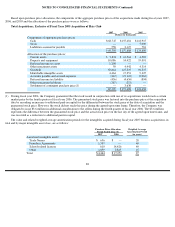

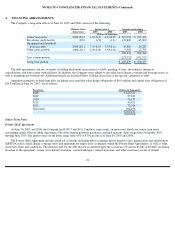

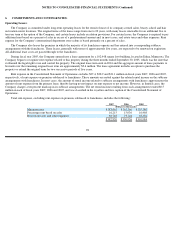

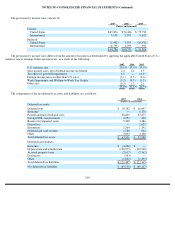

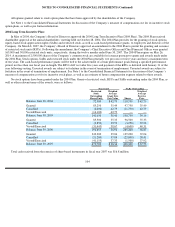

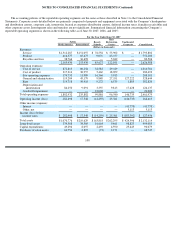

Total rent expense, excluding rent expense on premises subleased to franchisees, includes the following:

98

2007

2006

2005

(Dollars in thousands)

Minimum rent

$

283,862

$

262,166

$

229,180

Percentage rent based on sales

16,215

15,036

16,468

Real estate taxes and other expenses

82,743

73,724

65,336

$

382,820

$

350,926

$

310,984