Supercuts 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is designed to provide a reader of our

financial statements with a narrative from the perspective of our management on our financial condition, results of operations, liquidity and

certain other factors that may affect our future results. Our MD&A is presented in five sections:

•

Management’s Overview

•

Critical Accounting Policies

•

Overview of Fiscal Year 2007 Results

•

Results of Operations

•

Liquidity and Capital Resources

MANAGEMENT’S OVERVIEW

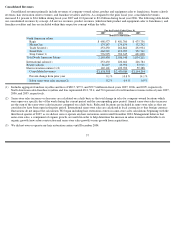

Regis Corporation (RGS) owns or franchises beauty salons, hair restoration centers and educational establishments. As of June 30, 2007,

we owned, franchised or held ownership interests in over 12,400 worldwide locations. Our locations consisted of 11,881 system wide North

American and international salons, 90 hair restoration centers, 56 beauty schools and approximately 400 locations in which we maintain an

ownership interest. Our salon concepts offer generally similar products and services and serve mass market consumers. Our salon operations

are organized to be managed based on geographical location. Our North American salon operations include 9,826 salons, including 2,168

franchise salons, operating in the United States, Canada and Puerto Rico primarily under the trade names of Regis Salons, MasterCuts, Trade

Secret, SmartStyle, Supercuts and Cost Cutters. Our international salon operations include 2,055 salons, including 1,574 franchise salons,

located throughout Europe, primarily in the United Kingdom, France, Italy and Spain. Hair Club for Men and Women includes 90 North

American locations, including 41 franchise locations. Our beauty schools are managed in aggregate, regardless of geographical location, and

include 52 locations in the United States and four locations in the United Kingdom. During fiscal year 2007, we had approximately 62,000

corporate employees worldwide.

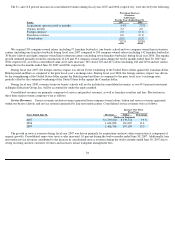

Our growth strategy consists of two primary, but flexible, components. Through a combination of organic and acquisition growth, we seek

to achieve our long-term objective of eight to ten percent annual revenue growth. We anticipate that going forward, the mix of organic and

acquisition growth will be roughly equal. However, depending on several factors, including the ability of our salon development program to

keep pace with the availability of real estate for new construction, hair restoration lead generation, the availability of attractive acquisition

candidates and same-store sales trends, this mix will vary from year to year. We believe achieving revenue growth of eight to ten percent,

including same-store sales increases in excess of two percent, will allow us to increase annual earnings at a low-double-digit growth rate. We

anticipate expanding our presence in both North America and Europe. In April 2007, the Company entered the Asian market through an

investment in a privately held Japanese company.

Maintaining financial flexibility is a key element in continuing our successful growth. With strong operating cash flow and balance sheet,

we are confident that we will be able to financially support our long-term growth objectives.

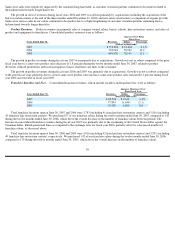

Salon Business

The strength of our salon business is in the fundamental similarity and broad appeal of our salon concepts that allow flexibility and

multiple salon concept placements in shopping centers and neighborhoods. Each concept generally targets the middle market customer,

however, each attracts a

30