Supercuts 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

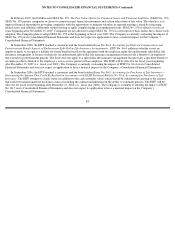

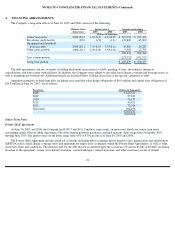

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

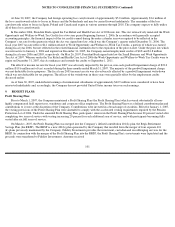

bankruptcy related situations, and other customary events of default. The interest rates under the facility vary and are based on a bank’s

reference rate, the federal funds rate and/or LIBOR, as applicable, and a leverage ratio for the Company determined by a formula tied to the

Company’s debt and its adjusted income.

As of June 30, 2007 and 2006, the Company had outstanding borrowings under this facility of $147.8 and $63.0 million, respectively.

Because the credit agreement provides for possible acceleration of the maturity date of the facility based on provisions that are not objectively

determinable, the outstanding borrowings as of June 30, 2007 and 2006 are classified as part of the current portion of the Company’s long-

term

debt. Additionally, the Company had outstanding standby letters of credit under the facility of $54.6 and $60.6 million at June 30, 2007 and

2006, respectively, primarily related to its self-insurance program and Department of Education requirements surrounding Title IV funding.

Unused available credit under the facility at June 30, 2007 and 2006 was $147.6 and $226.4 million, respectively.

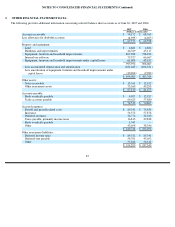

Equipment and Leasehold Notes Payable

The equipment and leasehold notes payable are primarily comprised of capital lease obligations which are payable in monthly installments

through fiscal year 2011. The capital lease obligations are collateralized by the assets purchased under the agreement.

Other Notes Payable

Within other notes payable are mortgage notes for $7.2 and $8.8 million at June 30, 2007 and 2006, respectively, related to the

Company’s distribution centers in Chattanooga, Tennessee and Salt Lake City, Utah. The note for the Salt Lake City distribution center is

secured by that distribution center and the note for the Chattanooga distribution center is unsecured. Additionally, the Company had $2.8 and

$3.9 million in unsecured outstanding notes at June 30, 2007 and 2006, respectively, related to debt assumed in acquisitions.

5.

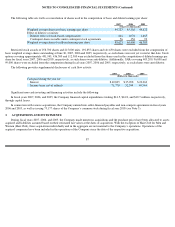

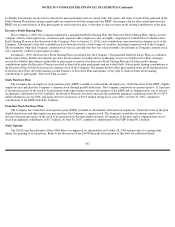

DERIVATIVE FINANCIAL INSTRUMENTS:

The primary market risk exposure of the Company relates to changes in interest rates in connection with its debt, some of which bears

interest at variable rates based on LIBOR plus an applicable borrowing margin. Additionally, the Company is exposed to foreign currency

translation risk related to its net investments in its foreign subsidiaries and, to a lesser extent, foreign currency denominated transactions. The

Company has established policies and procedures that govern the management of these exposures through the use of derivative financial

instrument contracts. By policy, the Company does not enter into such contracts for the purpose of speculation.

94