Supercuts 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management must assess the likelihood that deferred tax assets will be recovered. If recovery is not likely, we must increase our provision

for taxes by recording a reserve, in the form of a valuation allowance, for the deferred tax assets that will not be ultimately recoverable. Should

there be a change in our ability to recover our deferred tax assets, our tax provision would increase in the period in which it is determined that

the recovery is more likely than not.

In addition, the calculation of tax liabilities involves dealing with uncertainties in the application of complex tax regulations. Management

recognizes potential liabilities for anticipated tax audit issues in the United States and other tax jurisdictions based on our estimate of whether

and the extent to which additional taxes will be due. If payment of these amounts ultimately proves to be unnecessary, the reversal of the

liabilities would result in tax benefits being recognized in the period when we determine the liabilities are no longer necessary. If our estimate

of tax liabilities proves to be less than the ultimate assessment, a further charge to expense would result. In the United States, fiscal years 2003

and after remain open for federal tax audit. For state tax audits, the statute of limitations generally spans three to four years, resulting in a

number of states remaining open for tax audits dating back to fiscal year 2003. Internationally (including Canada), the statute of limitations for

tax audits varies by jurisdiction, but generally ranges from three to five years.

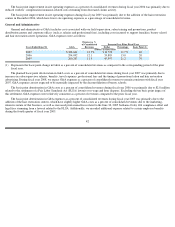

Stock-based Compensation Expense

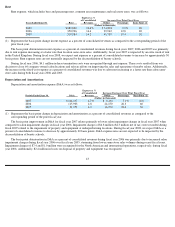

Compensation expense for stock-based compensation is estimated on the grant date using an option-pricing model. During fiscal years

2007, 2006, and 2005, stock-based compensation expense totaled $4.9, $4.9, and $1.2 million, respectively. Our specific weighted average

assumptions for the risk free interest rate, expected term, expected volatility and expected dividend yield are documented in Note 1 to the

Consolidated Financial Statements. Additionally, under SFAS No. 123R, we are required to estimate pre-vesting forfeitures for purposes of

determining compensation expense to be recognized. Future expense amounts for any particular quarterly or annual period could be affected by

changes in our assumptions or changes in market conditions.

Contingencies

We are involved in various lawsuits and claims that arise from time to time in the ordinary course of our business. Accruals are recorded

for such contingencies based on our assessment that the occurrence is probable, and where determinable, an estimate of the liability amount.

Management considers many factors in making these assessments including past history and the specifics of each case. However, litigation is

inherently unpredictable and excessive verdicts do occur, which could have a material impact on our Consolidated Financial Statements.

OVERVIEW OF FISCAL YEAR 2007 RESULTS

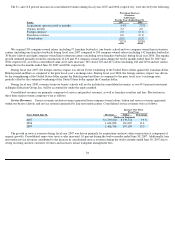

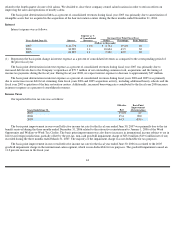

The following summarizes key aspects of our fiscal year 2007 results:

• Revenues increased 8.1 percent to $2.6 billion and consolidated same-store sales increased 0.2 percent during fiscal year 2007. An

increase in average ticket price offset by the continued decline in visitation patterns due to fashion trends resulted in consolidated same-

store sales of 0.2 percent. The Company expects fiscal year 2008 same-store sales growth to be consistent with this trend toward flat to

low-single-digit same-store sales growth.

• The decrease in operating income as a percentage of consolidated revenues during fiscal year 2007 was in part due to the pre-tax, non-

cash goodwill impairment charge of $23.0 million ($19.6 million net of tax) associated with our accredited cosmetology schools. On

August 1, 2007 (fiscal year 2008), our schools were contributed to a newly formed company, Empire Education Group, Inc.

35