Supercuts 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

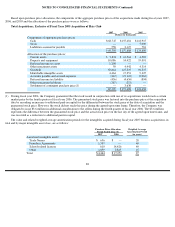

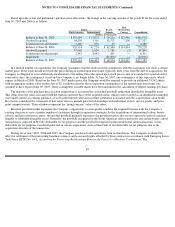

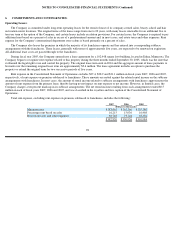

These pro forma results have been prepared for comparative purposes only and include certain adjustments such as additional amortization

expense as a result of identifiable intangible assets arising from the acquisition and from increased interest expense on acquisition debt.

Additionally, the pro forma results include management fees which are no longer incurred since the Company’s acquisition of the hair

restoration centers. The management fees included in the pro forma results above totaled approximately $0.6 million for the fiscal year ended

June 30, 2005. There were no extraordinary items, changes in accounting principles, or material nonrecurring items included in the pro forma

amounts above.

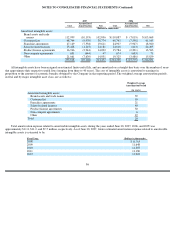

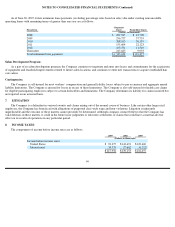

In April 2007, the Company acquired exchangeable notes issued by Yamano Holding Corporation and a loan obligation of a Yamano

Holdings subsidiary, Beauty Plaza Co. Ltd., for an aggregate amount of $11.3 million. This investment is accounted for under the cost method.

The notes are exchangeable for approximately 14.7 percent of the outstanding shares of Beauty Takashi Co. Ltd., a subsidiary of Yamano

Holdings. In connection with the purchase of the exchangeable notes and loan obligation, the parties also entered into a business collaboration

agreement with respect to their joint pursuit of opportunities relating to retail hair salons in Asia.

In October 2006, the Company invested $9.9 million to form a new limited liability company called Intelligent Nutrients, LLC and holds a

50 percent interest in the newly formed LLC. The Company is accounting for this investment under the equity method. Intelligent Nutrients,

LLC currently carries a wide variety of organic, harmonically grown™ products, including dietary supplements, coffees, teas and aromatics.

Additionally, a full line of professional hair-care and personal care products is in development and is expected to be available in the spring of

calendar year 2008. These products will be offered at the Company’s corporate and franchise salons, and eventually in other independently

owned salons. During fiscal year 2007, the Company recorded a loss of $1.8 million related to this equity investment.

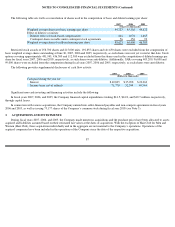

In September 2006, the Company invested $5.3 million in the preferred stock of a privately held entity. This investment was accounted for

under the cost method. During the three months ended December 31, 2006, the preferred stock was redeemed for the original investment

amount of $5.3 million. The Company received $0.1 million of preferred dividends from this investment prior to its redemption.

In May 2006, the Company acquired a 19.9 percent interest in the voting common stock of a privately held entity for $4.4 million. The

investment is accounted for under the equity method. As of June 30, 2007 and June 30, 2006, the Company also had $10.0 and $6.0 million of

long-term notes receivable under a credit agreement with the majority corporate investor in this privately held entity, respectively. In June,

2007, the Company extended the term of the note receivable under the credit agreement to March 31, 2009. For the fiscal year ended June 30,

2007, the Company recorded a loss of $1.3 million related to this equity investment.

In December 2004, the Company acquired an interest of less than 20 percent in a privately held entity, Cool Cuts 4 Kids, Inc., through the

acquisition of $4.3 million of preferred stock. This investment is accounted for under the cost method. During fiscal year 2006, the Company

determined that its investment was impaired and recognized an impairment loss within Other, net in the Consolidated Statement of Operations

for the full carrying value. The Company’s securities purchase agreement contains a call provision, giving the Company the right of first

refusal should the privately held entity receive a bona fide offer from another company, as well as the right to purchase all of the assets of the

privately held entity during the period from April 1, 2008 to January 31, 2009 for a multiple of cash flow.

91