Supercuts 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

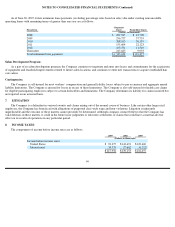

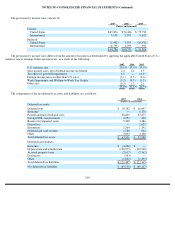

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

All options granted relate to stock option plans that have been approved by the shareholders of the Company.

See Note 1 to the Consolidated Financial Statements for discussion of the Company’

s measure of compensation cost for its incentive stock

option plans, as well as pro forma information.

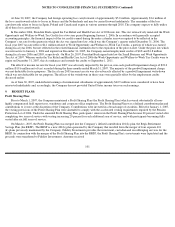

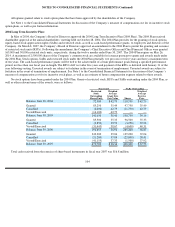

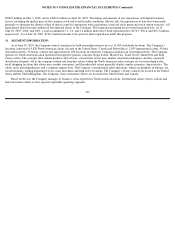

2004 Long Term Incentive Plan:

In May of 2004, the Company’s Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan received

shareholder approval at the annual shareholders’ meeting held on October 28, 2004. The 2004 Plan provides for the granting of stock options,

equity-based stock appreciation rights (SARs) and restricted stock, as well as cash-based performance grants, to employees and directors of the

Company. On March 8, 2007, the Company’s Board of Directors approved an amendment to the 2004 Plan to permit the granting and issuance

of restricted stock units (RSUs). Following the amendment, the Company’s Chief Executive Officer and Chief Financial Officer were granted

165,000 and 50,000 restricted stock units, respectively, during the twelve months ended June 30, 2007. The 2004 Plan expires on May 26,

2014. A maximum of 2,500,000 shares of the Company’s common stock are available for issuance pursuant to grants and awards made under

the 2004 Plan. Stock options, SARs and restricted stock under the 2004 Plan generally vest pro rata over five years and have a maximum term

of ten years. The cash-based performance grants will be tied to the achievement of certain performance goals during a specified performance

period, not less than one fiscal year in length. The RSUs cliff vest after five years and payment of the RSUs is deferred until January 31 of the

year following vesting. Unvested awards are subject to forfeiture in the event of termination of employment. Unvested awards are subject to

forfeiture in the event of termination of employement. See Note 1 to the Consolidated Financial Statements for discussion of the Company’s

measure of compensation cost for its incentive stock plans, as well as an estimate of future compensation expense related to these awards.

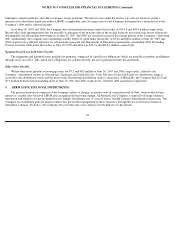

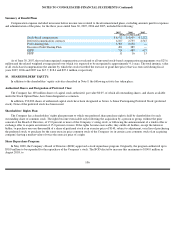

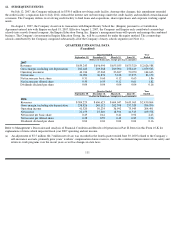

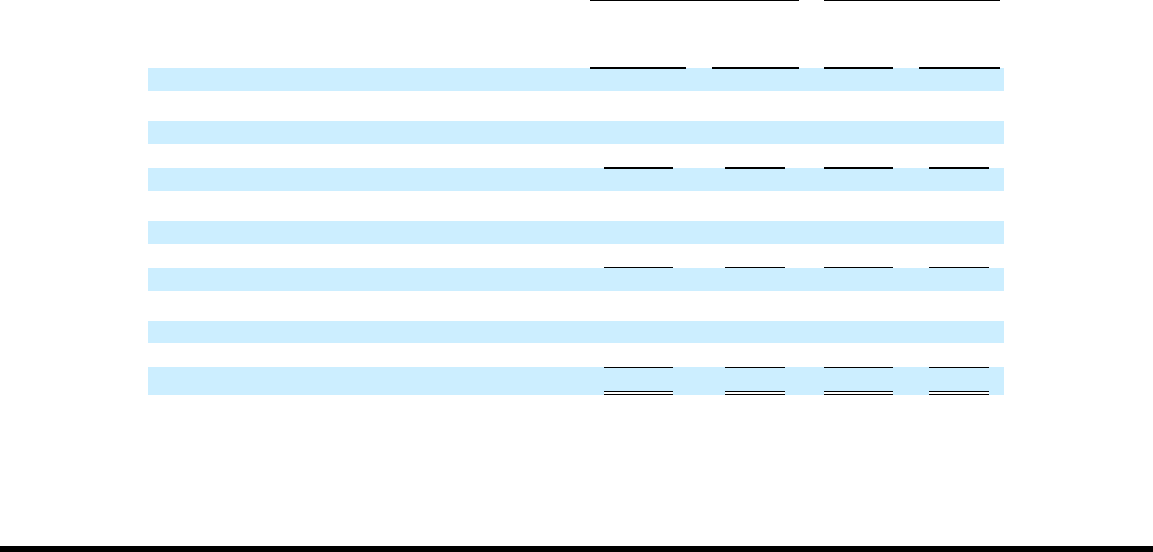

No stock options have been granted under the 2004 Plan. Grants of restricted stock, RSUs and SARs outstanding under the 2004 Plan, as

well as other relevant terms of the awards, were as follows:

Total cash received from the exercise of share-based instruments in fiscal year 2007 was $16.8 million.

104

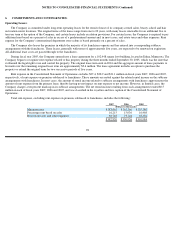

Nonvested

SARs Outstanding

Restricted

Stock

Outstanding

Weighted

Average

Grant Date

Weighted

Average

Exercise

Shares/Units

Fair Value

Shares

Price

Balance, June 30, 2004

72,500

$

42.79

110,750

$

42.79

Granted

85,250

35.49

97,750

35.49

Cancelled

(2,000

)

42.79

(11,750

)

42.79

Vested/Exercised

(14,100

)

42.79

—

—

Balance, June 30, 2005

141,650

38.40

196,750

39.16

Granted

85,500

35.33

96,500

35.33

Cancelled

(2,850

)

39.59

(3,250

)

39.98

Vested/Exercised

(31,445

)

38.67

(4,600

)

40.31

Balance, June 30, 2006

192,855

36.92

285,400

36.87

Granted

343,200

39.04

139,200

39.04

Cancelled

(21,200

)

37.84

(22,800

)

38.41

Vested/Exercised

(41,155

)

37.33

(1,500

)

37.92

Balance, June 30, 2007

473,700

$

38.36

400,300

$

37.53