Supercuts 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

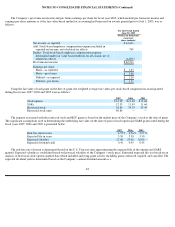

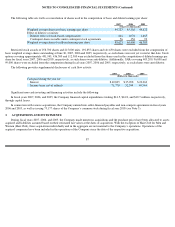

Shipping and Handling Costs:

Shipping and handling costs are incurred to store, move and ship product from the Company’s distribution centers to company-owned and

franchise locations, and include an allocation of internal overhead. Such shipping and handling costs related to product shipped to company-

owned locations are included in site operating expenses in the Consolidated Statement of Operations. Shipping and handling costs related to

shipping product to franchise locations totaled $2.8, $2.4, and $2.5 million during fiscal years 2007, 2006, and 2005, respectively, which are

included within general and administrative expenses. Any amounts billed to the franchisee for shipping and handling are included in product

revenues within the Consolidated Statement of Operations.

Advertising:

Advertising costs, including salon collateral material, are expensed as incurred. Net advertising costs expensed were $69.2, $61.5, and

$57.8 million in fiscal years 2007, 2006, and 2005, respectively. The Company participates in cooperative advertising programs under which

the vendor reimburses the Company for costs related to advertising for its products. The Company records such reimbursements as a reduction

of advertising expense when the expense is incurred. During fiscal years 2007, 2006, and 2005, no amounts were received in excess of the

Company’s related expense.

Advertising Funds:

Franchisees and certain company-

owned salons are required to contribute a percentage of sales to various advertising funds. The Company

administers the advertising funds at the directive of or subject to input from the franchise community. Accordingly, amounts collected and

spent by the advertising funds are not reflected as revenues and expenditures of the Company. Assets of the advertising funds administered by

the Company, along with an offsetting obligation to spend such assets, are recorded in the Consolidated Balance Sheet.

Preopening Expenses:

Non-capital expenditures such as payroll, training costs and promotion incurred prior to the opening of a new location are expensed as

incurred.

Sales Taxes:

Sales taxes are recorded on a net basis (rather than as both revenue and an expense) within the Company’s Consolidated Statement of

Operations.

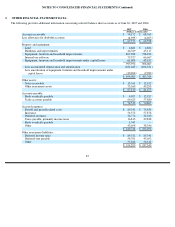

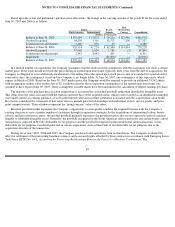

Income Taxes:

Deferred income tax assets and liabilities are recognized for the expected future tax consequences of events that have been included in the

Consolidated Financial Statements or income tax returns. Deferred income tax assets and liabilities are determined based on the differences

between the financial statement and tax basis of assets and liabilities using currently enacted tax rates in effect for the years in which the

differences are expected to reverse. Realization of deferred tax assets is ultimately dependent upon future taxable income. Inherent in the

measurement of deferred balances are certain judgments and interpretations of tax laws and published guidance with respect to the Company’s

operations. Income tax expense is primarily the current tax payable for the period and the change during the period in certain deferred tax assets

and liabilities.

79