Supercuts 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

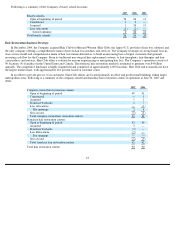

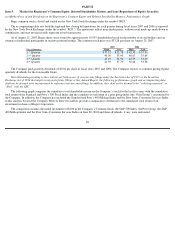

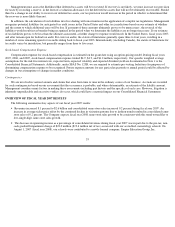

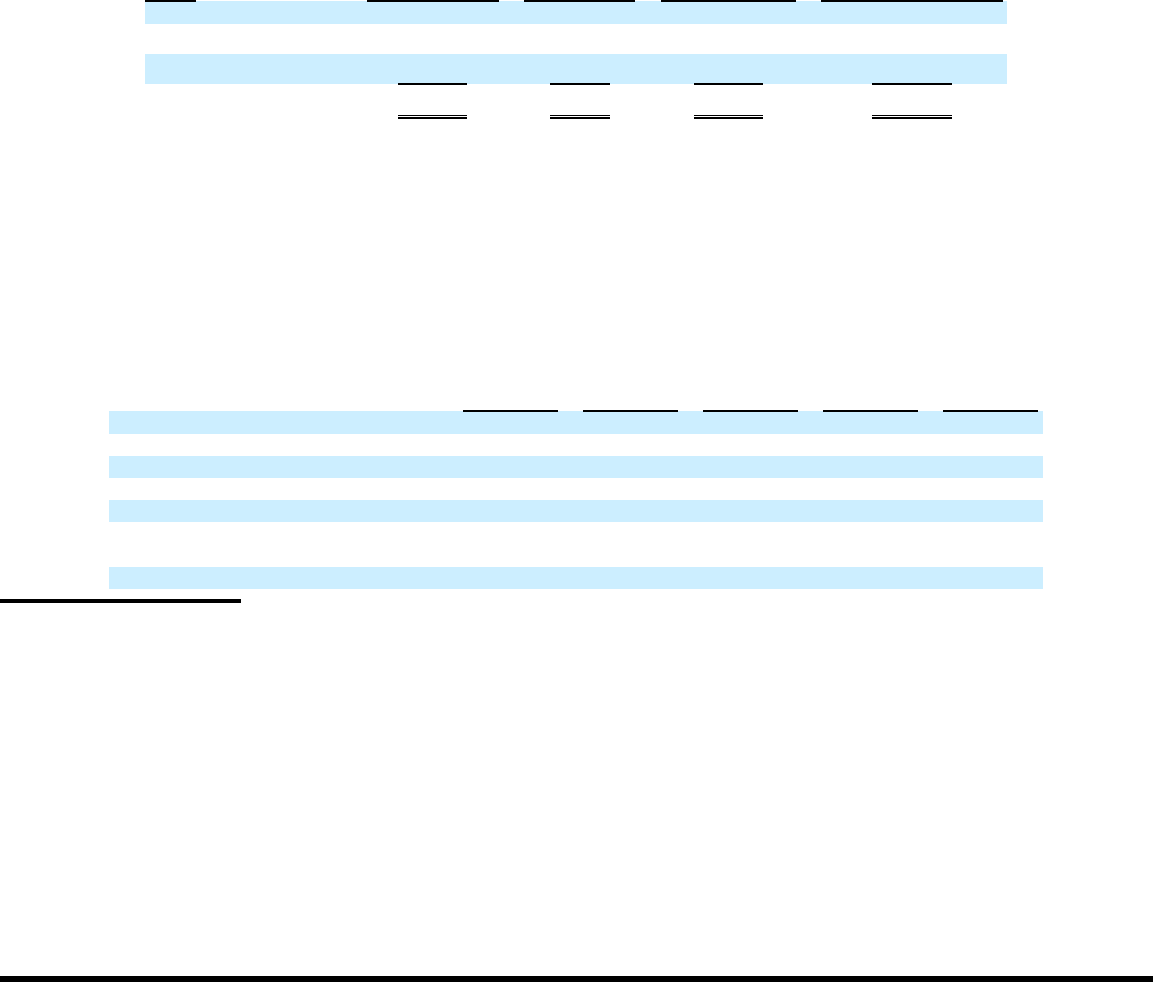

Repurchases of the Company’s common stock during the quarter ended June 30, 2007 were part of this repurchase program. These shares

are included within the total number of shares purchased and the average price paid per share in the table below, which shows the monthly,

fourth quarter fiscal year 2007 stock repurchase activity:

CEO and CFO Certifications

The certifications by our chief executive officer and chief financial officer required under Section 302 of the Sarbanes-Oxley Act of 2002,

have been filed as exhibits to this Annual Report on Form 10-K. Our CEO’s annual certification pursuant to NYSE Corporate Governance

Standards Section 303A.12(a) that our CEO was not aware of any violation by the company of the NYSE’s Corporate Governance listing

standards was submitted to the NYSE on November 16, 2006.

Item 6.

Selected Financial Data

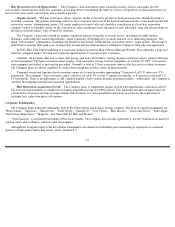

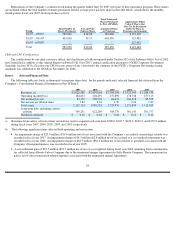

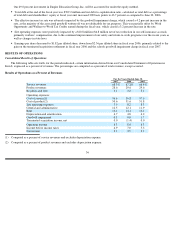

The following table sets forth, in thousands (except per share data), for the periods indicated, selected financial data derived from the

Company’s Consolidated Financial Statements in Part II, Item 8.

a)

Revenues from salons, schools or hair restorations centers acquired each year were $108.0, $165.7, $181.2, $122.3, and $152.9 million

during fiscal years 2007, 2006, 2005, 2004, and 2003, respectively.

b)

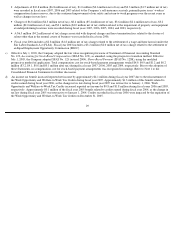

The following significant items affected both operating and net income:

•

An impairment charge of $23.0 million ($19.6 million net of tax) associated with the Company’s accredited cosmetology schools was

recorded in fiscal year 2007. An impairment charge of $4.3 million ($2.8 million net of tax) related to a cost method investment was

recorded in fiscal year 2006. An impairment charge of $38.3 million ($38.3 million net of tax) related to goodwill associated with the

Company’s European business was recorded in fiscal year 2005.

•

A net settlement gain of $33.7 million ($21.7 million net of tax) was recognized during fiscal year 2006 stemming from a termination

fee collected from Alberto-Culver Company due to the terminated merger Agreement for Sally Beauty Company. The termination fee

gain is net of direct transaction-related expenses associated with the terminated merger Agreement.

28

Period

Total Number of

Shares Purchased

Average Price

Paid per Share

Total Number of

Shares Purchased

As Part of Publicly

Announced Plans

or Programs

Approximate Dollar

Value of Shares that

May Yet Be Purchased

under the Plans or

Programs (in thousands)

4/1/07 - 4/30/07

582,000

$

38.88

582,000

$

139,269

5/1/07

-

5/31/07

403,050

39.17

403,050

123,482

6/1/07 - 6/30/07

―

―

―

123,482

Total

985,050

$

39.00

985,050

$

123,482

2007

2006

2005

2004

2003

Revenues (a)

$

2,626,588

$

2,430,864

$

2,194,294

$

1,923,143

$

1,684,530

Operating income(b)(c)

164,613

204,491

137,890

178,748

157,113

Net income(b)(c)(d)

83,170

109,578

64,631

104,218

85,555

Net income per diluted share

1.82

2.36

1.39

2.26

1.89

Total assets

2,132,114

1,985,324

1,725,976

1,271,859

1,112,955

Long-term debt, including current

portion

709,231

622,269

568,776

301,143

301,757

Dividends declared

$

0.16

$

0.16

$

0.16

$

0.14

$

0.12