Supercuts 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

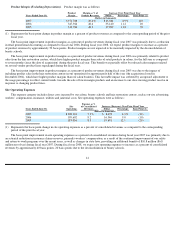

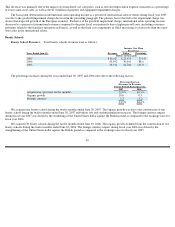

related to the fourth quarter closure of 64 salons. We decided to close these company-owned salon locations in order to refocus efforts on

improving the sales and operations of nearby salons.

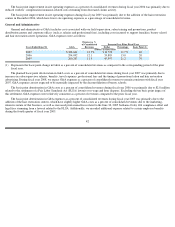

The basis point deterioration in D&A as a percent of consolidated revenues during fiscal year 2005 was primarily due to amortization of

intangible assets that we acquired in the acquisition of the hair restoration centers during the three months ended December 31, 2004.

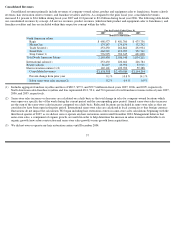

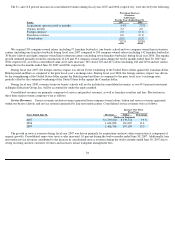

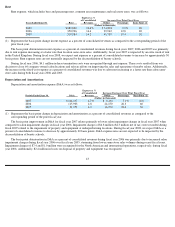

Interest

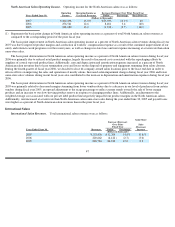

Interest expense was as follows:

(1)

Represents the basis point change in interest expense as a percent of consolidated revenues as compared to the corresponding period of

the prior fiscal year.

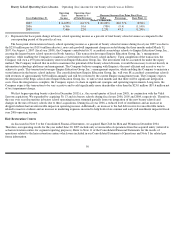

The basis point deterioration in interest expense as a percent of consolidated revenues during fiscal year 2007 was primarily due to

increased debt levels due to the Company’s repurchase of $79.7 million of our outstanding common stock, acquisitions and the timing of

income tax payments during the fiscal year. During fiscal year 2008, we expect interest expense to decrease to approximately $37 million.

The basis point deterioration in interest expense as a percent of consolidated revenues during fiscal years 2006 and 2005 was primarily

due to an increase in our debt level stemming from fiscal years 2006 and 2005 acquisition activity, including additional beauty schools and the

fiscal year 2005 acquisition of the hair restoration centers. Additionally, increased borrowing rates contributed to the fiscal year 2006 increase

in interest expense as a percent of consolidated revenues.

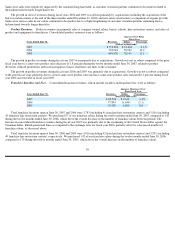

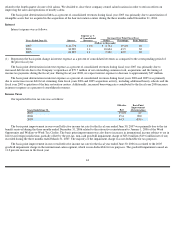

Income Taxes

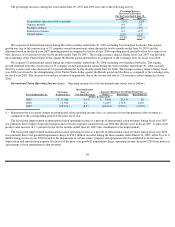

Our reported effective tax rate was as follows:

The basis point improvement in our overall effective income tax rate for the fiscal year ended June 30, 2007 was primarily due to the tax

benefit received during the three months ended December 31, 2006 related to the retroactive reinstatement to January 1, 2006 of the Work

Opportunity and Welfare-to-Work Tax Credits. The basis point improvement was also due to increases in international income subject to tax in

lower tax foreign jurisdictions, partially offset by the pre-tax, non-cash goodwill impairment charge of $23.0 million ($19.6 million net of tax)

recorded during the three months ended March 31, 2007. The majority of the impairment charge was not deductible for tax purposes.

The basis point improvement in our overall effective income tax rate for the fiscal year ended June 30, 2006 was related to the 2005

goodwill impairment charge in the international salon segment, which is non-deductible for tax purposes. The goodwill impairment caused an

11.0 percent increase in the fiscal year

44

Expense as %

of Consolidated

Increase Over Prior Fiscal Year

Years Ended June 30,

Interest

Revenues

Dollar

Percentage

Basis Point

(1)

(Dollars in thousands)

2007

$

41,770

1.6

%

$

6,781

19.4

%

20

2006

34,989

1.4

10,604

43.5

30

2005

24,385

1.1

7,321

42.9

20

Years Ended June 30,

Effective

Rate

Basis Point

Improvement

(Deterioration)

2007

35.0

%

60

2006

35.6

890

2005

44.5

(850

)