Supercuts 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

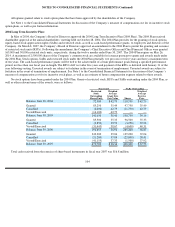

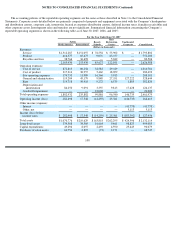

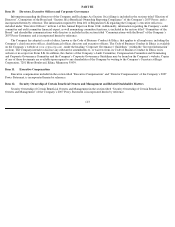

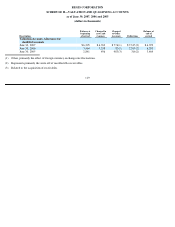

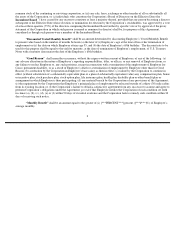

The following table provides information about the Company’s common stock that may be issued under all of the Company’s stock-based

compensation plans in effect as of June 30, 2007.

(1) Includes stock options granted under the Regis Corporation 2000 Stock Option Plan and 1991 Stock Option Plan as well as shares granted

through stock appreciation rights and restricted stock units under the 2004 Long Term Incentive Plan. Information regarding the stock-

based compensation plans is included in Notes 1 and 9 to the Consolidated Financial Statements.

(2) The Company’s 2004 Long Term Incentive Plan (2004 Plan) provides for the issuance of a maximum of 2,500,000 shares of the

Company’s common stock through stock options, stock appreciation rights, restricted stock, or restricted stock units. As of June 30, 2007,

473,700 unvested restricted stock units and shares were outstanding under the 2004 Plan, which are not reflected in this table. However,

the remaining 1,747,950 common shares available for grant under the 2004 Plan (which are available for grant as restricted stock, as well

as stock options or stock appreciation rights) are included in the number of securities remaining available for future issuance under equity

compensation plans as disclosed in this table.

Item 13.

Certain Relationships and Related Transactions

Information regarding certain relationships and related transactions is included in the section titled “Certain Relationships and Related

Transactions” of the Company’s 2007 Proxy Statement, and is incorporated herein by reference.

Item 14.

Principal Accounting Fees and Services

A description of the fees paid to the independent registered public accounting firm will be set forth in the section titled “Independent

Registered Public Accounting Firm” of the Company’s 2007 Proxy Statement and is incorporated herein by reference.

PART IV

Item 15.

Exhibits and Financial Statement Schedules

(a) (1). All financial statements:

Consolidated Financial Statements filed as part of this report are listed under Part II, Item 8 of this Form 10-K.

114

Number of

Securitiesto be

issued upon exercise

of outstanding options,

warrants and rights

Weighted

-

average

exercise price of

outstanding options,

warrants and rights

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected

in the column(a))

Plan Category

(a)

(b)

(c)

Equity compensation plans approved

by security holders(1)

2,808,191

$

26.40

1,883,544

(2)

Equity compensation plans not approved

by security holders

—

—

—

Total

2,808,191

$

26.40

1,883,544