Supercuts 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

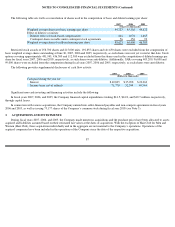

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Company determined that the effective settlement of the preexisting franchise contracts at the date of the acquisition did not result in a gain or

loss, as the agreements were neither favorable nor unfavorable when compared to similar current market transactions, and no settlement

provisions exist in the preexisting contracts. Therefore, no settlement gain or loss was recognized with respect to the Company’s franchise

buybacks.

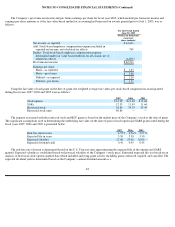

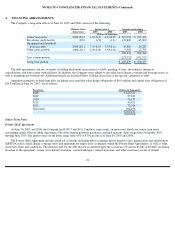

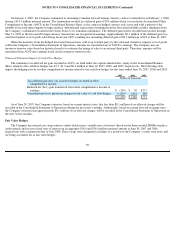

Fiscal Year 2005 Acquisition of Hair Club

In December 2004, the Company purchased Hair Club for approximately $210 million, financed with debt. Hair Club offers a

comprehensive menu of hair restoration solutions ranging from Extreme Hair Therapy™ to the non-surgical Bio-Matrix® Process and the

latest advancements in hair transplantation. This industry is highly fragmented, and the Company believes there is an opportunity to consolidate

this industry through acquisition.

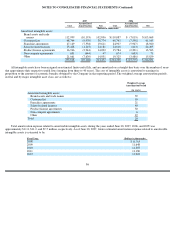

Hair Club operations have been included in the operations of the Company since the acquisition was completed on December 1, 2004, and

are reported in Note 11 in the “Hair Restoration Centers” segment. Unaudited pro forma summary information is presented below for the year

ended June 30, 2005, assuming the acquisition of Hair Club had occurred on July 1, 2004 (i.e., the first day of fiscal year 2005). Preparation of

the pro forma summary information was based upon assumptions deemed appropriate by the Company’

s management. The pro forma summary

information presented below is not necessarily indicative of the results that actually would have occurred if the acquisition had been

consummated on the first day of fiscal year 2005, and is not intended to be a projection of future results.

90

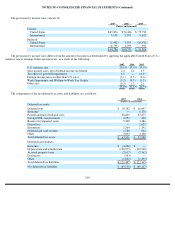

2005

(Dollars in thousands)

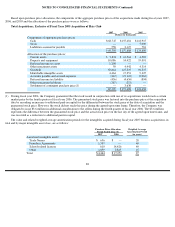

Components of aggregate purchase prices:

Cash

$

209,652

Stock

—

Liabilities assumed or payable

1,032

$

210,684

Allocation of the purchase prices:

Current assets

$

8,311

Property and equipment

5,928

Other noncurrent assets

4,434

Identifiable intangible assets

126,839

Goodwill

127,373

Accounts payable and accrued expenses

(22,180

)

Deferred income tax liability

(40,021

)

$

210,684

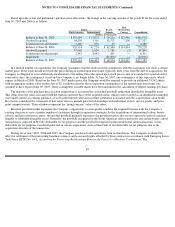

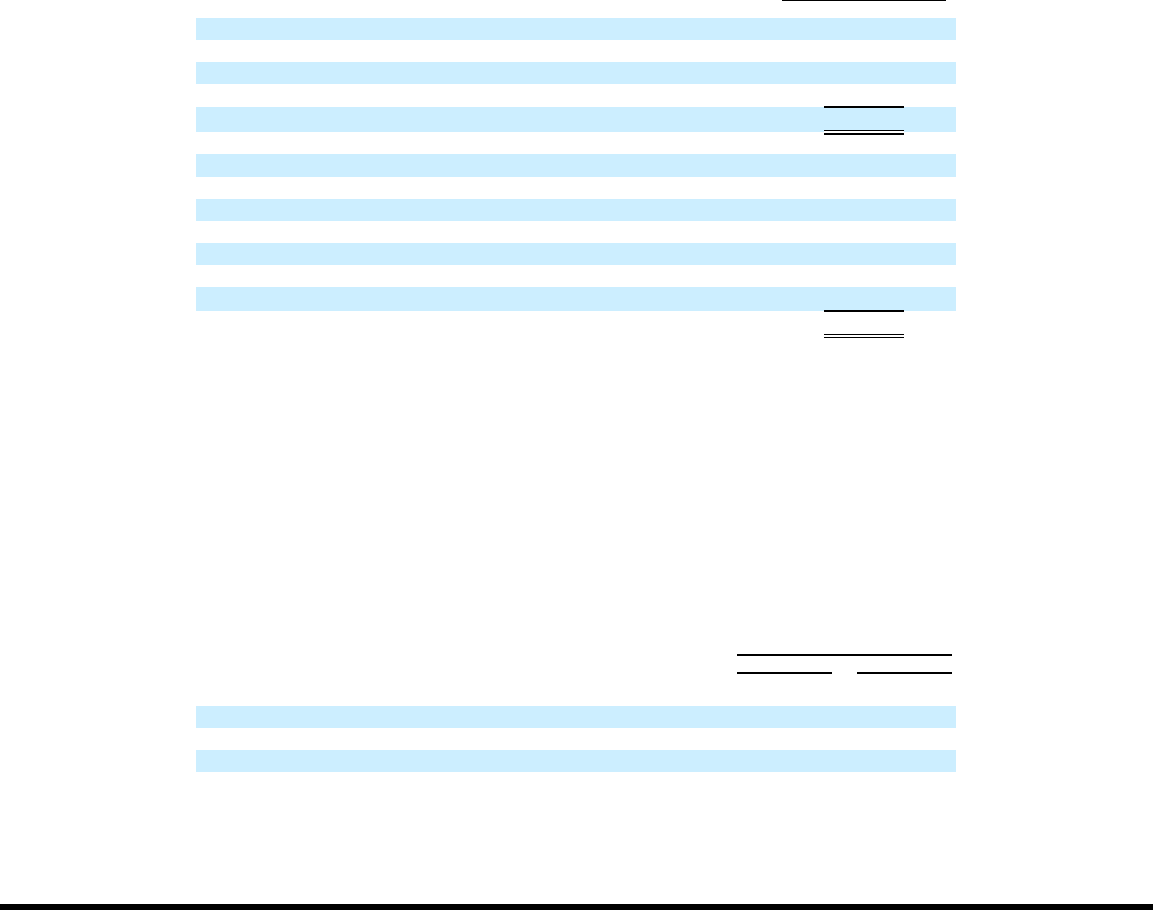

For the Year Ended

June 30, 2005

Actual

ProForma

(Dollars in thousands)

(unaudited)

Revenue

$

2,194,294

$

2,243,290

Net Income

64,631

64,538

EPS

1.39

1.39