Supercuts 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193

|

|

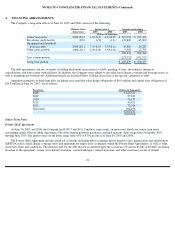

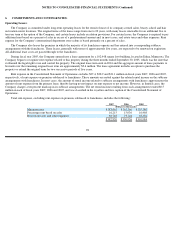

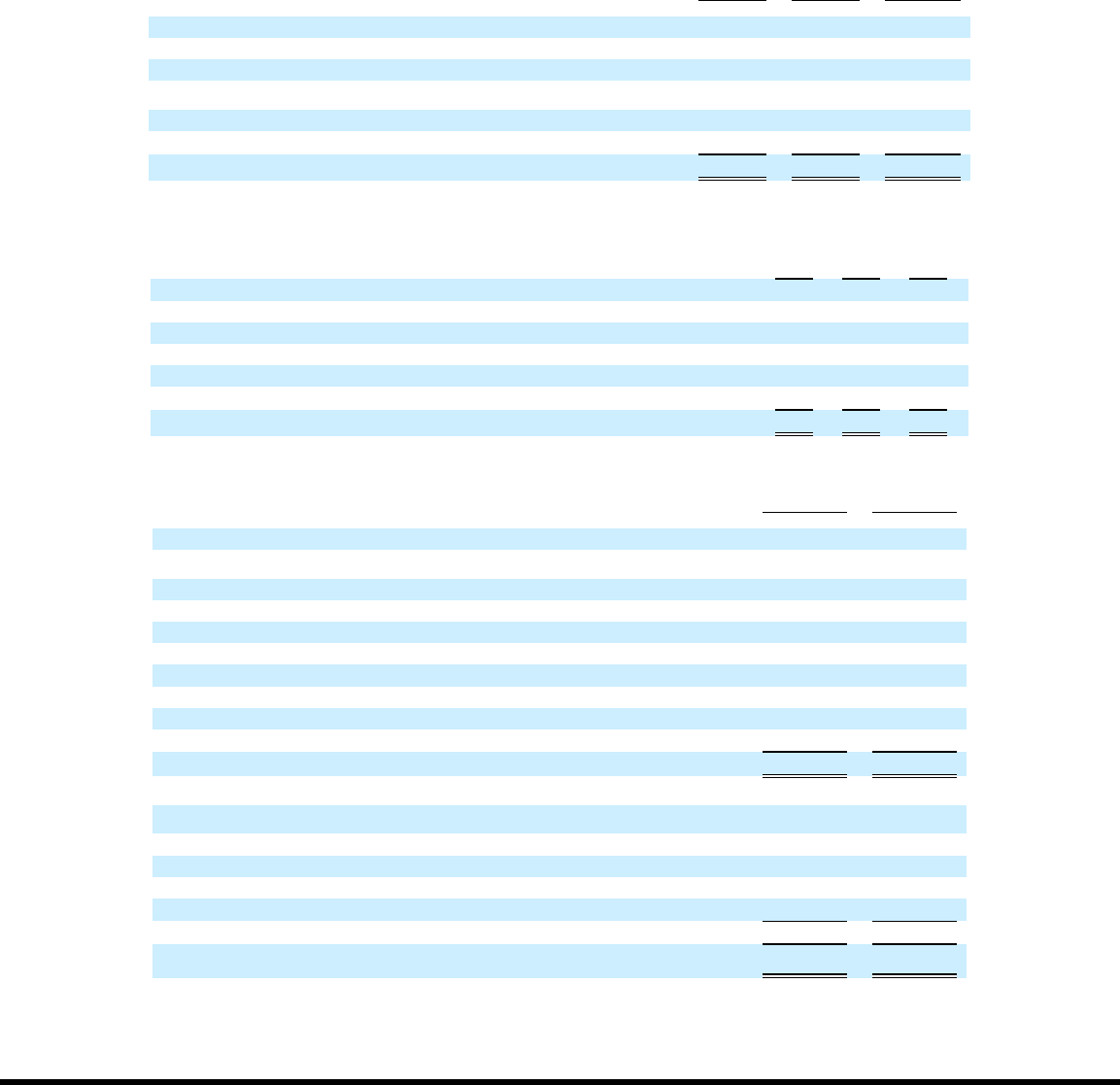

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

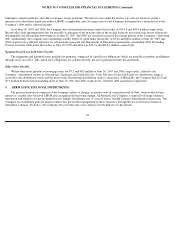

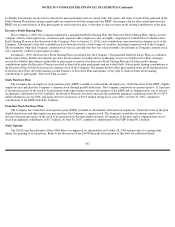

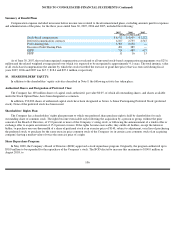

The provision for income taxes consists of:

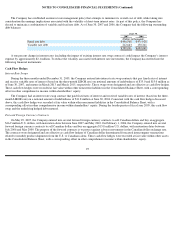

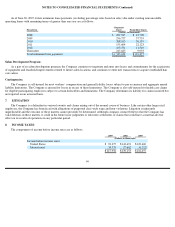

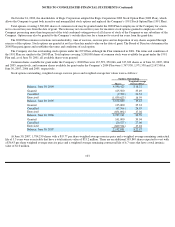

The provision for income taxes differs from the amount of income tax determined by applying the applicable United States (U.S.)

statutory rate to earnings before income taxes, as a result of the following:

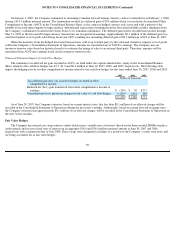

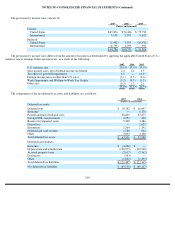

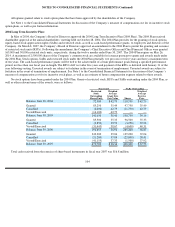

The components of the net deferred tax assets and liabilities are as follows:

100

2007

2006

2005

(Dollars in thousands)

Current:

United States

$

45,876

$

50,426

$

55,732

International

5,153

2,795

5,618

Deferred:

United States

(3,492

)

5,555

(10,476

)

International

(2,751

)

1,799

952

$

44,786

$

60,575

$

51,826

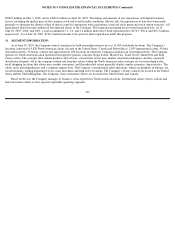

2007

2006

2005

U.S. statutory rate

35.0

%

35.0

%

35.0

%

State income taxes, net of federal income tax benefit

2.4

2.4

2.5

Tax effect of goodwill impairment

4.2

—

11.0

Foreign income taxes at other than U.S. rates

(3.1

)

(2.5

)

(4.6

)

Work Opportunity and Welfare

-

to

-

Work Tax Credits

(3.2

)

(0.5

)

(1.5

)

Other, net

(0.3

)

1.2

2.1

35.0

%

35.6

%

44.5

%

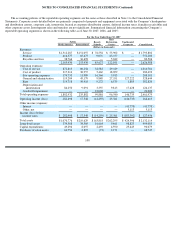

2007

2006

(Dollars in thousands)

Deferred tax assets:

Deferred rent

$

18,382

$

16,697

Insurance

—

1,176

Payroll and payroll related costs

26,605

22,275

Foreign NOL carryforwards

4,752

490

Reserve for impaired assets

5,328

3,486

Derivatives

—

2,623

Inventories

1,204

1,191

Deferred gift card revenue

1,788

922

Other

5,892

4,128

Total deferred tax assets

$

63,951

$

52,988

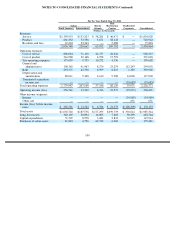

Deferred tax liabilities:

Insurance

$

(4,280

)

$

—

Depreciation and amortization

(120,975

)

(118,548

)

Accrued property taxes

(2,617

)

(2,362

)

Derivatives

(583

)

—

Other

(1,032

)

(1,195

)

Total deferred tax liabilities

$

(129,487

)

$

(122,105

)

Net deferred tax liabilities

$

(65,536

)

$

(69,117

)