Supercuts 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

On October 24, 2000, the shareholders of Regis Corporation adopted the Regis Corporation 2000 Stock Option Plan (2000 Plan), which

allows the Company to grant both incentive and nonqualified stock options and replaced the Company’s 1991 Stock Option Plan (1991 Plan).

Total options covering 3,500,000 shares of common stock may be granted under the 2000 Plan to employees of the Company for a term

not to exceed ten years from the date of grant. The term may not exceed five years for incentive stock options granted to employees of the

Company possessing more than ten percent of the total combined voting power of all classes of stock of the Company or any subsidiary of the

Company. Options may also be granted to the Company’s outside directors for a term not to exceed ten years from the grant date.

The 2000 Plan contains restrictions on transferability, time of exercise, exercise price and on disposition of any shares acquired through

exercise of the options. Stock options are granted at not less than fair market value on the date of grant. The Board of Directors determines the

2000 Plan participants and establishes the terms and conditions of each option.

The Company also has outstanding stock options under the 1991 Plan, although the Plan terminated in 2001. The terms and conditions of

the 1991 Plan are similar to the 2000 Plan. Total options covering 5,200,000 shares of common stock were available for grant under the 1991

Plan and, as of June 30, 2001, all available shares were granted.

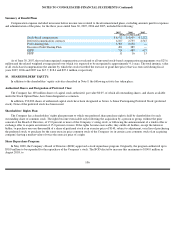

Common shares available for grant under the Company’s 2000 Plan were 135,593, 250,066, and 337,300 shares as of June 30, 2007, 2006

and 2005, respectively, and common shares available for grant under the Company’s 2004 Plan were 1,747,950, 1,971,350 and 2,147,500 at

June 30, 2007, 2006 and 2005, respectively.

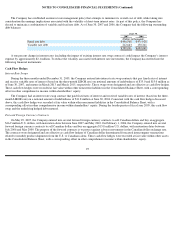

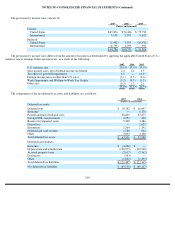

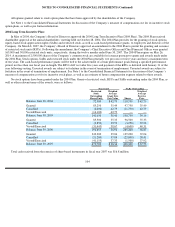

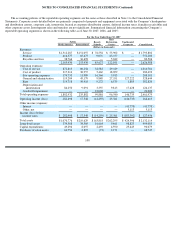

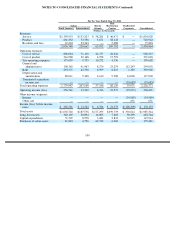

Stock options outstanding, weighted average exercise prices and weighted average fair values were as follows:

At June 30, 2007, 1,784,250 shares with a $19.77 per share weighted average exercise price and a weighted average remaining contractual

life of 3.5 years were exercisable that have a total intrinsic value of $33.2 million. There are an additional 385,849 shares expected to vest with

a $36.43 per share weighted average exercise price and a weighted average remaining contractual life of 6.7 years that have a total intrinsic

value of $1.0 million.

103

Options Outstanding

WeightedAverage

Shares

Exercise Price

Balance, June 30, 2004

4,596,423

$

18.32

Granted

125,500

35.49

Cancelled

(9,700

)

23.53

Exercised

(1,039,623

)

16.59

Balance, June 30, 2005

3,672,600

19.43

Granted

135,000

35.33

Cancelled

(47,766

)

26.95

Exercised

(851,892

)

17.02

Balance, June 30, 2006

2,907,942

20.59

Granted

141,000

39.04

Cancelled

(26,527

)

27.06

Exercised

(829,524

)

17.22

Balance, June 30, 2007

2,192,891

$

22.97