Supercuts 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

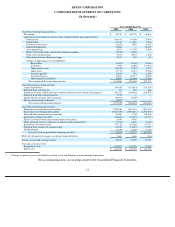

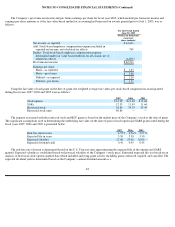

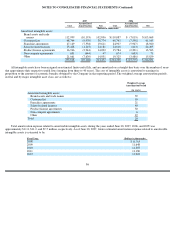

Net Income Per Share:

Basic earnings per share (EPS) is calculated as net income divided by weighted average common shares outstanding, excluding unvested

outstanding restricted stock shares and restricted stock units. The Company’s dilutive securities include shares issuable under the Company’s

stock option plan and long-term incentive plan, as well as shares issuable under contingent stock agreements. Diluted EPS is calculated as net

income divided by weighted average common shares outstanding, increased to include assumed exercise of dilutive securities. Stock options

with exercise prices greater than the average market value of the Company’s common stock and other anti-dilutive awards are excluded from

the computation of diluted EPS.

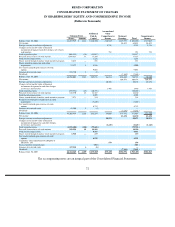

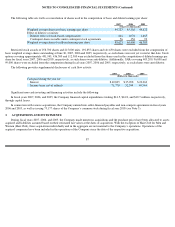

Comprehensive Income:

Components of comprehensive income for the Company include net income, changes in fair market value of financial instruments

designated as hedges of interest rate or foreign currency exposure and foreign currency translation charged or credited to the cumulative

translation account within shareholders’ equity. These amounts are presented in the Consolidated Statements of Changes in Shareholders’

Equity and Comprehensive Income.

Derivative Instruments:

The Company may manage its exposure to interest rate and foreign currency risk within the Consolidated Financial Statements through

the use of derivative financial instruments, according to its hedging policy. The Company does not use derivatives with a level of complexity or

with a risk higher than the exposures to be hedged and does not hold or issue derivatives for trading or speculative purposes. The Company

currently has or had interest rate swaps designated as both cash flow and fair value hedges, treasury locks designated as cash flow hedges, a

hedge of its net investment in its European operations and forward foreign currency contracts designated as cash flow hedges of forecasted

transactions denominated in a foreign currency. Refer to Note 5 to the Consolidated Financial Statements for further discussion.

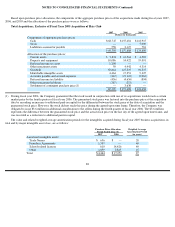

The Company follows SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities (SFAS No. 133), as amended and

interpreted, which requires that all derivatives be recorded on the balance sheet at fair value. SFAS No.133 also requires companies to

designate all derivatives that qualify as hedging instruments as fair value hedges, cash flow hedges or hedges of net investments in foreign

operations. This designation is based upon the exposure being hedged. Cash flow and fair value hedges are designated and documented at the

inception of each hedge by matching the terms of the contract to the underlying transaction. At inception, as dictated by the facts and

circumstances, all hedges are expected to be highly effective, as the critical terms of these instruments are generally the same as those of the

underlying risks being hedged. All derivatives designated as hedging instruments are assessed for effectiveness on an on-going basis. The

Company classifies the cash flows from hedging transactions in the same categories as the cash flows from the respective hedged items.

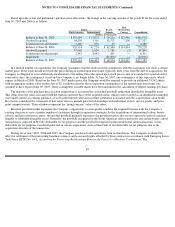

Stock-Based Employee Compensation Plans:

Stock-based compensation awards are granted under the terms of the 2004 Long Term Incentive Plan (2004 Plan) and the 2000 Stock

Option Plan. Additionally, the Company has outstanding stock options under its 1991 Stock Option Plan, although the Plan terminated in 2001.

Under these plans, four types of stock-based compensation awards are granted: stock options, equity-based stock appreciation rights (SARS),

restricted stock and restricted stock units (RSUs). The stock-based awards, other than the RSUs,

80